November stocks rallied in favor of the higher U.S. stock market on the back of lower U.S. long-term interest rates. The CG Top 20 stock price underperformed both the TOPIX and JPX400 for the first time in three months.

November stocks began the month buoyed by a buy-back and then rallied on the back of the U.S. stock market, which climbed on the lower long-term U.S. interest rates as investors became more risk oriented due to the FOMC meeting summary released on November 23, which suggested a slowdown in the pace of interest rate hikes. Topix recovered to the 2,000-point level on a closing basis for the first time in about 10 months since January 12. Toward the end of the month, the market remained cautious, anticipating Chairman Powell’s speech and the upcoming employment data.

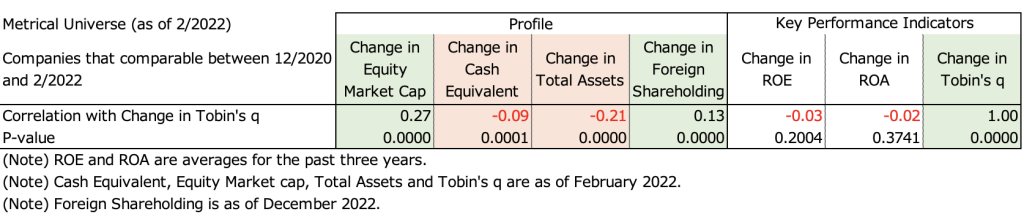

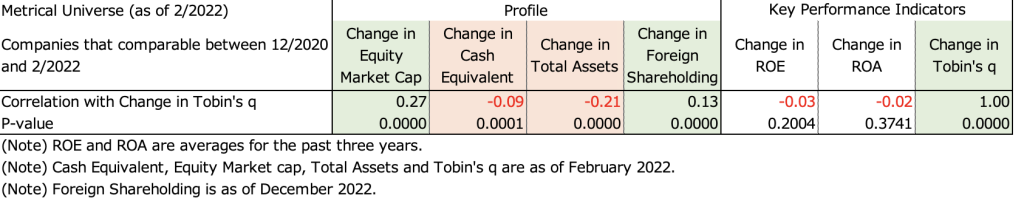

TOPIX and JPX400 indexes performed well in November, rising 2.94% and 3.36%, respectively. The CG Top 20 stock prices underperformed both indices this month with a gain of 1.47%.

Over the long term since 2014, the CG Top20 continues to outperform both indices by about 2% per year. Note that the CG Top20 has been reassessing its component stocks since July 1. The new individual stocks are listed in the table below.

-1024x767.png)