by David Snoddy, CEO of Nezu Asia

SUMMARY

The nature of Japan’s relationship with equity market capitalism changed significantly from the first decade to the second of the 21st century. The first decade, particularly after the resignation of PM Koizumi in 2006, was often characterized by open conflict, with the most obvious examples being the arrest and conviction of shareholder activists Horie and Murakami, and the legal and regulatory attacks on both the consumer finance and leveraged real estate businesses (among others). However, approximately around 2011, the attitude of both government and the public morphed into something more resembling symbiosis than conflict. In the third decade of this century the symbiosis mode seems still to be ascendant.

Many of the top-down aspects of this shift have been well documented and discussed both in Japan and in the West – from the 2015 Corporate Code, to the 2014 Fiduciary Code and the emerging catalysts created by the rule set for Tokyo’s new “Prime” market. From the perspective of governance per se, there have been some concrete steps “backwards” (with the Toshiba drama a prime example). However, the cumulative effect of the change in the regulatory suasion regime in Japan is such that it is difficult to find equity market participants who believe that the governance environment in 2021, on average, is not noticeably more shareholder-friendly than it was 10 years ago.

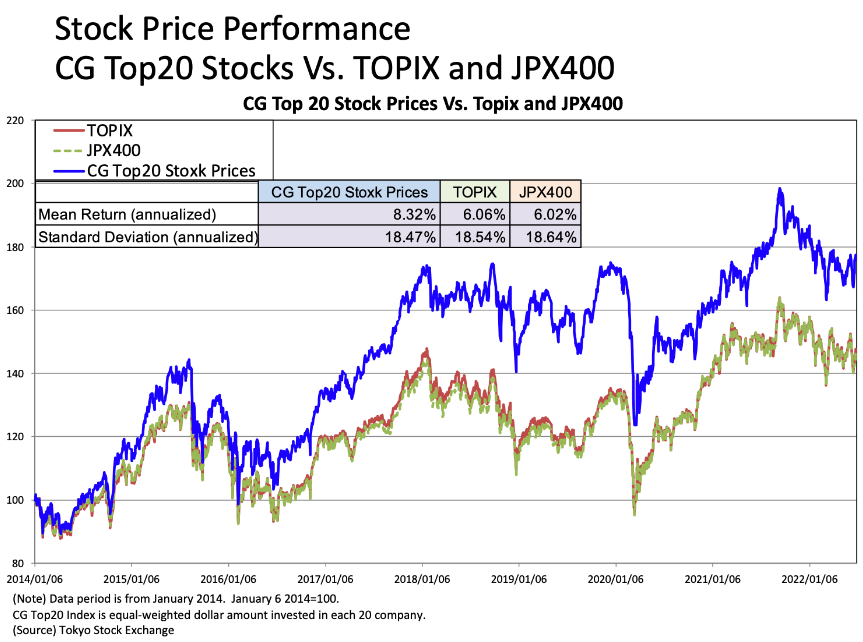

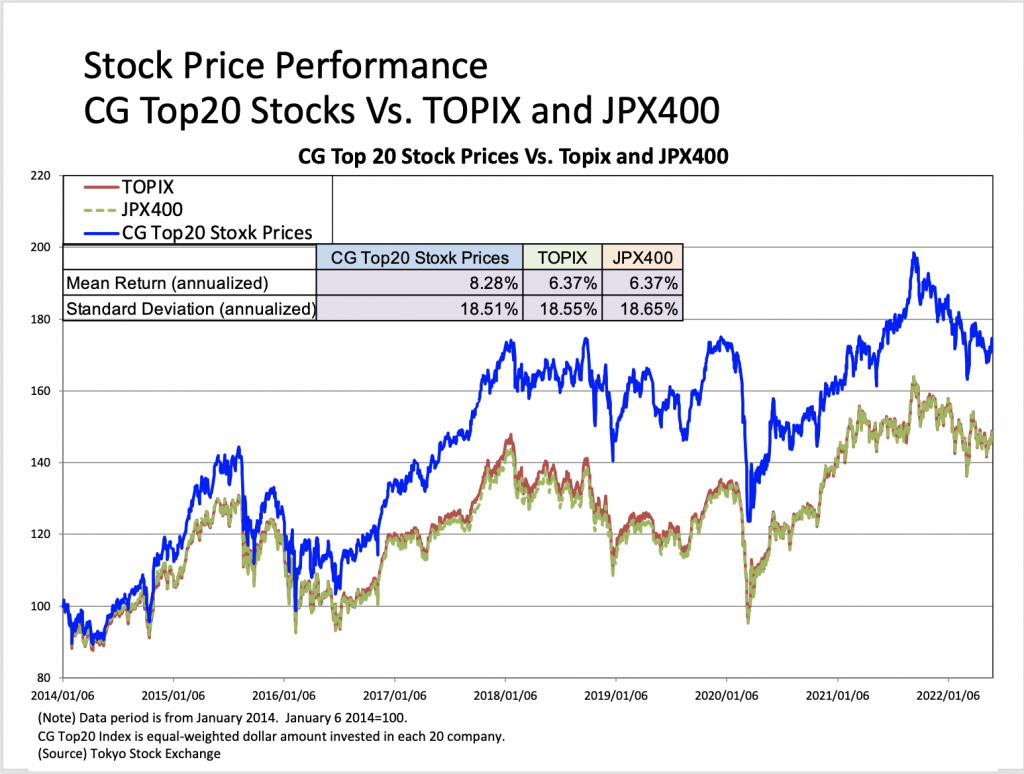

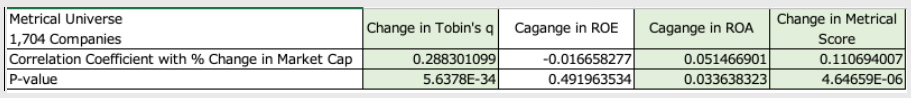

Over the same period there has also been a dramatic shift in trends in Japanese equity price formation. This is not well documented or understood. But it is in fact the micro expression of the same impulses which are driving the “macro” changes in the regulatory regime. Since 2011, there has been a marked change in how the market “votes with its feet” – rewarding companies who conform to the new desired profile, and punishing those who don’t. Specifically, capital efficiency and, to a slightly lesser extent, revenue growth, have captured outsized returns.

The top-down changes in the regulatory regime are on one side of the coin. The bottom-up changes in price formation are the other side of the same coin.

The socio-economic function of equity capitalism in Japan is somewhat uncomfortably positioned between two massive sources of pressure. On the one hand, the aging of Japan’s society is slowly turning active employees into pensioners who, either directly or indirectly, depend on financial income to maintain their living standards. This economic pressure provides the core motivation for the changes in Japan’s approach to equity capitalism – both from the top and the bottom. One the other hand, there is a near-consensus social desire to protect and maintain the lifetime employment system, albeit only for a subset of employees. Predictably, these two pressures are often in conflict, which accounts for some of the peculiarities of “equity capitalism with Japanese characteristics.”

The social commitment to maintain the lifetime employment system predates all of the data to be presented here. The demographic challenges posed by the aging of society have been building for a generation or so, but it was only after 2011 that they resulted in a shift towards a noticeably more cooperative approach to equity markets.