We would greatly appreciate it if you could possibly donate to BDTI, and even if not, forward this link to any and all. Thank you for your support !

s

Crafting the ‘G’ in ESG: Accountability in the Boardroom

As investment in environment, social and governance (ESG) gains momentum, investors and stakeholders increasingly expect swift and concrete sustainability initiatives from companies across the globe. But boards have lagged behind the ESG fervor. While 40% of directors were found to be ESG conscious with some level of knowledge in the space, only 8% of board directors were found to be competent and capable of effective, embodied action, according to a 2021 study of the top 100 public corporations internationally.

We recently considered the evolving perspectives in ESG, as well as tools and strategies for boards to meet the ESG expectations of their stakeholders.

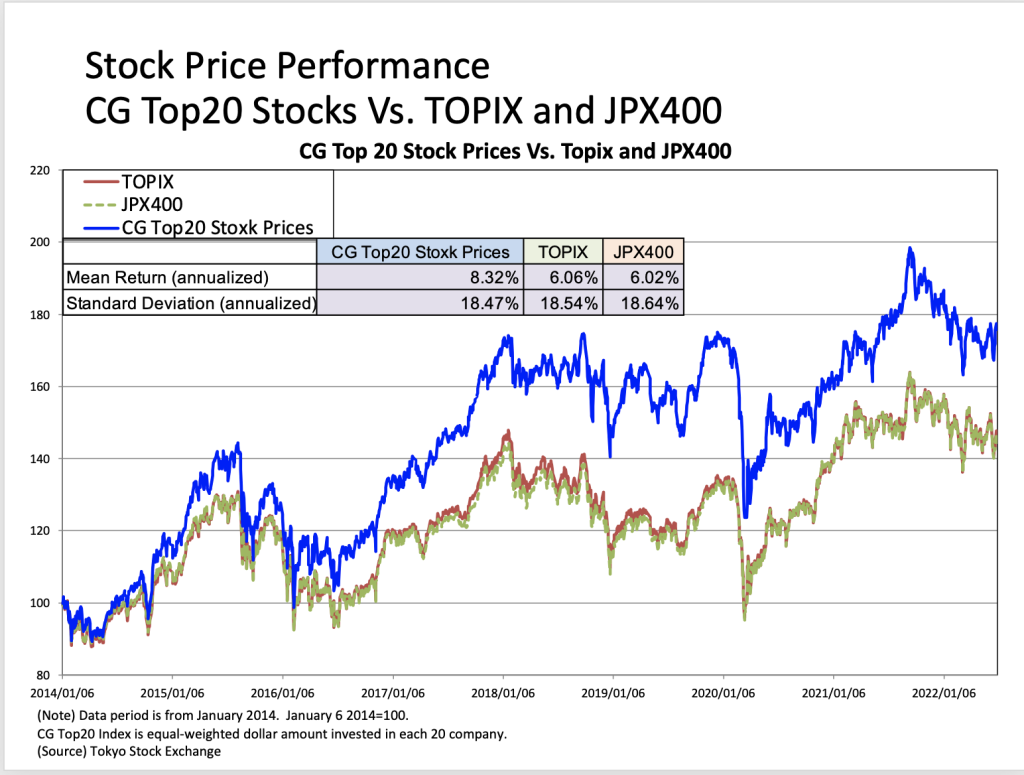

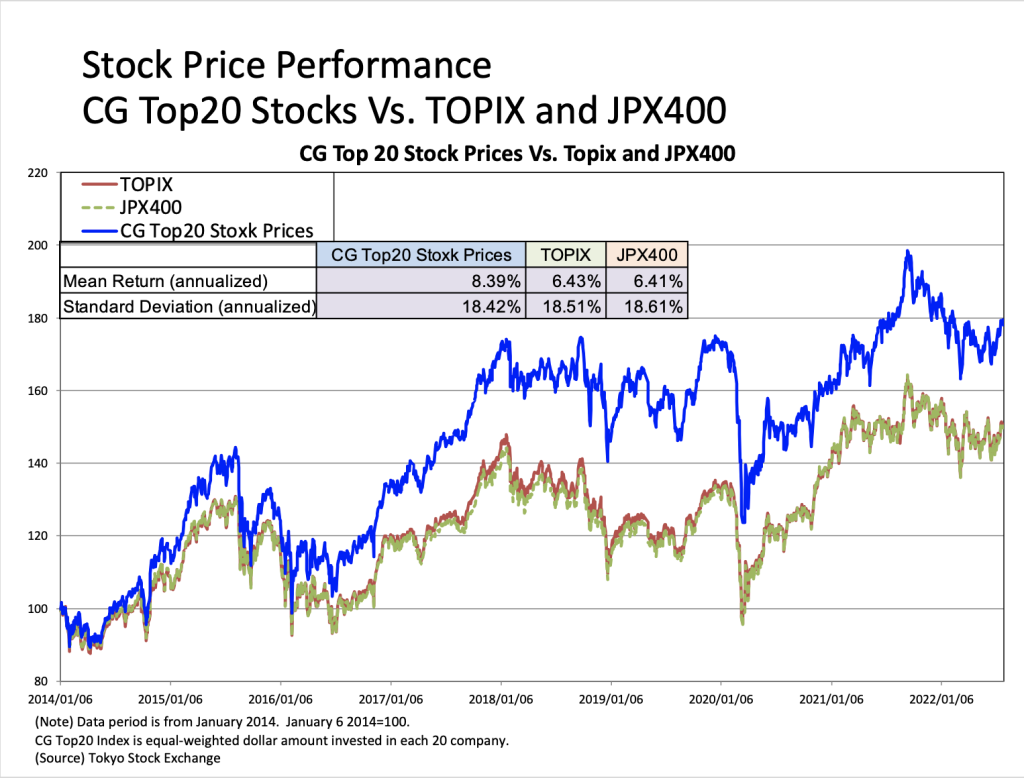

CG Top 20 Stock Performance (October 2022)

The stock market closed higher in October, driven by rising U.S. equity prices, which rose on expectations of a slowdown in U.S. policy rate hikes.

The performance of the TOPIX and JPX400 indexes in October was up 5.11% and 5.22%, respectively. Over the long term since 2014, the CG Top 20 continues to outperform both indices by about 2% per year. Note that the CG Top20 has been reassessing its component stocks since July 1. The new individual stocks are listed in the table below.

-1024x767.png)

METRICAL: What Initiatives are Companies with High Valuations Taking?

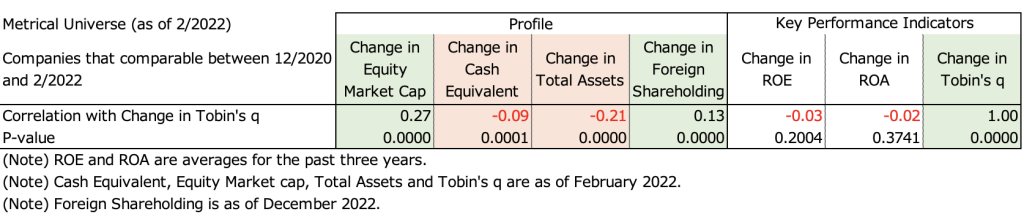

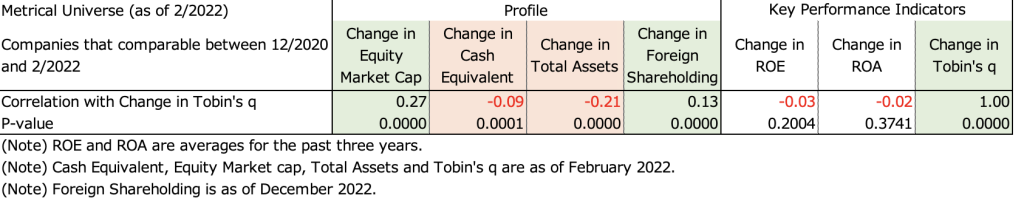

In my previous article, “Transitional companies in the prime market: to increase valuations,” I examined companies that increased their market capitalization over the December 2020-February 2022 period and found that the increase was due to higher valuations. I then examined the initiatives of the companies whose Tobin’s q increased during the period in question. I found that changes in Tobin’s q were closely related to increases in foreign ownership, and that firms with large increases in Tobin’s q showed declines in cash equivalents and total assets, suggesting that firms moved to use their assets more effectively. Related to the effective use of assets, these companies have clearly articulated the balance between investment in growth and shareholder returns in their capital allocation policies and have made efforts to communicate with shareholders and investors. With regard to board practices, the companies that significantly increased their Tobin’s q made notable improvements in ensuring the independence of their independent director ratios and compensation committees, as required by prime market listing standards. It was also inferred that the inclusion of companies that eliminated takeover defenses also contributed to boosting Tobin’s q. In light of these results, I’m now interested in what tends to happen to companies with high valuations in the first place, and would like to examine what efforts have been made to address this issue.

The table below shows the correlation analysis between the change in Metrical Tobin’s q and the change in Profile and Key Performance Indicators. Over the period, changes in Tobin’s q are significantly positively correlated with changes in market capitalization and foreign ownership. This confirms that changes in Tobin’s q (valuation) are closely related to changes in market capitalization and foreign ownership. The change in Tobin’s q also shows a significant negative correlation with the change in cash equivalents and the change in total assets. I find that firms that increased Tobin’s q tended to decrease cash equivalents and total assets during the period in question.

Why Leaders Must Adapt To Evolving ESG Demands

By Helle Bank Jorgensen, CEO of Competent Boards

The discussion focused on the rapidly changing picture of environmental, social and governance (ESG) requirements for companies as they come under increasing pressure from stock markets to provide transparent, measurable and comparable data on their activities.

And let’s not forget pressure from employees, suppliers, customers and other societal stakeholders. ESG risks and opportunities are a fast-moving field, with new regulations and expectations coming thick and fast.

It starts and ends with the board of directors

For companies that want to effectively adapt to these evolving ESG requirements, including climate change, that process must start and end with the board of directors. ESG and climate change are areas where board directors cannot provide oversight if they don’t have the insight.

METRICAL: Transitional Companies in the Prime Market: To Increase Valuations

・Is the “Plan” for Prime Market Transitional Companies Sufficient?

With the reorganization of the TSE market segmentation has started in April, each listed company has disclosed the market it chooses. Of the 1,841 companies currently listed on the TSE 1st Section that have selected the prime market but cannot meet the prime market listing criteria, 296 companies will be allowed to list on the prime market for the time being through “transitional measures.” The main criteria for prime market listing are a ratio of tradable shares of 35% or more and a total market capitalization of tradable shares of 10 billion yen or more. These companies disclose a “Plan” and apply for the transitional measures. The content of that Plan document is to present medium-term numerical targets and describe measures to achieve those targets. In the case of a company with a shortfall in the current tradable share ratio, the main measure is the elimination of cross-held shares. The problem faced by companies applying transitional measures is often the market capitalization of tradable shares, and there is no special remedy for increasing this. As far as the “Plan” is concerned, most of such companies are trying to draw a story of growth of corporate value and enhancement of shareholder returns, which will lead to an increase in market capitalization. Growth in corporate value and enhanced shareholder returns are very important themes for shareholders and investors. Only when the specifics and probability of these measures are in place can sufficient communication with shareholders and investors be achieved. If these measures are approved by shareholders and investors, they will probably bring about a change in valuations. Valuations can be considered to be built-in to the future cash flows of corporate value growth, so solid growth prospects and cash flow allocations should be required. This is true for all listed companies, not just those to which transitional measures apply. In this issue, I would like to explore some tips on how to improve valuations, one of the most important factors in determining market capitalization.

・Explore factors that can be used to enhance valuations

First, we examine which companies tend to have a higher Tobin’s q

Using the 1,487 comparable companies in the Metrical universe from the end of December 2020 to the end of February 2022, I explore the changes in Tobin’s q and effective factors over the relevant period. The table below shows the correlation analysis between changes in Tobin’s q and changes in the Profile and Key Performance Indicators for the period from the end of December 2020 to the end of February 2022. During this period, changes in Tobin’s q are significantly positively correlated with changes in market capitalization and foreign shareholding ratios. This confirms that changes in Tobin’s q (valuation) are closely related to changes in market capitalization and foreign shareholding ratios. The change in Tobin’s q has also shown a significant negative correlation with the change in cash equivalents and the change in total assets. I find that companies that increased Tobin’s q tended to decrease their cash equivalents and total assets during the period in question.

METRICAL: CG Stock Performance (Japan): September 2022

The stock market closed lower in September due to declines in the U.S. and European stock markets on concerns over rising interest rates. The CG Top20 stock price outperformed both the TOPIX and the JPX400 over the month.

The stock market was firm from the second half of the month as the U.S. market rallied in mid-September on the back of lower long-term interest rates in anticipation of a recession in the U.S. economy. Over the long term since 2014, the CG Top 20 has continued to outperform both indices by about 2% per year. Over the long term since 2014, the CG Top20 continues to outperform both indices by about 2% per annum. The CG Top 20 has been reassessed as of July 1. The new individual stocks are listed in the table below.

9/13 “Director Boot Camp” Held by Zoom! Next Courses: 12/1 !

Letter to Prime Minister Fumio Kishida from Nicholas Benes on New Capitalism

September 2, 2022

Nicholas Edward Benes

(Writing as an individual. Please see below.)

Setagaya-ku, Tokyo

benesjp22@gmail.com

(Please feel free to email me to receive a PDF copy of this letter.)

Prime Minister Fumio Kishida

Prime Minister’s Residence

2-chōme-3-1 Nagatachō

Chiyoda-ku, Tokyo 100-0014

cc:

Deputy Chief Cabinet Secretary Seiji Kihara

Mr. Masahiko Shibayama, Deputy Chairperson, Election Strategy Committee of the LDP

Hon. Prime Minister,

I am writing this letter with the respect that is due you as the foremost leader of this country, who has set forth a concept for “a new form of capitalism.” If I may, I would like to share my concrete thoughts on how further improving corporate governance in Japan can be a positive game-changer for Japan’s economy, society, and financial markets.

When I saw your moving speech to the NPT Review Conference, I was impressed how fluently you read English. Therefore, I am taking the liberty to write this letter in English, attaching a Japanese translation. As the person who suggested to the US government that President Obama visit Hiroshima, I was pleased with your passionate comments.

METRICAL:CG Stock Performance (Japan): August 2022

August stock prices rose sharply until the first half of the month as the U.S. stock market rallied on expectations of an early end to monetary tightening in the U.S. Toward the end of the month, the market turned highly volatile as the U.S. stock market fell on the concern about longer-than-expected U.S. monetary tightening. The CG Top 20 outperformed both TOPIX and JPX400 during the month.

Until mid-August, the stock market rallied in favor of the U.S. stock market, which rose on expectations of an early end to the U.S. monetary tightening due to the U.S. economic recession speculation. In the latter half of the month, market volatility increased due to concerns about the U.S. FED’s long-term monetary tightening. The TOPIX and JPX400 indexes gained 1.53% and 1.33%, respectively, during the month of August, while the CG Top20 index outperformed both indices, rising 1.66%. The table below shows the components of the CG Top 20 as reviewed on July 1.