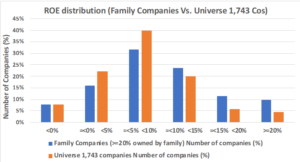

The environment surrounding our business is changing significantly in line with changes in social life due to the spread of the new corona virus infection. The biggest challenge for management is to adapt to these changes in the environment with a post-corona scenario in mind. We believe that one of the keys to adapting to these changes in a timely and flexible manner is management leadership. We expect to see a lot of interest in the relatively fast-moving family-owned companies. In the past, METRICAL research has shown that companies owned by founder’s families with 20% or more of their companies performing significantly better than average. We would like to focus again on the latest data. The following two charts show the distribution of ROE (actual for past 3-5 years) and Tobin’s Q between family-owned companies (those with 20% or more ownership) and the universe of 1,743 firms, with both ROE and Tobin’s Q being higher for family companies than for the universe of 1,743 companies’ distribution. It remains to be seen whether the family companies will be able to adapt to these changes at a rapid pace and achieve higher profitability, which will be reflected in their stock performance.