【Closed】BDTI’s Director Training for Women Initiative 2025

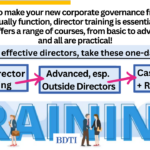

With many applications from talented women, 91 women were selected to receive scholarships this year. More than half of the scholarship recipients took BDTI’s Governance “Juku”, BDTI’s core director training taught in Japanese, while the rest participated in either Advanced Outside Director Training, BDTI’s Director Boot Camp taught in English, BDTI’s Role Play course, or went through e-Learning (which consists of 4 digital courses in total).

Detail/Nominate: https://jwliccja.org/apply-3/

Deadline (extended): Sunday, May 19 – Japan Time

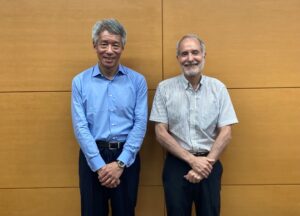

Based on interest from participants overseas, BDTI held its English Director Boot Camp via teleconference on January 19th. The day-long intensive course was attended by highly-experienced and highly interactive participants all the way from Hong Kong, Papua New Guinia to Europe. The participants heard lectures about corporate governance by Nicholas Benes and there were lots of interactive discussion and Q&A about real-life situations on Japanese boards, and how to handle them. You get even more in the additional materials we provide in your thick binder.

The tax year will soon end! If you are interested to help improve corporate governance in Japan by supporting its up-and-coming “Institute of Directors”, please consider making a tax-deductible donation to our government-certified non-profit using this link: https://bdti.or.jp/en/about/make-a-donation/ . a Here is “why director training is so essential in Japan: あ Donations to BDTI can be […]

Unfortunately, every June at AGMs in Japan most investors approve the vast majority of director candidates –even first-time director candidates — without confirming whether they have ever received any form of director training to prepare them, or a “refresher” course on emerging issues and new best practices. Because of this, an increasingly large percent of directors in Japan have served less than three years (at least 30% in the case of outside directors!) in their very first director position, but have never even received basic training. METI and the FSA are starting to consider this as a major problem.

Serving as a director on a public company board is not the same job as serving as a lawyer, academic, or the head of global sales. It requires different knowledge, mindset and preparation. Raising PBRs, improving sustainability, DEI, and optimizing the business portfolio are not going to “happen” by themselves just because those topics appear in pronouncements and the press. They will only take root and consistently improve if the quality of Japanese boards increases. But right now, the average quality of boards is quite low, as can be seen from these…

Here is BDTI’s most recent newsletter. Please sign up at the top right of https://bdti.or.jp/en/ to receive this periodically.

Click on the link above to see the newsletter.

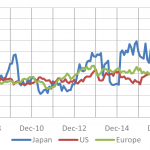

On June 13th, join us for a discussion showing the future of corporate governance analysis. In this webinar we will introduce the results of leading-edge academic research to determine whether corporate governance practices and firm characteristics can be used to predict firm performance over the short-, mid-, and long-term. Earlier attempts at this research have always come with limitations or been focused narrowly on certain practices, but using BDTI’s detailed database focusing on Japanese corporate governance practices and important characteristics of all listed firms in Japan, researchers have been able to conclude that certain corporate governance practices and facts should be of interest to every investor.

This is the first draft of a working paper led by two respected Japanese academicians who used governance and firm-specific big data to predict future equity returns in Japan . Conclusion: “we constructed a prediction model of firms’ future TSR and used it to show that the investment strategy based on the model’s predictions could generate non-negligible improvement in returns. These results suggest that high-dimensional corporate governance variables contain informative signals associated with future firm performance over and above reliance on purely financial data.”

The research was conducted using BDTI’s detailed, Japan-specific time-series database for all listed companies in Japan. The results are consistent with the fact that every fund manager that has backtested our data so far has bought a license, and every licensee has renewed so far. It would seem that Japan’s square peg of three different governance structures and peculiar practices does not seem to fit into the standard “global” round hole framework used by other data providers.