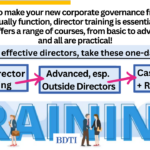

Unfortunately, every June at AGMs in Japan most investors approve the vast majority of director candidates –even first-time director candidates — without confirming whether they have ever received any form of director training to prepare them, or a “refresher” course on emerging issues and new best practices. Because of this, an increasingly large percent of directors in Japan have served less than three years (at least 30% in the case of outside directors!) in their very first director position, but have never even received basic training. METI and the FSA are starting to consider this as a major problem.

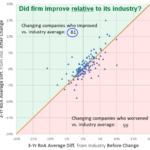

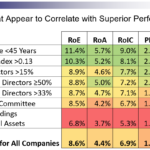

Serving as a director on a public company board is not the same job as serving as a lawyer, academic, or the head of global sales. It requires different knowledge, mindset and preparation. Raising PBRs, improving sustainability, DEI, and optimizing the business portfolio are not going to “happen” by themselves just because those topics appear in pronouncements and the press. They will only take root and consistently improve if the quality of Japanese boards increases. But right now, the average quality of boards is quite low, as can be seen from these…