On October 14, the Nikkei Shimbun published an article titled “The Magnetism of “Founder’s Family Companies with Reverse Strategies”: Aggressive Even in a Crisis, Corporate Governance is an Issue.” I would like to think about the points discussed in the article.

The October 14 Nikkei article outlined the following report.

Founding family companies that did not flinch in the face of the crisis and moved to a “reverse strategy” are attracting investors. Companies that made quick management decisions and expanded store openings during the COVID-19 pandemic have been unique in the stock market because of the explosive power of their earnings recovery. Weak governance, which has been a longstanding issue, has also been addressed, and money is flocking to companies that are ahead of the curve.

The Nikkei Stock Average rebounded sharply in the Tokyo market on October 14, ending the day 853 yen higher than the previous day. Compared to the end of last year, it was 6% lower. The market environment remained nervous due to strong concerns about continued U.S. interest rate hikes and economic recession. One company that has seen its share price rise steadily and more than double its appreciation rate is TKP, a major rental meeting room company. In FY02/2021, when face-to-face events decreased due to the Corona disaster, the company fell into the red for the first time since its listing. While reducing fixed costs such as personnel expenses and rent, the company remained on the offensive behind the scenes. The company aggressively purchased prime properties that were undervalued. This “reverse management strategy” is now bearing fruit. With the lifting of restrictions on activities, demand has returned, and the company is back in the black for the March-August period of 2022 for the first time in 3 years. President Takateru Kono, speaking at the October 13 financial results briefing, enthusiastically stated, “We will not only rent out space, but also provide content (such as distribution services) to increase added value.”

Nextage, a used car sales company, is another company that boldly took risks. Although it suffered from an increase in inventory in the early days of COVID-19 pandemic, it did not stop opening new stores. Its large “general stores,” which provide buying, maintenance, and vehicle inspection services all in one package, expanded to 51 at the end of August 2022, a 2.4 times increase from the end of November 2019. Profit margins improved by attracting blue-chip customers.

What both companies have in common is that they are founding family companies whose major shareholders consist of the management and its family members. Investors who are looking to discover companies that can go on the offensive even during a crisis are paying attention to these companies. Junpei Kitahara, senior fund manager of Nikko Asset Management’s “Zipangu Owner Company Stock Fund,” points out that “the strength of founding family companies is their speed of decision-making and bold management strategies. He analyzes that “the perspectives of management and shareholders are unified, making it easier to convince stakeholders even in times of crisis.”

Discussion Point 1: “Founder family companies have strengths in speed of decision-making and bold business strategies, and the perspectives of management and shareholders are unified, making it easier to convince stakeholders even in times of crisis.”

The founder originally took risks to expand the business and became a publicly listed company. As a founder, he/she is well aware that risk-taking is an opportunity to expand the business. It is no wonder that they think that out-of-the-box thinking and strategy are also very necessary elements. In addition, since the founder and his/her family own a significant percentage of the company’s shares, they are in a position to share the same goal of maximizing corporate value in the same boat with other shareholders, since they are the major shareholders themselves. I believe the key lies in the shareholding.

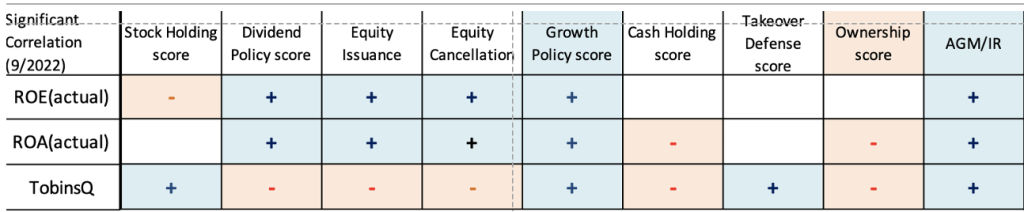

The table below examines the correlation between ROE and ROA (averaged over the past three years) and Tobin’s Q for each of the 1,785 companies in the Metrical universe (September 2022) by criteria. The 1,785 companies in the Metrical universe were divided into 3 groups: (a) companies with shareholders owning 50% or more, (b) companies with shareholders owning 20% to less than 50%, and (c) companies with no shareholders owning 20% or more, and score them as Ownership Score (Group (a)<Group (b)<Group (c)). We can see that the Major Shareholder Factor (Ownership Score) is negatively correlated with ROA and Tobin’s Q with significance. Therefore, we can say that Group (a), Group (b), and Group (c) with lower Ownership Score have higher ROA and Tobin’s Q, in that order. In other words, ROA and stock valuations are higher for companies with a large shareholder holding 50% of the shares (followed by a large shareholder holding between 20% and 50% of the shares). Groups (a) and (b) include subsidiaries and affiliates under the listed parent company as well as the founding family. The management focus on specific businesses with strengths is the same as that of the founding family companies. In both cases, they tend to be strongly influenced by certain major shareholders. In particular, founder family companies are characterized by a high awareness of stock price, which is highly influenced by the family’s assets.

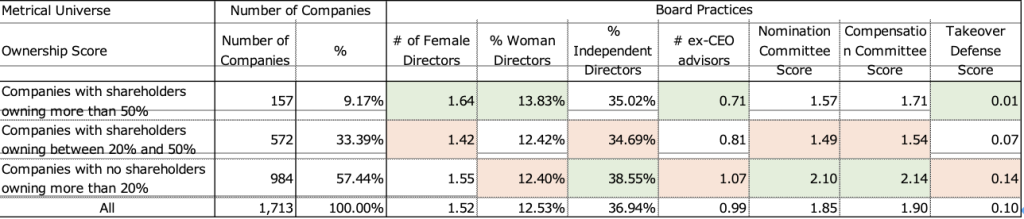

In a previous article, “Parent-Subsidiary Listing Investment Strategy Update (4) – The Impact of Major Shareholder Stakes on Governance and Stock Performance,” I discussed the correlation between Major Shareholder Factor and Corporate Governance Practices. I analyzed the change in corporate governance practices (12/2020-1/2022) for the 1,713 companies in the Metrical universe (January 2022), divided into the above groups (a), (b), and (c). The results confirm that the Major Shareholder Factor has a significant impact on Corporate Governance Practices, as there are many evaluation items that have a significant correlation between the Major Shareholder Factor and Board Practices and Key Actions. With regard to board practices, companies with shareholders holding more than 50% interest are generally less aware of the need to improve their practices, partly because they do not need to pay much attention to the voices of minority shareholders (see table below).

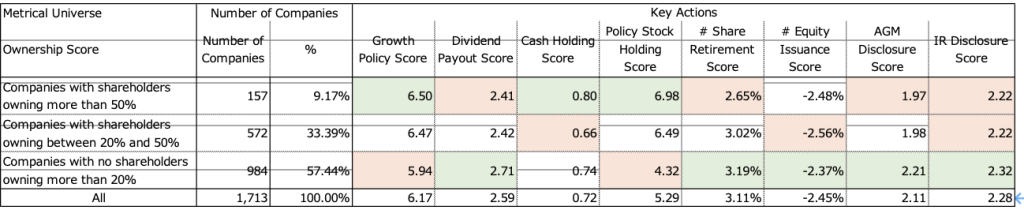

On the other hand, with regard to key actions, companies with shareholders holding more than 50% interest are presumed to be proactive in growth investment. Since they have a robust Conversely, companies with no shareholders owning more than 20% of the company’s equity indicate that many of them have unclear growth policies, perhaps because they do not see opportunities for growth investment. On the other hand, these companies have a high percentage of foreign shareholders and are highly conscious of shareholder returns, with a high dividend payout ratio and a high frequency of treasury stock retirement, and they try to communicate with investors in their AGM and IR disclosure (see table below).

In summary, I have thought about the point of the Nikkei article, which states that “founding family companies have strengths in speed of decision-making and bold management strategies, and that the perspectives of management and shareholders are unified, making it easier to convince stakeholders even in times of crisis.”

Certainly, I agree that the founders know from experience that risk-taking is an opportunity for business expansion, and they are flexible enough to manage their companies with out-of-the-box ideas and strategies to turn a crisis into an opportunity. The biggest difference between founder family companies and other companies seems to be shareholding. Metrical Universe (September 2022) 1,785 companies with or without major shareholders are classified as (a) companies with shareholders holding 50% or more, (b) companies with shareholders holding 20% to less than 50%, and (c) companies without shareholders holding 20% or more, and the correlation between ROE, ROA, and Tobin’s Q was verified. The results showed that the Major Shareholder Factor was negatively correlated with ROA and Tobin’s Q with significance. Thus, it is shown that ROA and stock valuations are higher for companies with large shareholders who own 50% of the stock (followed by large shareholders who own between 20% and 50% of the stock). Groups (a) and (b) include not only the founding families but also subsidiaries and affiliates under the listed parent company, but founding family companies tend to have relatively high profitability (ROA) and high stock valuations.

With regard to corporate governance practices, I discussed the correlation between major shareholder factors and corporate governance practices in my previous article, “Parent-Subsidiary Listing Investment Strategy Update (4) – The Impact of Major Shareholder Stakes on Governance and Stock Performance. I divided the Metrical Universe of 1,713 companies (as of January 2022) into the above groups (a), (b), and (c) to determine the correlation between the Major Shareholder Factor and Corporate Governance Practices, and analyzed the change in Corporate Governance Practices (12/2020-1/2022). The results show that, with regard to board practices, companies with shareholders holding more than 50% interest are generally less conscious of improving their practices, partly because they do not have to pay much attention to the voices of minority shareholders.

On the other hand, with regard to key actions, companies with shareholders holding more than 50% interest are presumed to be proactive in growth investment. Since they have a clear growth policy and have few excess cash holdings or cross-held shares, I can assume that they are effectively using their cash and assets for growth investment. Conversely, companies with no shareholders owning more than 20% of the company’s equity indicate that many of them have unclear growth policies, perhaps because they do not see opportunities for growth investment. Meanwhile, these companies tend to communicate with investors in their AGMs and IR disclosures, as they have a high percentage of foreign shareholders and are highly conscious of shareholder returns, with a high dividend payout ratio and a high frequency of share retirements.

Aki Matsumoto, CFA

Please see detail research the following links.

http://www.metrical.co.jp/

Please feel free to contact the below email address if any interest or query.

Aki Matsumoto, CFA

Executive Director

Metrical Inc.

akimatsumoto@metrical.co.jp

http://www.metrical.co.jp/jp-home/