I am sure you are aware that the number of companies moving to retire treasury stock is gradually increasing due to prime market listing standards. In my previous article, Metrical’s analysis has also revealed that companies that have retired treasury stock three or more times are also more positive in their corporate governance efforts. If share repurchases are a sign that corporate governance initiatives and performance improvement are working in tandem, it is very welcome. I would like to think more about how the actual action taken by the company to retire its own shares relates to corporate governance.

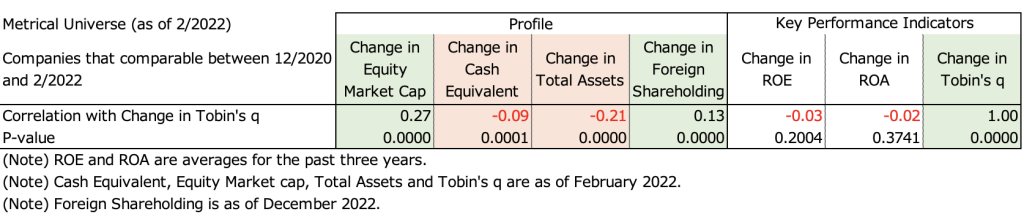

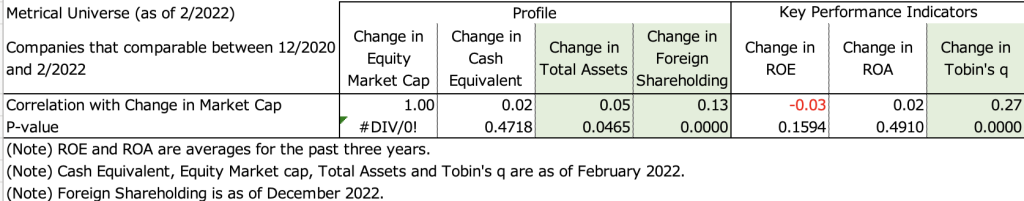

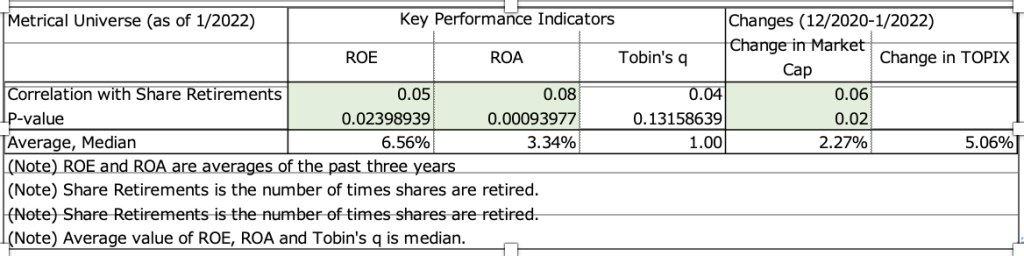

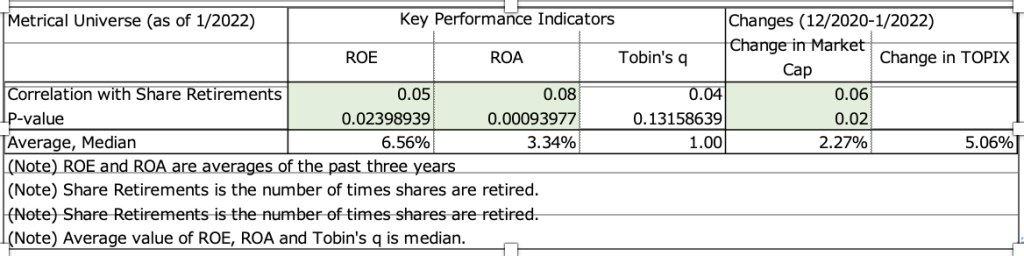

The table below shows the correlation between the frequency of share buybacks and ROE, ROA, and Tobin’s q for the Metrical Universe (as of 1/2022). As shown in the previous article, a highly significant positive correlation between the frequency of share buybacks and ROE and ROA has been confirmed, indicating that the more frequently a company retires its own shares, the higher its ROE and ROA.

This result seems reasonable, because to cancel treasury stock, a company has to buy back its own shares, which has a positive effect on ROE and ROA. On the other hand, the correlation between Tobin’s q and the frequency of share repurchases is not shown to be significant. This means that a company that retires its own shares more frequently does not have a higher stock price valuation, which means that a company that retires its own shares does not have a significant relationship with its stock price valuation. Although the company buys back its own shares before retiring them, this result is also reasonable because the company does not take Tobin’s q (P/B) into account when making its decision to buy back its own shares. On the other hand, it is interesting to note that there is a highly significant positive correlation between the rate of change in market capitalization (12/2021-1/2022) and the frequency of stock repurchases. Even though the frequency of share buybacks is not correlated with respect to stock price premium or discount, it is related to the rate of change in market capitalization over the period 12/2021-1/2022. Over this 13-month period, the more frequent the company’s share retirement (or stock repurchase), the greater the increase in market capitalization. The results show that stock retirement was associated with an increase in market capitalization over this period.

-1024x767.png)