I am sure you are aware that the number of companies moving to retire treasury stock is gradually increasing due to prime market listing standards. In my previous article, Metrical’s analysis has also revealed that companies that have retired treasury stock three or more times are also more positive in their corporate governance efforts. If share repurchases are a sign that corporate governance initiatives and performance improvement are working in tandem, it is very welcome. I would like to think more about how the actual action taken by the company to retire its own shares relates to corporate governance.

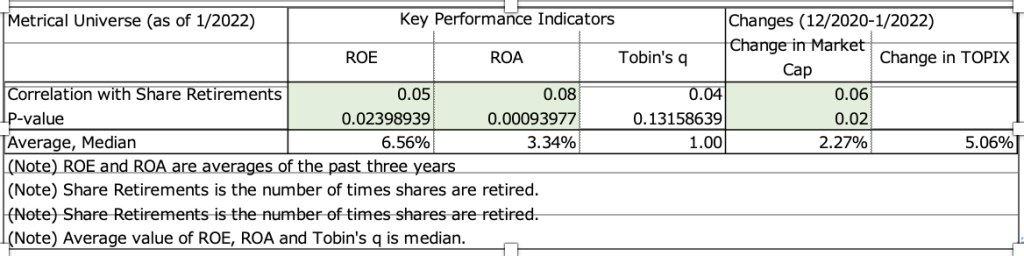

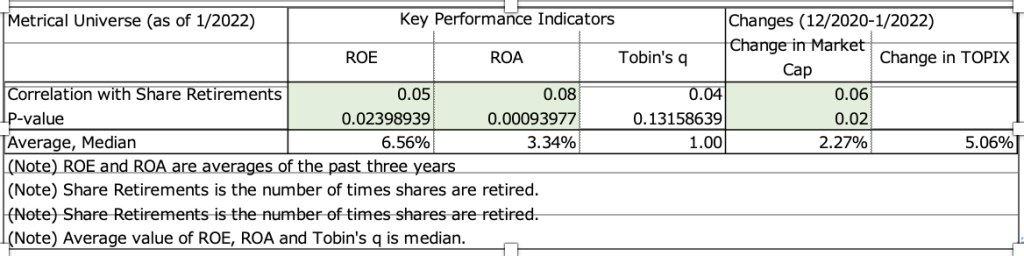

The table below shows the correlation between the frequency of share buybacks and ROE, ROA, and Tobin’s q for the Metrical Universe (as of 1/2022). As shown in the previous article, a highly significant positive correlation between the frequency of share buybacks and ROE and ROA has been confirmed, indicating that the more frequently a company retires its own shares, the higher its ROE and ROA.

This result seems reasonable, because to cancel treasury stock, a company has to buy back its own shares, which has a positive effect on ROE and ROA. On the other hand, the correlation between Tobin’s q and the frequency of share repurchases is not shown to be significant. This means that a company that retires its own shares more frequently does not have a higher stock price valuation, which means that a company that retires its own shares does not have a significant relationship with its stock price valuation. Although the company buys back its own shares before retiring them, this result is also reasonable because the company does not take Tobin’s q (P/B) into account when making its decision to buy back its own shares. On the other hand, it is interesting to note that there is a highly significant positive correlation between the rate of change in market capitalization (12/2021-1/2022) and the frequency of stock repurchases. Even though the frequency of share buybacks is not correlated with respect to stock price premium or discount, it is related to the rate of change in market capitalization over the period 12/2021-1/2022. Over this 13-month period, the more frequent the company’s share retirement (or stock repurchase), the greater the increase in market capitalization. The results show that stock retirement was associated with an increase in market capitalization over this period.

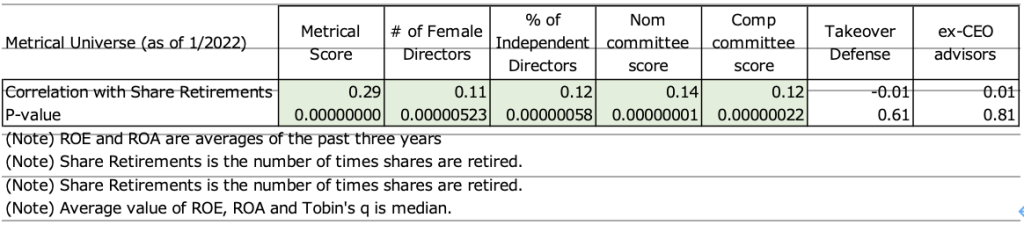

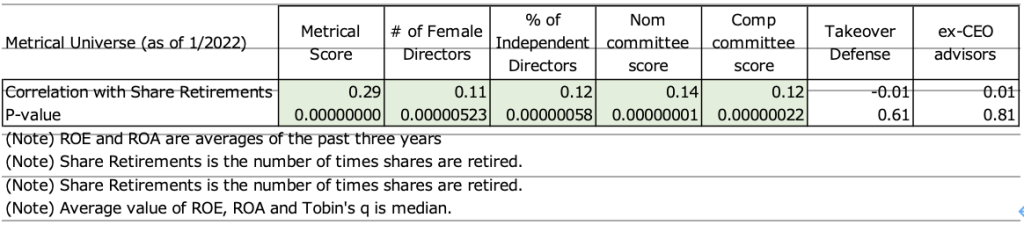

The table below shows the correlation between the frequency of share repurchases and board practices. The presence or absence of anti-takeover measures and the number of ex-CEO advisors did not show a significant correlation with the frequency of share repurchases, but the Number of Female Directors, % of Independent Directors, Nomination committee scores and Compensation committee score. Since the frequency of stock retirement is significantly positively correlated with these practices, I can hypothesize that these board practices have a lot to do with the process of determining the action to be taken to retire stock.

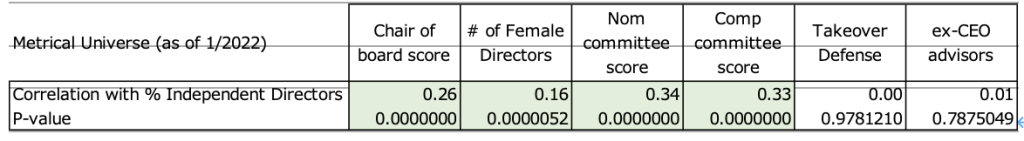

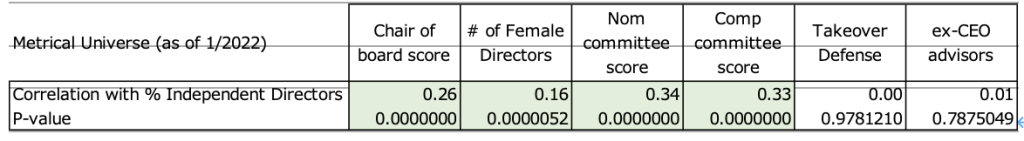

The core of the board practices mentioned above is the % of Independent Directors. Initiatives to incorporate independent directors into the board of directors are gradually progressing, but only 148 of the 1,713 companies in the Metrical Universe (8.64%) have a majority of independent directors on their boards. This shows how high a hurdle this is. The table below shows how this key practice is closely related to board practices. Although there is no significant correlation between the presence of anti-takeover measures and the number of ex-CEO advisors and the ratio of independent directors, there is a significant correlation between the Chair of board score, Number of Female Directors, Nomination committee score and Compensation committee score.

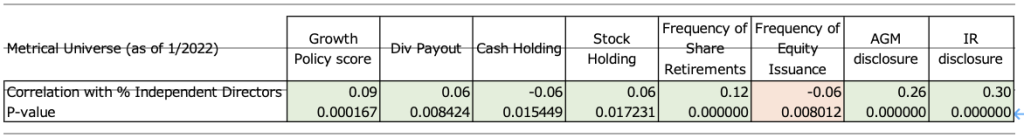

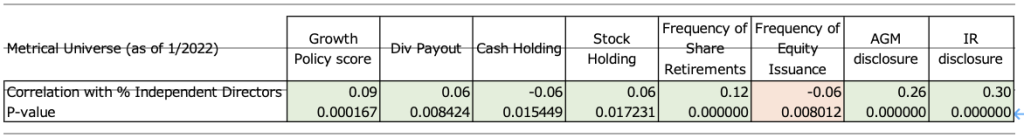

The table below shows the correlation between the percentage of independent directors and the actual actions taken by the company, showing that there is a close relationship between the ratio of independent directors and the actual actions taken by the company. The growth policy score (the stronger the KPIs, numerical targets, etc., the higher the score), the dividend policy score (the higher the dividend payout ratio up to 50%), the Cash Holding score (the lower the cash to sales ratio, the higher the score), and the Stock Holding score (the lower the policy holdings to total assets ratio, the higher the score) are all correlated with the actions taken by the company. There are significant positive correlations between the Cash Holding score (the lower the cash to sales ratio, the higher the score), the Stock Holding score (the lower the policy stock holdings to total assets ratio, the higher the score), the Frequency of Share Retirements, and the AGM disclosure and IR disclosure scores. It can be inferred that companies with higher independent director ratios have a more positive impact on these company behaviors. On the other hand, the percentage of independent directors has a significant negative correlation with Frequency of Equity Issuance (the higher the ratio of independent directors, the more equity issuance). This suggests that companies with a high percentage of independent directors are more willing to accept equity issuance to invest in growth. This can be viewed as a positive sign that the company sees growth opportunities, but it is necessary to follow the company’s returns separately from ROE and ROA. The positive correlation between the growth policy score and the percentage of independent directors suggests that the company has a solid growth policy in place at this time, but we need to carefully monitor whether the company is generating returns through equity issuance and subsequent cash collection with an emphasis on the cost of capital.

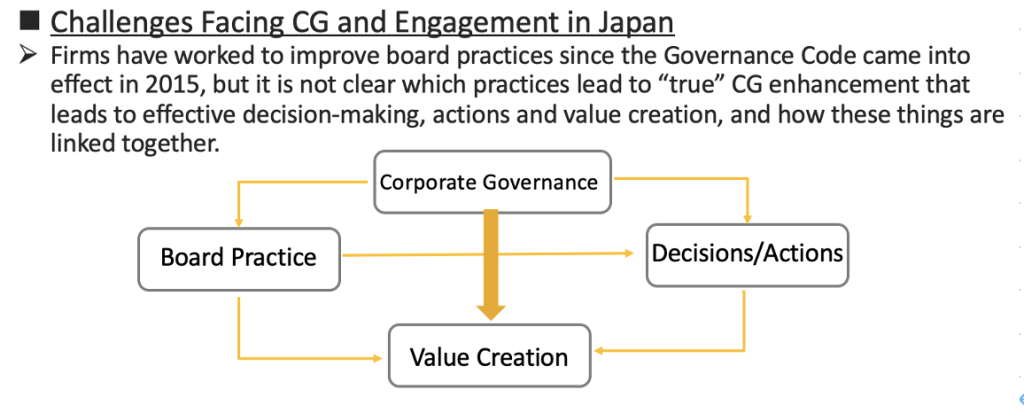

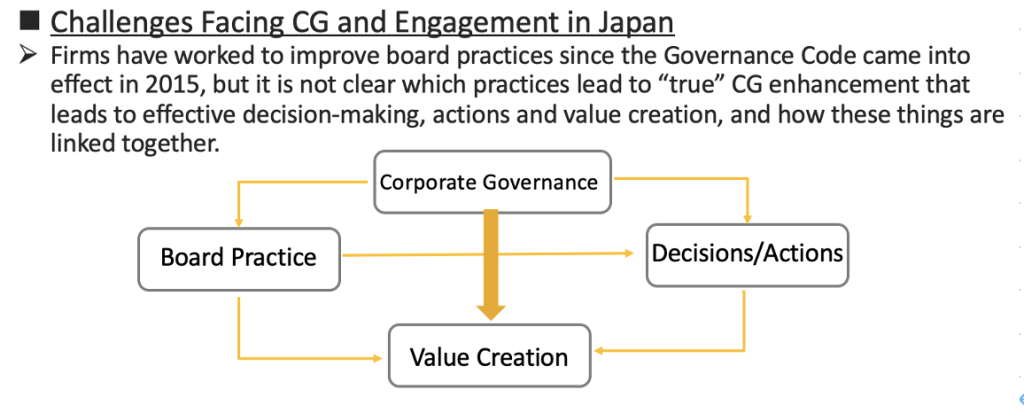

Let me summarize what I have said above. The frequency of share repurchases is highly correlated not only with ROE and ROA returns, but also with changes in market capitalization, confirming once again that repurchasing and retiring treasury stock has a positive effect on share price appreciation, regardless of whether the stock is undervalued or not. In addition, the frequency of share repurchases was found to be highly correlated with major board practices, so I focused on the percentage of independent directors, which is key to ensuring the transparency and objectivity of the board. From a statistical standpoint, the percentage of independent directors has a significant positive correlation with other major board practices. Therefore, I analyzed the correlation with the company’s actions to see if an increase in the percentage of independent directors would improve board practices and also have a positive impact on the actual actions taken by the company. The results confirm that the percentage of independent directors is positively correlated with a number of actions with significance. As shown in the diagram below, Metrical has been analyzing how board practices and decision making/actions are linked for value creation since 2015. Based on the results above, it appears that these links are slowly emerging.

Aki Matsumoto, CFA

Please see detail research the following links.

http://www.metrical.co.jp/

Please feel free to contact the below email address if any interest or query.

Aki Matsumoto, CFA

Executive Director

Metrical Inc.

akimatsumoto@metrical.co.jp

http://www.metrical.co.jp/jp-home/