TSE reorganizes its market reclassification, the guidelines for “higher governance standards” required for the prime market, which is equivalent to the current 1st Section market, have been presented.

In this article, I would like to focus on the use of electronic voting platforms and disclosure in English. In the Corporate Governance Code revised in June 2021, Supplemental Principles 1-2 (4), 1-2 (4), and 3-1 (2) state that companies listed on the prime market are required to use electronic voting platforms and disclose information in English under “Use of electronic voting platforms and disclosure in English.”

The original text is as follows Supplementary Principle 1-2(4), “Listed companies should promote the creation of an environment to enable electronic exercise of voting rights (e.g., use of electronic voting platforms) and the translation of convocation notices into English, taking into account the ratio of institutional investors and overseas investors among their shareholders. In particular, companies listed on the prime market should be able to use electronic voting platforms, at least for institutional investors.”

Supplementary Principle 3-1 (2), “Listed companies should promote disclosure and provision of information in English to a reasonable extent, taking into account the ratio of overseas investors, etc. among their shareholders. In particular, companies listed on the prime market should disclose and provide necessary information in English in their disclosure documents.”

In summary, Supplemental Principle 1-2(iv) clearly states that companies listed on the prime market should make available an electronic platform to facilitate the exercise of voting rights and that English translations of convocation notices should be sent to overseas investors. Supplemental Principle 3-1(2) clearly states that companies listed on the prime market should disclose and provide required information in English in their disclosure documents.

Since supplementary principle 1-2(4) specifies the means of exercising voting as “electronic platforms should be made available,” companies listed on the prime market will have to be ready to use these by the next general shareholders meeting. Since it is a recommendation to send convocation notices in English translation, it is an effort target since it is not as urgent as electronic platforms. The supplementary principle 3-1 (2) states that companies listed on the prime market should disclose and provide required information among disclosure documents in English, but it does not specify what the required documents are, so it is left to the judgment of companies listed on the prime market as to which documents or information need to be translated into English. One piece of information that I believe should be translated into English is the annual securities report. Since this document is a legal document, it contains all the necessary information. Everything in this document, including the notes, should be translated into English. There are times when we receive questions from overseas institutional investors about a particular company, and since there are many items that are described in the annual securities report (for information that is not described in the annual securities report, we have to ask the listed company in question), it would be a great convenience for overseas institutional investors if this document, which contains very useful information for investors, were translated into English. At present, there are very few listed companies that translate these documents into English.

I have reported on the status of information disclosure in English by listed companies. This time, as mentioned above, I would like to focus on the use of electronic voting platforms and English-language disclosure in accordance with the TSE Prime Market listing criteria.

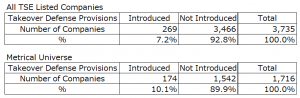

The table below shows the use of e-voting platforms and English-language disclosure by companies in the Metrical Universe (as of October 2021) based on information obtained from TSE disclosure and corporate governance reports. According to the report, 64.7% of the 1,716 companies in the Metrical Universe are able to use the e-voting platform required for companies listed on the prime market under the supplementary principle 1-2(4), and 69.5% of the companies have translated their convocation notices into English, which is required as much as possible. For reference, apart from providing an electronic voting platform, 78.9% of the companies support the exercise of voting rights by electronic means.

As for the disclosure and provision of required information in English, which is required for companies listed on the prime market in the supplementary principle 3-1 (2), as mentioned above, it is not specified what the required documents are, but I will refer to the TSE’s data “Availability of English Disclosure Information by Listed Companies.” From the TSE data, we can see that the following 4 types of documents are disclosed in English: Earnings Reports in English, Corporate Governance Reports in English, Annual Securities Reports in English, and IR Presentations in English. 62.8% of the 1,716 companies in the Metrical Universe disclose Earnings Reports in English, 21.6% of the companies disclose Corporate Governance Reports in English, 11.5% of companies disclose Annual Securities Reports in English, and 66.6% of companies disclose IR Presentations in English.