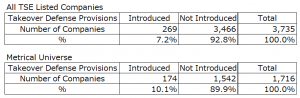

As shown in the table below, more than 90% of all TSE-listed companies have not adopted takeover defense provisions, and about 90% of the companies in the Metrical universe (which consists mainly of companies listed on the TSE 1st Section and slightly larger in market capitalization than all listed companies) have not adopted takeover defense provisions.

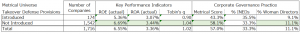

While companies that do not retain takeover defenses are now the mainstream, we looked at the performance and corporate governance practices of companies that have adopted takeover defenses and those that have not. The table below shows them. As you can see, the performance of companies without takeover defense measures is superior in terms of ROE (actual), ROA (actual) for the past three years on average and Tobin’s Q. In terms of corporate governance practices, other than the percentage of independent directors, companies were found to be superior in terms of the percentage of female directors and Metrical score.

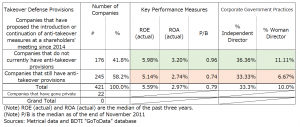

Now, with the help of BDTI’s database, we have tried to analyze the situation from a slightly different angle. We decided to focus on companies that have proposed anti-takeover measures at their general meetings of shareholders since 2014, one year before the introduction of the Corporate Governance Code. The table below summarizes the results of our analysis, showing that 443 companies have proposed anti-takeover measures to their shareholders since 2014. Of these, 22 have gone private, so we will analyze the performance and corporate governance practices of the 421 companies that are currently listed (including the 109 companies outside the Metrical Universe). Of the 421 companies that proposed takeover defenses to their shareholders, 41%, or 173 companies, no longer have them (or they never were approved in the first place; – but now, only four of those firms are still listed), while 248 companies still have anti-takeover measures in place. As mentioned above, according to TSE Governance Reports the total number of listed companies stating that they have anti-takeover measures is 270 (surprisingly, an increase of one company in over the last month), meaning that 22 companies decided to adopt anti-takeover measures before 2014 and still have them. I will leave the discussion of this issue for another time, so I will examine the performance and corporate governance practices of the 421 companies in the table below, which clearly show that the performance and corporate governance practices of companies that have not adopted takeover defenses are superior. The table below shows the performance and corporate governance practices of 421 companies.

As shown by Tobin’s Q above and P/B in the table below, the fact that the stock price of a company that does not have a takeover defense plan is highly valued means that shareholders would be aware of the problem of having a takeover defense plan clause if the fact that the company has a takeover defense plan is one of the factors that cause the stock price to be undervalued. Also, from the perspective of a company that has a takeover defense plan, we can infer that they may be thinking that they cannot let go of the takeover defense plan clause because the stock price is undervalued. In fact, it is interesting to note that the median market capitalization of the same 421 companies that do not have takeover defenses and those that still have takeover defenses are 120,192 million yen and 26,772 million yen, respectively. We can probably assume that the market capitalization of companies that still have takeover defense measures has not expanded much. It is unfortunate for the shareholders of such companies if they are unable to penetrate investors with their growth policies and are more nervous about shrinking and locking themselves in their castles. It is difficult to say whether it is because the market capitalization of the company is small that the company cannot let go of the anti-takeover clause, or whether it is because the anti-takeover clause makes investors reluctant to buy the company’s shares. This kind of debate, whether the chicken or the egg comes first, is an issue we often face in corporate governance analysis. This analysis is just the first step, and there are many factors involved that need to be further analyzed.

Here, whether a company has adopted takeover defense measures or not is based on the data in the corporate governance report submitted to the TSE. However, there are some companies, such as Nintendo (7974), that state in their corporate governance report that they have not adopted any takeover defense measures, but in the subsequent “Supplementary Explanation” they state that they are prepared to take countermeasures against takeover bids. As you can see from the recent case of Shinsei Bank (8303), there are also cases where the board of directors resolves to take countermeasures even though the corporate governance report states that the company has not introduced any takeover defense measures. Therefore, it is important to keep in mind that even if a company reports that it has not introduced any takeover defense measures, it may actually implement such measures depending on the situation.

In summary, this analysis once again confirms that the number of companies that still employ takeover defense provisions is much smaller. There is a clear difference in performance between companies that still have anti-takeover measures and those that have dropped anti-takeover measures, and there is also a clear difference in corporate governance practices in terms of initiatives to hire independent directors and female directors. I also found that many of the companies that still have anti-takeover provisions are companies with small market capitalization. The fact that the market capitalization of these companies is small does not mean that their market capitalization is small because they have anti-takeover provisions, but rather that their market capitalization is related to a combination of factors such as a lack of a clear growth policy, a failure to communicate such a growth policy to investors, and a failure to fully utilize investor relations and other functions. I would imagine that this is related to a combination of factors. Currently, companies that do not meet the listing criteria due to the TSE’s market reclassification are submitting “plans” for transitional measures. It can be inferred that some of the companies with takeover defense clauses in the above analysis and small market capitalization will submit the “plan.” In most cases, this “plan” will include specific measures to increase the market capitalization (specifically market capitalization of tradable shares). For such companies, this “plan” will be a very good opportunity to submit solid and concrete measures for disclosing their growth to the public.

Aki Matsumoto, CFA

Executive Director

Metrical Inc.

akimatsumoto@metrical.co.jp

http://www.metrical.co.jp/jp-home/