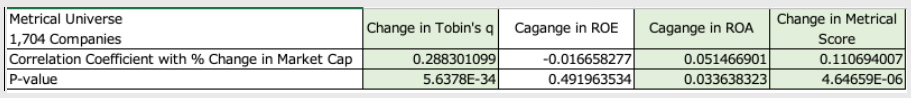

In my previous article, “How far has corporate governance progressed in 2021 (3),” I discussed the results of a correlation analysis between the percentage change in market capitalization as of December 2020 and December 2021 for 1,704 companies in the Metrical universe and the respective changes in Tobin ‘s q, ROA, and Metrical Score, respectively. The results of the analysis showed a significant positive correlation between the percentage change in market capitalization and the respective percentage changes in Tobin’s q, ROA and Metrical score, as shown in the table below.

In this article, I would like to focus on the question of why the percentage change in market capitalization has a more significant positive correlation with ROA than with ROE. As you know, ROA is a measure of a company’s earnings power, while ROE can be increased by changing the capital structure to match that earning power. This means that ROA can be directly impacted by improving business performance, while ROE can be increased without necessarily relying directly on improving business performance. In this article, I would like to examine whether there has been any change in the corporate governance practices of the companies whose ROA has improved (and thus whose market capitalization tends to increase).

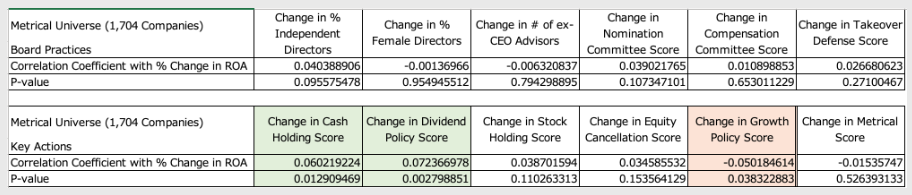

The table below shows the percentage change in ROA for 1,704 companies in the Metrical Universe as of December 2020 and December 2021, correlated with each of the Corporate Governance Practices. The table below shows the results separately for Board Practices and Key Actions. There is a significant positive correlation between the cash holding score and the dividend policy score among the key actions that the company actually takes, and a significant negative correlation between the growth policy score and the rate of change of ROA in one year in 2021. It could be argued that a company is not motivated to change its board practices because of a one-year change in ROA. On the other hand, for key actions, we found that when ROA changed over the year, the company tended to reduce cash by increasing dividends. Although further analysis is needed to determine the significant negative correlation between ROA change and growth policy, it may be inferred that the cash accumulated in the balance sheet due to the increase in profits was used to return profits to shareholders through dividend increases, but the use of cash to invest in growth is still lacking in conviction.

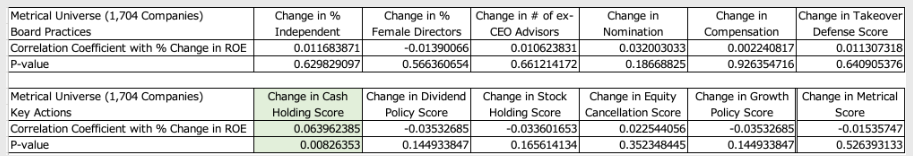

Next, as shown in the table below, I perform a correlation analysis of the rate of change in ROE for each of the corporate governance practice measures, and find that the rate of change in ROE over the year 2021 is positively correlated with the cash holding score in the key actions that the company actually takes. Similar to ROA above, the results show that companies are not motivated to change their board practices by a one-year change in ROE. This may mean that companies are not motivated to enhance their corporate governance practices because their performance has improved. There has been a chicken-and-egg debate as to whether companies that are confident in their performance tend to improve their corporate governance practices, or whether improving corporate governance practices tends to improve performance and stock price (Metrical is hoping for the latter). The results give us some hope. Getting back to the original topic, on the other hand, the key actions confirmed that companies tend to reduce cash from their balance sheets when ROE changes over the year. There were no significant positive correlations with the dividend policy score, equity cancellation score, or growth policy score, suggesting that while companies with higher ROE tended to reduce cash, the way they did so was not as strong a tendency to increase dividends or invest in growth. The fact that there is no significant positive correlation with stock repurchases suggests that it was not directly related to stock repurchases. If there is no clear correlation between dividend increase and investment in growth, it is very likely that the company used cash to buy back its own shares, although it did not decide to cancel them.

Let us summarize the above examination. Although I did not find a clear answer to the question of “Why is the percentage change in market capitalization (stock price) significantly more positively correlated with ROA than with ROE?,” there were some interesting findings in the correlation analysis between the percentage change in ROA and ROE and the evaluation items of corporate governance practices. First, with respect to the debate on whether companies that are confident in their performance tend to have better corporate governance practices, or whether better corporate governance practices tend to improve performance and stock price, I wonder if there are other incentives for companies to improve their corporate governance practices (especially board practices) than improved performance (improved ROA and ROE). Second, I can assume that the companies that improved their ROA used the cash built up on their balance sheets from increased profits to return profits to shareholders through increased dividends, but that they still lacked conviction in using the cash to invest in growth. Third, it is inferred that companies with higher ROE tend to use cash to buy back their own shares.

Since these analyses are for one year in 2021, I need to continue to examine the results, but the fact is that I have obtained some interesting results. From an investor’s standpoint, it was confirmed that the percentage change in market capitalization (stock price) is significantly correlated with the change in Metrical Score (overall evaluation of corporate governance practices) and ROA, so we need to continue to pay attention to the improvement of corporate governance practices of listed companies. Since it is effective to focus on the rate of change of ROA, it is of course necessary to pay attention to business performance trends and management strategies through fundamental analysis. Although we did not find a significant correlation between the percentage change in ROE and the percentage change in market capitalization (stock price), we speculate that companies with improved ROE tend to use less cash, and one of the most effective ways to do so is to buy back their own shares. Since share buybacks provide an opportunity to increase the share price in the short term, we need to keep a close eye on companies that hold a lot of cash, even though it is unclear when they will buy back their own shares.

Aki Matsumoto, CFA

Please see detail research the following links.

http://www.metrical.co.jp/

Please feel free to contact the below email address if any interest or query.

Aki Matsumoto, CFA

Executive Director

Metrical Inc.

akimatsumoto@metrical.co.jp

http://www.metrical.co.jp/jp-home/