In the previous article, “What Kind of Firm Adopts Takeover Defenses? (Metrical Analysis Using BDTI Data)” we used data from BDTI to analyze the performance and corporate governance practices of companies that have and have not adopted takeover defense measures. The results of the analysis showed that of the 421 companies found to have proposed anti-takeover measures at shareholder meetings since 2014, those companies that have not adopted anti-takeover measures now have superior performance in terms of ROE, ROA, and P/B, as well as in terms of the percentage of independent directors and the percentage of female directors as corporate governance practice metrics.

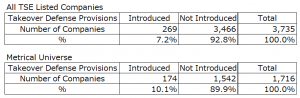

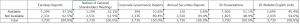

In BDTI’s data, 443 companies were confirmed to have proposed anti-takeover measures at their shareholders meetings since 2014, of which 10 were rejected and 433 were approved (see table below). As can be seen from the table below, once a takeover defense measure is proposed as an agenda item, it is usually approved. Whether the proposal is approved or rejected depends on the composition of the company’s shareholders, and mainly on the shareholding ratio of foreign shareholders. The TSE’s disclosure document “White Paper on Corporate Governance 2021” also states, “In terms of foreign shareholding ratio, the ratio of companies that have adopted takeover defense measures is lowest in the category of foreign shareholding ratio of 30% or more, at 2.7%, a decrease of 3.7 percentage points from the previous survey. The percentage of holdings in the 20% to 30% category was 9.2%, a significant decrease of 11.1 percentage points from the previous survey. Looking at the relationship with the ownership ratio of the largest shareholder, there was a tendency for the adoption ratio to be higher in the category where the ownership ratio of the largest shareholder is low, while the ratio in the category where the ownership ratio is less than 5% was 13.8%, a significant decrease of 9.5 percentage points from the previous survey.”

As shown in the table below, of the 433 companies that were confirmed to have proposed anti-takeover measures in their shareholder meetings since 2014, 421 are still listed on the stock exchange. Of these companies, 41% (173 companies) do not currently have takeover defense measures, and 59% (248 companies) still have takeover defense measures. As noted above, companies that do not currently have takeover defenses show superior performance and corporate governance practices. Furthermore, in terms of market capitalization, there is a significant difference between companies that do not currently have takeover defenses and those that still do.