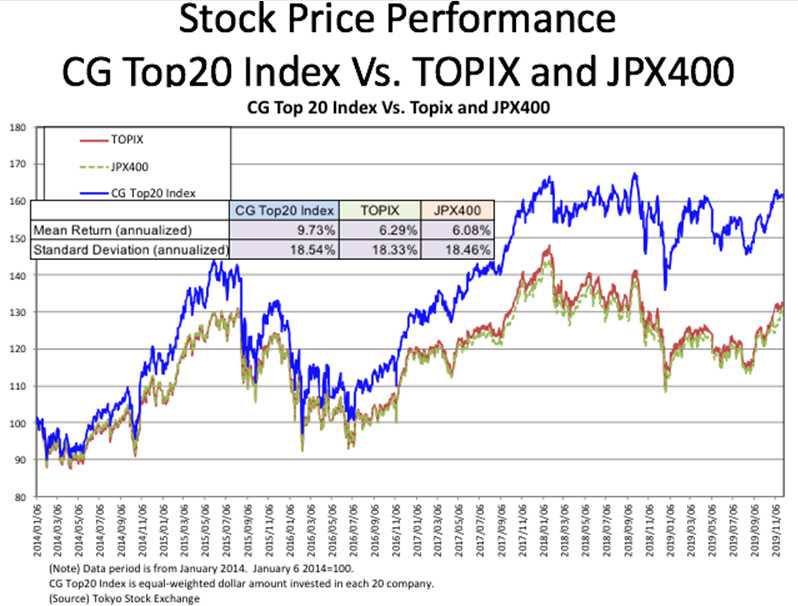

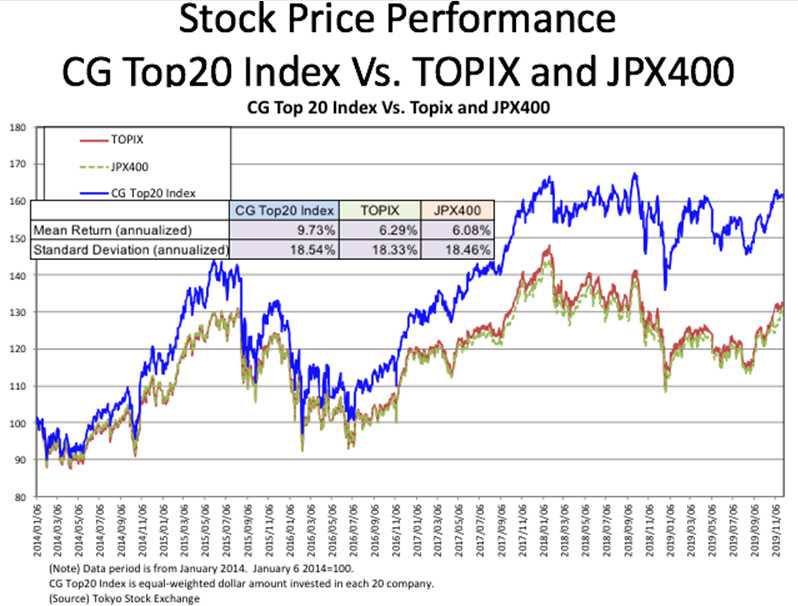

Stock prices closed higher amid risk-on mood from the previous month. TOPIX and JPX400 market indices gained 0.10% and 0.08% respectively for the month. CG Top 20 stocks rose modestly by 0.04% for the same period.

Stock prices closed higher amid risk-on mood from the previous month. TOPIX and JPX400 market indices gained 0.10% and 0.08% respectively for the month. CG Top 20 stocks rose modestly by 0.04% for the same period.

This month METRICAL shows how the disclosure about ex-CEO advisors has progressed from a year ago. As shown the table below, in October 2018, 829 companies on METRICAL’s research universe disclosed the number of ex-CEOs (ex- Representative Directors) who retained positions as “advisor” in the company after stepping down as CEO. Of these companies that voluntarily disclosed, 474 companies had ex-CEO advisors. A year later in October 2019, a total of 894 companies disclosed the number of ex-CEOs who retained such advisory positions seat in the company after stepping down from the top management position. Of these 894 companies, 503 companies had ex-CEO advisors in October 2019.

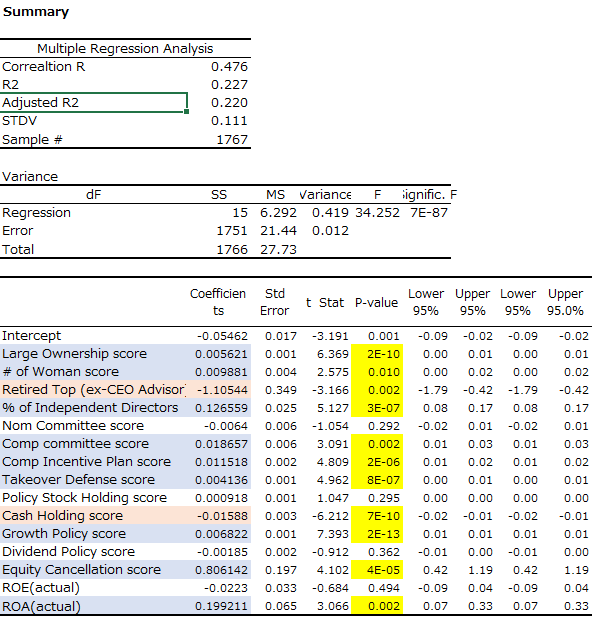

BDTI and METRICAL are continuing to collaborate on finding “linkages between CG practice and value creation.” METRICAL has recently updated the results of our analysis at the end of October 2019 for about 1,800 listed companies representing a market capitalization of more than 10 billion yen. In this update, we see that the number of […]

Stock prices closed higher amid low trading volume. TOPIX and JPX400 market indices rose 0.26% and 0.27% respectively from the end of the previous month. CG Top 20 stocks slightly underperformed against the both indices, closed up by 0.16% in September.

While overseas investors’ ownership decreased a year ago, activist investors are now likely to focus on Japanese companies. Corporate governance in Japan has improved since the Corporate Governance Code was introduced in June of 2015, but progress is much slower than foreign investors hoped. At this time, we analyze the relationship between % ownership held by overseas investors and key governance criteria. The following table shows the result of our regression analysis of the 13 governance factors that METRICAL uses as criteria and two performance measures, ROE and ROA. Of the 15 factors, 14 factors are significantly correlated with level of ownership by overseas investors.

“Policy Stockholdings”

Many companies set the fiscal year to end at the end of March and hold their AGM in June. Those companies file Yuho financial reports by the end of June. According to the Yuho reports, we are able to lots of new data at this time. Among the data, in this post we will focus on ”policy stock” holdings, also known as “allegiant shareholdings”.

The average holding of “policy stocks” was JPY34,861 million for 1,775 companies, which has come down 13.7% from JPY40,389 million a year as the average of the 1,794 companies in our universe. Of course, we should carefully analyze these numbers, but the decrease of the stock holding was larger than the change in the stock index Topix for the same period. The Topix fell 7.3% from 1,716.30 on March 31 2018 to 1,591.64 on March 31 2019.

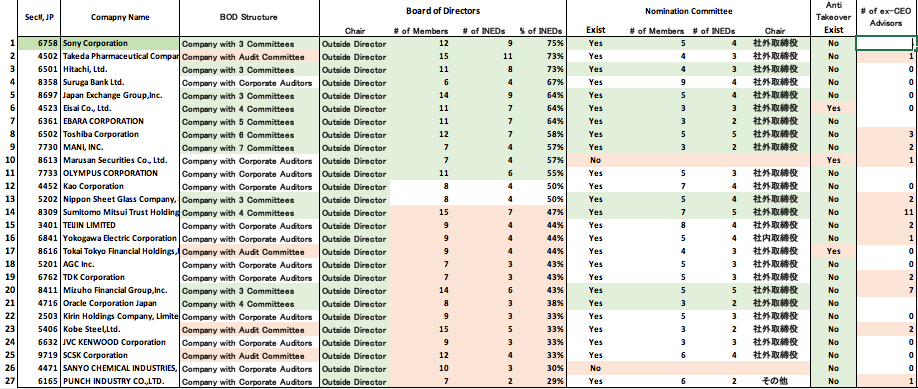

Chair of the Board of Directors

We would like to highlight the function of the chair of the board. Of about 1,800 companies, only 27 companies are chaired by an outside director. This indicates just how resistant inside directors are in entrusting the position of chair of the board to an outside director. The table below shows the 27 companies.

CG Top 20 stocks expanded outperformance amid the recovery market in April.

April stock prices continued relatively firm supported by US market. The quality CG stocks expanded outperformance toward the end of April.

You can download our full report for April here.

March stock prices recovered after sharp drop in January. The quality CG stocks expanded outperformance during the continuing uncertain market environment toward the end of March. This month, we highlight capital allocation.

Our joint research – “Linkage Between Corporate Governance and Value Creation” – between BDTI and METRICAL has been updated as of January 31. The most important inferences are summarized below.

(1) Correlations: Board Practices

and Performance

Significant correlation between board practices and performance continues.

(a) ROE: Nominations Committee existence, the number of female directors and percentage of INEDs show a significant positive correlation.

(b) Tobins Q: Nominations Committee, retired top management “advisors” (ex-CEO “advisors”), and percentage of INEDs show significant positive correlation.

(c) ROA (actual): Compensation Committee existence (negative correlation), Incentive Compensation Plan disclosure, and retired top management (ex-CEO) serving as advisors show significant correlation.