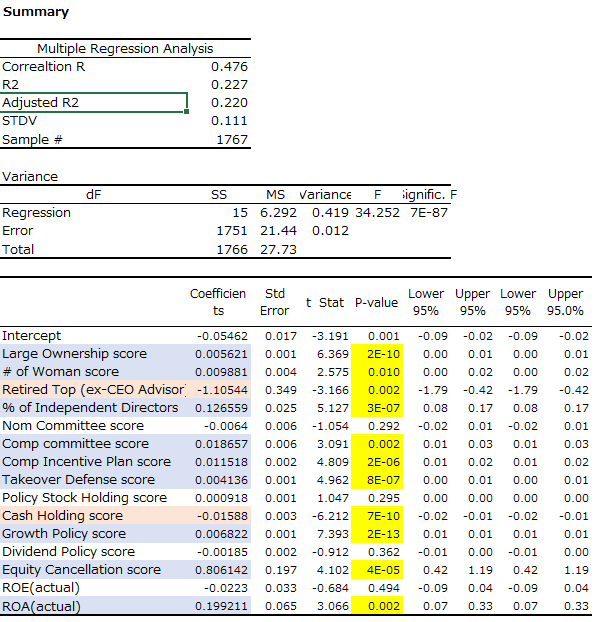

While overseas investors’ ownership decreased a year ago, activist investors are now likely to focus on Japanese companies. Corporate governance in Japan has improved since the Corporate Governance Code was introduced in June of 2015, but progress is much slower than foreign investors hoped. At this time, we analyze the relationship between % ownership held by overseas investors and key governance criteria. The following table shows the result of our regression analysis of the 13 governance factors that METRICAL uses as criteria and two performance measures, ROE and ROA. Of the 15 factors, 14 factors are significantly correlated with level of ownership by overseas investors.

Overseas investors are likely to focus more on ROA than ROE, with the result that they often invest in firms that generate higher cash flows and are piling up excess cash on the B/S (hence the negative correlation with Cash Holdings score).

We don’t know exactly how they consider governance factors in investing. However, the table above shows that statistically, foreign ownership is significantly correlated with a diversified/fragmented shareholder base (Large Ownership score), a higher number of woman directors, a higher % of independent outside directors, the presence of a compensation committee, the presence of an incentive compensation plan, the absence of a takeover defense, robust growth policy and frequent equity cancellation. From this, we can understand that foreign investors tend to favor governance practices.

On the other hand, the presence of nomination committee, lower “allegiant” stock-holdings and dividend policy score don’t show significant correlation with foreign ownership. In this analysis, we are also interested in the negative correlation with retired top management (ex-CEO Advisor) score. (Note: this is a voluntary disclosure item to the TSE.) We believe that foreign shareholders are concerned (negatively) when ex-CEO Advisors are employed by companies, but the companies that generate higher ROA and higher cash on hands happened to have more ex-CEO advisors. We believe that this would become a crucial issue of discussion through the engagement going forward. Because not many companies disclose in detail how many ex-CEO Advisors and ex-senior board director (not-CEO) Advisors remain after their retirement it could simply be that only superior companies are reporting anything at all.

Please see detail research the following links.

http://www.metrical.co.jp/