Capital Allocation

The goal of our research is to examine how the enhancement of corporate governance positively affects the value of a company. We have analyzed it in different angles such as compensation, ex-CEO, number of independent directors and other board practices, and so forth. Also, we believe that corporate actions reflect how a board of directors thinks corporate governance seriously and realizes the board practice as actions really. This is also crucial factors in analyzing corporate governance particularly companies in Japan, as local issues such as cross-holdings would not be well analyzed by just focusing on board practices.

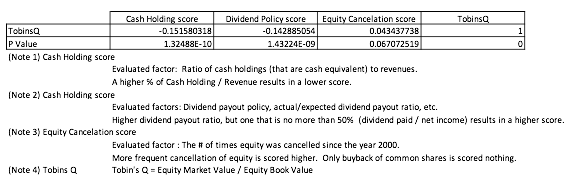

This month, we highlight capital allocation. The policy of a company would depend on future growth and value of a company for the long-term. Therefore, for many investors, this is a very important topic. However, for the analysis of companies in Japan, it is not easy to gather data for all companies and there are a number of problems. As a proxy of capital allocation, we analyze it in 3 factors: (a) cash holding, (b) dividend policy and (c) equity cancelation. It would be useful to analyze how these 3 factors affect the value of a company in Tobin’s Q.

The table below shows the correlations of 3 factors to Tobin’s Q. Cash Holding score correlates with Tobin’s Q significantly negatively. A company that holds excess cash tends to be traded at higher share price, as such a company tends to generate more cash on its higher return (our research shows significant negative correlation between cash holding score and actual ROA).

Dividend Policy score correlates with Tobin’s Q significantly negatively. A company that pays little dividends tends to be traded at higher share price, as such a company would like to retain cash for future investment, or a company that suffers poor profit would result in higher dividend payout, maintaining its cash dividend due to its stable dividend policy.

As for the 3rd factor, Equity Cancelation score correlates with Tobin’s Q positively (P-Value is 0.06, which is slightly larger than 0.05 but should consider almost significant in statistic). A company that cancels its treasury shares more frequently tends to be traded at higher share price.

In conclusion, investors who buys a company that earns a higher return and holds excess cash would be right. The discussion with management of such a company on capital allocation would be also a right strategy. Excess cash after free cash flow might be used for share repurchase and result in cancelation of equities in the future. We believe that the strategy that buying such a cash-rich and high ROI company and dialogue with management on appropriate capital allocation would be performing well, although it’s not a new idea. Of course, the key is an assumption that the discussion would value for the both sides, and management of a company seriously consider working on raising the value of a company and enhancing corporate governance.

Please see detail in the following link.

http://www.metrical.co.jp/