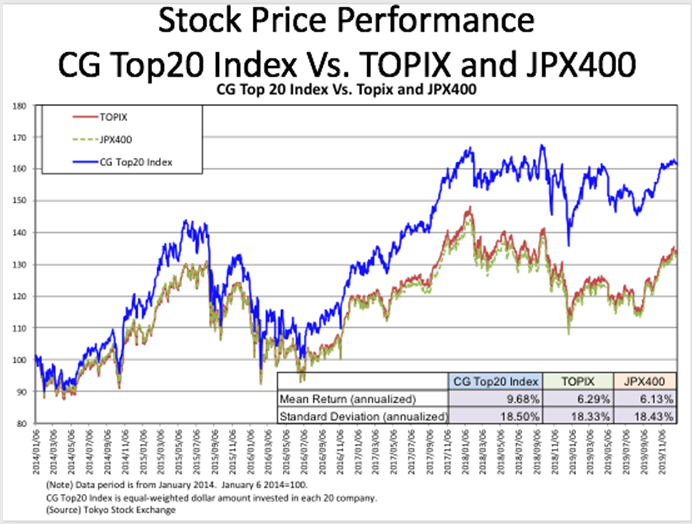

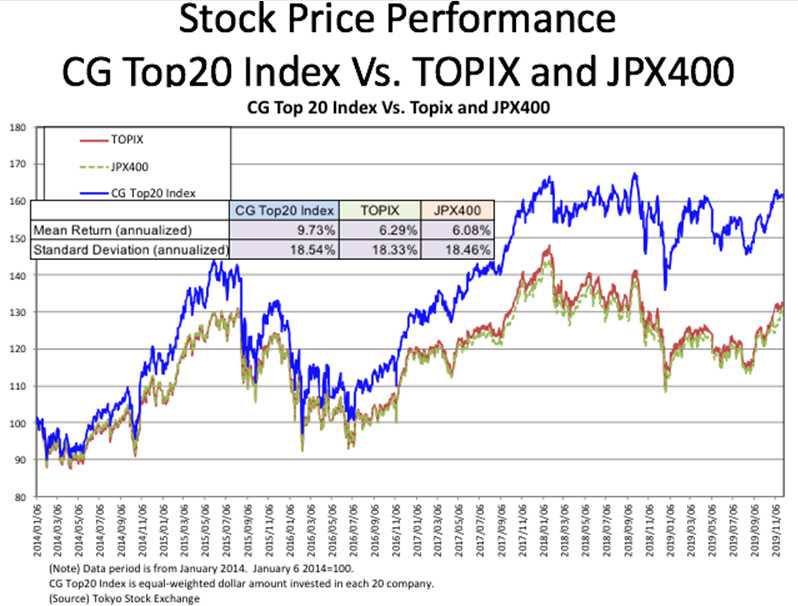

The market price in March 2020 continued to fluctuate with high fluctuations due to concerns about the spread of the Coronavirus around the world. Approximately half of the sharp decline by mid-month recovered at the end of the month. Both Topix and JPX400 stocks have fallen sharply in March for the month of -6.46% and -6.79% respectively. The Top20 CG rating score was -6.22%, outperforming the previous month at -0.30% compared to the two main stock indices, with a lower rate of decline. By the way, the stock prices of the ten companies with the top 10 CG rating scores were -1.44%, which was even smaller.