Chair of the Board of Directors

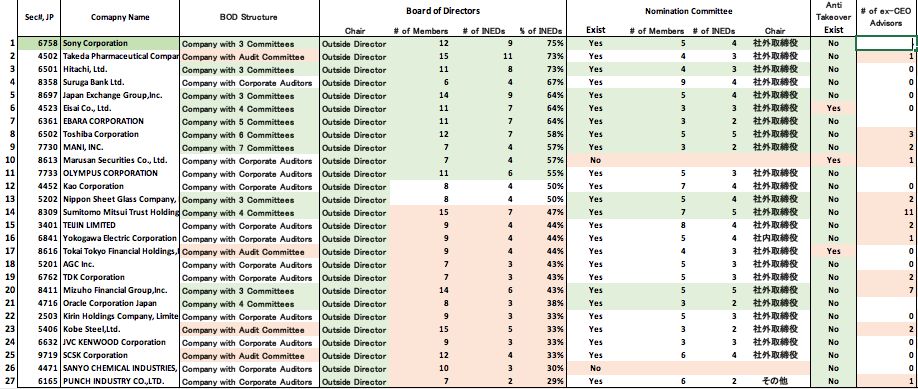

We would like to highlight the function of the chair of the board. Of about 1,800 companies, only 27 companies are chaired by an outside director. This indicates just how resistant inside directors are in entrusting the position of chair of the board to an outside director. The table below shows the 27 companies.

As shown in the table, there are several names that suffered scandals in the past, such as Suruga Bank, Toshiba, Olympus, Nippon Sheet Glass, Kobe Steel, and etc. These companies had changed the structure after the scandals.

Of course, these 27 companies are moving relatively better corporate governance structure than other many companies in Japan. Let’s look more closely at the reality at these firms.

The table shows ‘% of Independent Outside Directors,’ the existence of a ’Nomination Committee’ that affects nomination of directors and succession planning, ‘Takeover Defense,’ ‘ex-CEO Advisors (although non-ex-CEO Advisors are not disclosed),’ ‘Policy Stockholding such as cross-shareholdings’, and ‘Large Ownership’ as well as ‘Chair of Board of Directors.’

As a result of analysis on the criteria above, positive is colored in green and negative is colored in red in the table above. If the majority of the board is comprised by inside directors, an outside chair of the board may have little effect on the board in terms of corporate governance practice such as transparency, objectivity, and other ways. However, a company with the “3- committee” structure would tend to function better in its nomination committee than the merely “advisory” committees of the other structures. Also, the absence of takeover defense provisions would be favored by minority shareholders and lower policy stock holdings that would reduce shareholder value and pull down the pressure on ROE would be positive to shareholders. Also, a company owned by large shareholders would have a different viewpoint from minority shareholders.

Analyzing the 27 companies on these points, only the chair at Sony could function well in terms of corporate governance. We can’t come to this conclusion as an insider, but we can surmise it by using public information such as that analyzed here.

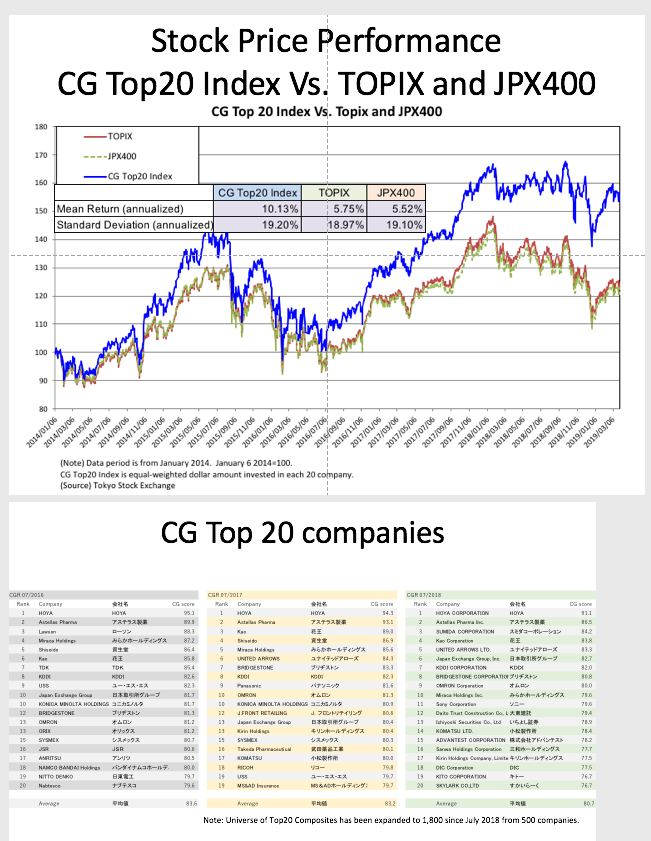

Here is the performance of our Index in May:

You can download our full report for May here.