We were amiss…in that we recently discovered this video interview of Nicholas Benes made some months ago, has been kindly made public by Econvue.com . (Econvue provides succinct, timely, evidence-based research and commentary on economic topics that matter, delivered to your inbox. ) In it, Mr. Benes explains how a number of major steps […]

Category: Other News

Why Secom is the Only Non-Financial Japanese Corporate Pension Fund to Sign the Stewardship Code

Yes, it is true. Secom’s pension fund is the only one. Following the report of a government study group urging private pension funds to sign the Stewardship Code, it is an open secret that many firms in industrial Japan are now waiting for either Panasonic or Toyota to sign the Stewardship Code. If one of these iconic companies’ pension funds signs, it is said there will be an avalanche of other corporate funds that sign. Conversely, if neither of them signs, everyone can use that as an excuse for why they did not sign, e.g. “even mainstream companies like Toyota or Panasonic did not sign it yet.”.

Oddly, Japanese companies pride themselves on the strength of their covenant to employees, yet neglect employees’ pensions by failing to sign the stewardship code and report how they have handled those funds. Why is this? Quite simply, Japanese companies are afraid that if their pension funds become more proactive, those same governance and proxy voting practices might come back and hit them in the face at their own shareholders meeting. What is in the best interests of employees’ pensions may not be in the self-interest of corporate executives. This breaks the most important link in the investment chain – asset owner voice.

Here is an article from Bloomberg focusing on this increasingly interesting situation:

https://www.bloomberg.com/news/articles/2017-06-26/an-unusual-manager-defies-peers-in-870-billion-pension-world

” “The only way you can explain this behavior pattern is to say that, let’s face it, senior executives don’t want active proxy voting and engagement in the market,” said Nicholas Benes, the Tokyo-based head of the Board Director Training Institute of Japan. He said they fear “blowback” at their own shareholder meetings. Judging by their actions, “they care more about that than they do about their employees’ funds,” he said.”

Progress: GPIF Refers to “Corporate Governance Codes” for the First Time

The GPIF should be highly commended for including reference to “the corporate governance codes of each country” to its recent statements regarding its stewardship policy and its proxy voting policy. This is a major step forward, considering the politics that it faces and the long-standing and unfounded claim by leaders in the industrial community who claim that if the GPIF had its own “principles and guidance for governance and proxy voting”, that would be “intervening in managerial decision making. Even though the reference in the recently-released principles bends over backwards to encourage “giving a full hearing to explanations of non-compliance”, if you know the full background, this is significant progress. (For the first time, the GPIF has uttered the words “corporate governance code” in writing!)

PRI Publishes “Japan Roadmap” Regarding Fiduciary Duty in Japan

PRI published a “Japan Roadmap” suggesting improvements in Japan regarding fiduciary duty and ESG practices. (http://bit.ly/2pmrbus) The Roadmap cited BDTI’s recent joint research with METRICAL with regard to our analysis showing that lower cross-shareholders correlate with better corporate performance.

Quote from the PRI’s introduction of the Roadmap: “Japan’s governance reforms will fail unless more asset owners join in, and all the talk about stewardship is accompanied by analysis, action and sweat,” said Nicholas Benes, representative director, The Board Director Training Institute of Japan. “The Japan Roadmap makes sensible recommendations to turn governance goals into realities.”

Corporate Governance in Japan 2017 – Report

This is an insightful report with some similar conclusions that recent analysis by BDTI and Metrical (Titlis) also reveals, which will be the subject of a seminar on 3/16. In particular, the presence of large owners matters, foreign shareholders select well-governed and well-performing companies (a leading indicator for decades), and the quality of directors matters. The latter point is the reason why BDTI is focused like a laser on director training. The pilot analogy has been in my materials since 2014. I am tickled pink if the FSA has adopted it. Quote: “Improving board behaviour is a mindset issue, not a regulatory one. A successful company should be willing to encourage open debate. More so for a company that has been struggling for years with its strategic direction. ….. Independent directors should not be viewed as an ‘unavoidable cost’ but as a ‘wise investment’ for firms. …Would an airline actively seek unqualified pilots to fly its passengers?”

https://newmanlive.files.wordpress.com/2017/03/corp-governance-in-japan-2017-analogica-kk1.pdf

DON’T CRY FOR HITACHI’S HEDGE FUND “VICTIMS” by Stephen Givens

Pity poor Hitachi.

In 2015 Hitachi, accustomed to the forgiving corporate governance culture of Japan, acquired control of Italian railway operator Ansaldo STS, a publicly listed company, without fully comprehending the traps for the unwary that lurk in corporate governance environments outside Japan. The shareholder list of Ansaldo STS, it turns out, was loaded with sophisticated hedge funds that have cleverly exploited their “rights” as minority shareholder “victims” to try to shake down Hitachi for more cash. The case for victimhood made by the hedge funds is superficially appealing, but on closer analysis unpersuasive.

”Research Reveals “Human” Issues as Top Cyber Security and Business Risk”

”…Based upon the data collected from the first global survey to capture the voice of cyber security professionals on the state of their profession, this final report of the two-part series, titled “Through the Eyes of Cyber Security Professionals: Annual Research Report (Part II),” concludes:

- The clear majority (92%) believe that an average organization is vulnerable to some type of cyber-attack or data breach.

- People and organizational issues contribute to the onslaught of security incidents.

- Most organizations are feeling the effect of the global cyber security skills shortage.

- Cyber security professionals have several suggestions to help improve the current situation.

- Sixty-two percent (62%) believe critical infrastructure is very vulnerable to cyber-attacks.

- Sixty-six percent (66%) believe government cyber security strategy tends to be incoherent and incomplete.

- Eighty-nine percent (89%) of cyber security professionals want more help from their governments

ISS Proposes Policy Opposing the Creation of “Advisory” Posts (sodanyaku, komon)

ISS has proposed a policy for Japan essentially opposing the creation of “advisory” posts for retired directors or kansayaku, who can tend to over-influence the decisions of currently serving executives because the “advisors” were previously the “senpai” (seniors) of executives, thus creating bottlenecks or “legacy” issues can make changing strategy difficult. This occurs notwithstanding the fact that “advisors” bear no fiduciary duties, cannot be sued by shareholders, and require no disclosure (not even regarding their compensation). At the same time, METI has announced that it will undertake a study about the impact of such positions.

Such advisory posts are a custom in Japanese corporate governance that I have publicly opposed for some time, even before I proposed the full disclosure of all compensation paid to “advisors” when proposing the contents of the Corporate Governance Code to the FSA in 2014. (Unfortunately, the FSA did not include that provision. )

While ISS’ proposed policy is the outcome of my recommendations in an indirect sense, in fact I have had no recent discussions whatever with anyone at ISS about this topic, and it is most accurate to say that concern about the practice simply “percolated” and came to be shared by many others over the past few years. This is further evidence of a deepening dialogue and consideration of key issues related to corporate governance practice in Japan.

I would like to encourage those who have comments on the proposed policy to respond to the questions below by sending an email to: jp-research@issgovernance.com

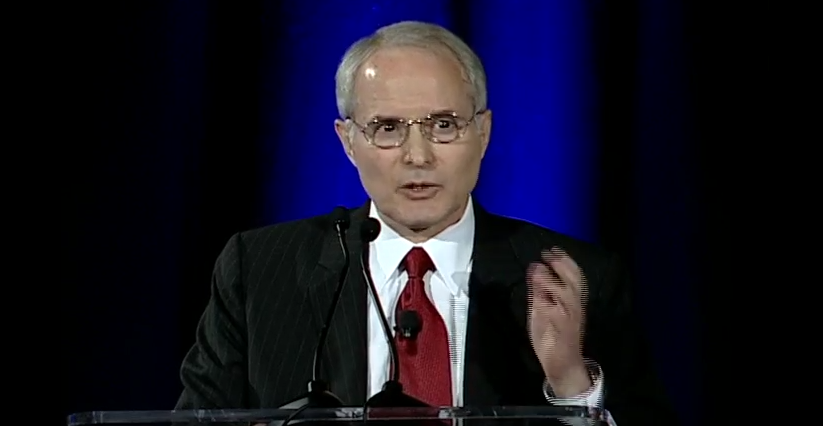

“How Japanese Companies are Navigating the Corporate Governance Code” (Speech to CII)

Here is the short speech that I gave to the Fall 2016 Conference of the Council of Institutional Investors (CII), on September 30, 2016. On this video, my speech starts at the 36:00 minute point. Below, I have reproduced the CII’s summary of my comments, and further below, the full text of my speech.

” Nick Benes, representative director for the Board Director Training Institute of Japan, said a sea change is underway in Japan in terms of companies beginning to comply with the Corporate Governance code, but there is still room for improvement. He reported that almost 80 percent of Japanese companies now have two or more independent directors and 40 percent of large companies have their own corporate governance guidelines, but beyond that, the reforms that companies say they have in place are lacking in substance. He estimated that 90 percent of firms say they comply, but have little evidence this is the case and few have actually changed their practices. Despite these setbacks, Benes said he remains optimistic that Japanese companies will move in the right direction because there is now broad awareness that “governance is good”. Additionally, disclosure has vastly improved and the number of votes opposing the re-election of directors is climbing. A video of this session is available here.

Text of Speech (and Slides)

“In 2013, I was lucky enough to propose to key congressmen in Japan, that Japan should have a Corporate Governance Code. I then advised them, and then the Financial Services Agency, about the content of the Code.

So I am very pleased to have this opportunity to summarize the progress that Japanese companies have made so far in implementing the principles of the Code, based on my activities as consultant, independent director, “directorship” trainer, and policy advocate.

My main message to Committee members is this:

1) A sea change is underway in companies, the media, the government, and the public. Because Japan is a “shame-based” society, the vastly enhanced disclosure required by the Code has created a strong virtuous circle.

2) These changes represent a very big opportunity for foreign investors, but only IF they study the Code and the disclosures in detail, and then leverage the Code’s principles so as to make specific requests for better governance practices to Japanese companies they invest in, while also brandishing the possibility of consequences – such as not re-electing senior executives, – if progress is not made.

Here are some highlights “from the trenches” about what is occurring in Japan:

Sagami-FamilyMart UNY Holdings: Can a Board Justify Selling a Subsidiary to the Low Bidder?

Sagami Co. Ltd. (8201) is a Tokyo Stock Exchange First Section company, 56% of the shares of which are owned by FamilyMart UNY Holdings (8028), the holding company of the recent convenience store mega-merger between Family Mart and UNY (Circle K-Sunkus). Sagami is a national chain of retail kimono stores established in the 1970s under the UNY corporate umbrella. UNY converted Sagami into a “listed subsidiary” in the bubbly mid-1980s.

Needless to say, the kimono business is facing demographic and other headwinds. Sagami’s revenues have declined steadily year to year. At ¥100 a share, Sagami’s market capitalization is ¥2.87 billion. By contrast, Family-UNY’s market capitalization is nearly ¥700 billion. Sagami is a drop in the bucket. Sagami’s thinly traded shares have bumped up and down between ¥50 and ¥80 over the last year.

Earlier this summer Family-UNY made the decision to dispose of Sagami as a non-core business. Family-UNY entered into discussions with domestic private equity fund Aspirant Group in which it was agreed that Family-UNY would accept a discounted tender offer for its shares at ¥56 a share. Part of the deal included an agreement by Family-UNY to forgive ¥1.6 billion of parent company loans to Sagami. The tender offer expires on October 11, 2016.

Enter New Horizon Capital, a rival domestic private equity fund, which in September offered Family-UNY better terms– ¥70 a share. Family-UNY has yet to indicate how it will respond to the higher bid, but recent news reports leave the strong impression of distress and hesitation within Family-UNY.

The fact that the situation is creating distress and hesitation should be viewed as evidence of progress in Japanese attitudes about corporate governance and shareholder rights over the last decade. In 2004, in the much larger but parallel case involving competing bids by the Mitsubishi Tokyo Bank and Sumitomo Mitsui Bank for UFJ, the Japanese establishment and press were largely oblivious to the UFJ shareholder issues raised by Mitsubishi Tokyo’s pre-emptive bid that foreclosed a higher bid by Sumitomo Mitsui. (See p. 159 of the attached article for a more detailed description of that case.)