Metrical provides monthly corporate governance assessments of approximately 1,700 companies with market capitalization exceeding approximately 10 billion yen, primarily those listed on the TSE 1st Section. This year, continuing on from last year, I would like to see how far listed companies have progressed in their corporate governance efforts over the past year.

The chart below shows the changes in each of the evaluation items for approximately 1,700 companies in the Metrical Universe over the past 3 years (December 2020, December 2021, and December 2022). Metrical divides the evaluation items into Board Practices and Key Actions. This time, I will look at the Board Practices section. Let’s take a look at them in order.

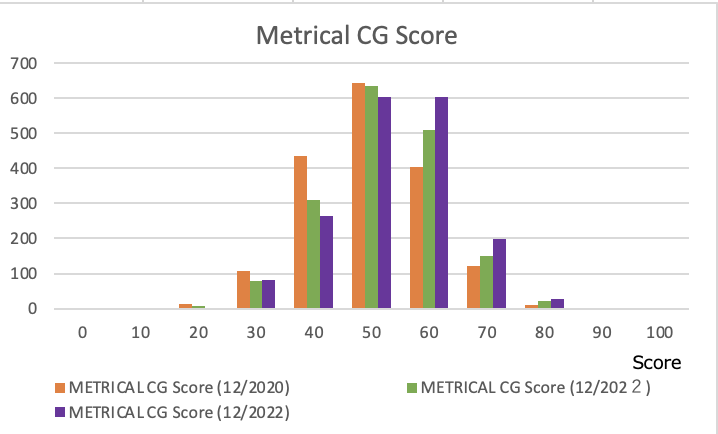

The first chart shows the distribution of Metrical CG scores, which represent the overall corporate governance rating of a listed company across a number of corporate governance measures. The distribution of scores in December 2022 is indicated by purple bars. distribution of the bars shows that the distribution of the bars moves to the right (toward higher scores) with each subsequent year, from December 2020, December 2021, and December 2022. It can be inferred that listed companies have advanced their corporate governance initiatives in response to the revision of the Corporate Governance Code in 2021 and the market reorganization of the TSE in 2022. Let’s take a look at the contents of these efforts by evaluation item below.

-1024x767.png)