The TSE disclosed the Survey of the Status of Disclosure in English as of the end of July 2022 on August 3, 2022, and I would like to discuss the issues.

At the beginning of the disclosure document, the TSE states the following in the beginning of the disclosure report: “In order to clarify the situation after the transition to the new market classification in April 2022, we conducted a survey as of July 2022 and compiled the results of the survey. For companies listed on the Prime Market, a market for companies focused on constructive dialogue with global investors, the percentage of companies disclosing in English reached 92.1% (85.8% as of December 31, 2021), indicating that listed companies have made some progress in English-language disclosure since the transition to the new market classification. On the other hand, even for timely disclosure documents (excluding financial statements) and annual securities reports, which were required to be disclosed in English by more than 70% in the survey of overseas investors conducted last year, the percentage of companies listed on the prime market that disclose in English is still less than half. The Corporate Governance Code, which has been in effect since the transition to the new market classification, states that “Prime market listed companies, in particular, should disclose and provide required information in English in their disclosure documents” (the second sentence of Supplementary Principle 3-1). Further progress is expected toward expanding the scope and content of English-language disclosure and eliminating differences in the timing of disclosure.”

As stated in the statement in the TSE’s summary of survey results above, many listed companies in the prime market translate some documents into English. The increase in the number of companies disclosing in English can be evaluated to a certain extent. However, the fact is that the TSE has only just begun, and as the TSE also states in the latter part of the statement, very few companies are disclosing important disclosure documents, such as annual securities reports, in English. The importance of the annual securities report is further increased by the fact that sustainability items are planned to be included in the report from the next fiscal year, instead of being submitted quarterly. Below are the results of TSE’s survey.

Overview of English-language disclosure

The percentage of listed companies that disclose in English is 56.0% (up 3.2 points from the end of the previous year) for all markets, and 92.1% (up 6.3 points from the end of the previous year) for the prime market. There are not many listed companies outside the prime market that disclose in English. The Corporate Governance Code, which was revised last year, stipulates in Supplemental Principle 3-1(ii) that “Prime market listed companies should disclose and provide required information in English in their disclosure documents. However, it does not specifically indicate which documents should be disclosed in English as required information. The only document mentioned in Supplemental Principle 1-2(iv) of the Corporate Governance Code that “English translation of the notice of convocation should be promoted” was the notice of convocation. The percentage of listed companies in the prime market that have translated their convocation notices into English increased to 76.1% (up 11.9 points from the end of the previous year). The highest rates of English translation were 77.1% (+9.3 points) for financial statements and 61.1% (+3.5 points) for IR presentation materials. On the other hand, few companies translated into English materials for timely disclosure (excluding financial statements), corporate governance reports, notices of convocation of AGMs (business reports), and annual securities reports, at 38.7% (up 2.3 points from the end of the previous year), 24.5% (up 2.3 points), 22.7% (up 2.1 points), and 13.1% (up 2.1 points), respectively. It is clear that important documents such as annual securities reports and corporate governance reports are not translated into English for the majority of companies. In August 2021, the TSE surveyed overseas institutional investors (48 companies) regarding disclosure documents of high importance in the following choices: “Essential: If listed Japanese companies do not provide disclosure documents in English, we will not make investments.” “Necessary: We need disclosure documents in English.” “Useful: If disclosure documents are available in English, we will use them.” and “Not necessary: We do not use disclosure documents in English even if they are available.” Based on the results of the survey, the documents with the highest total response rate of “Essential” and “Necessary” are shown in the following order. The most frequent responses were: financial statements (80%), IR presentation materials (74%), timely disclosure materials (72%), annual securities reports (70%), annual reports (69%), corporate governance reports (61%), business reports in notices of convocation of general meetings of shareholders (61%), ESG reports (59%), and the text of notices in notices of convocation of general meetings of shareholders (56%). The importance of these reports to foreign institutional investors is high (69%). It can be seen that there is a mismatch between documents of high importance to overseas institutional investors and those translated into English by listed companies. One year has passed since the results of this survey, but the situation does not seem to have changed much. It makes us think that there may be a reason why annual securities reports and corporate governance reports do not want to be translated into English.

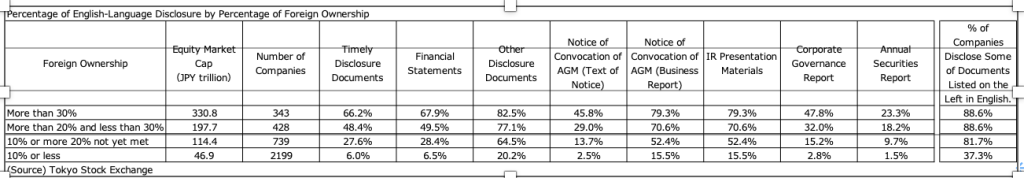

Finally, there is some interesting data that I would like to share with you. The table below shows the percentage of companies disclosing documents in English by foreign shareholding ratio. As might be expected, companies with a foreign shareholding ratio of more than 30% have a higher percentage of all documents translated into English than companies with a lower foreign shareholding ratio. Nevertheless, only a small number of companies translate their annual securities reports, notices of convocation (business reports), and corporate governance reports into English.

In summary, 90% of the companies listed on the prime market have translated some documents into English, but very few companies listed on other markets have translated their disclosure documents into English. There is a mismatch between the documents that prime market listed companies translate into English and the documents that foreign institutional investors require to be translated into English. The percentage of companies that implement English translations is higher than that of companies with low foreign shareholding ratios. Nevertheless, we find that few companies translate their annual securities reports, convocation notices (business reports) and corporate governance reports, which are documents that foreign institutional investors require to be translated into English. There may be a reason why they must be reluctant to translate these documents into English.

Aki Matsumoto, CFA

Please see detail research the following links.

http://www.metrical.co.jp/

Please feel free to contact the below email address if any interest or query.

Aki Matsumoto, CFA

Executive Director

Metrical Inc.

akimatsumoto@metrical.co.jp

http://www.metrical.co.jp/jp-home/