The stock market ended December with a sharp decline after the Bank of Japan announced operational revisions to its interest rate operations at its monetary policy meeting. The CG Top20 stocks underperformed both the TOPIX and JPX400 for the second month in a row.

December stock market was unable to find a sense of direction until the middle of the month as investors watched the monetary policy of the U.S. FOMC meeting. The stock market fell sharply immediately after the Bank of Japan decided to expanded the range of the long-term interest rates from 0.25% to 0.5% at its monetary policy meeting on December 20. After that, stocks closed lower with no sign of a rebound. While bank stocks rose sharply in response to the interest rate hike, notable declines were seen in other stocks, especially growth stocks.

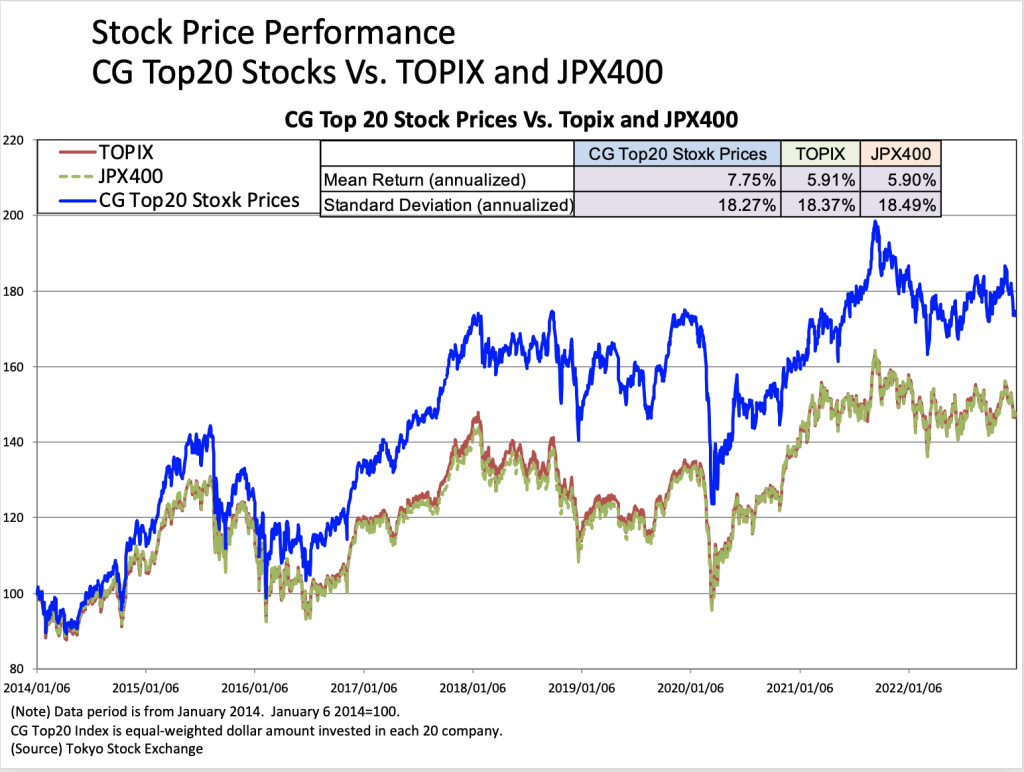

The TOPIX and JPX400 indexes fell -4.79% and -4.87%, respectively, in December performance. The CG Top20 stock index underperformed against both indices, falling -5.59%. Over the long term since 2014, the CG Top20 continues to outperform both indices by about 2% per year. The CG Top 20 stocks have been revised on July 1. The new components are listed in the table below.

Please see detail in the following link.

http://www.metrical.co.jp/

Please feel free to contact the below email address if any interest or query.

Aki Matsumoto, CFA

Executive Director

Metrical Inc.

akimatsumoto@metrical.co.jp

http://www.metrical.co.jp/jp-home/