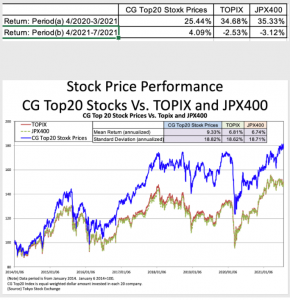

The CG Top 20 continued to outperform both the Topix and JPX400 indices in July. The change in the Bank of Japan’s ETF purchase program may have had an impact.

Topix and JPX400 indexes were down -2.12% and -2.52% respectively in July. The top CG rating score, CGTop20, was flat, but outperformed both indices for the 4th consecutive month.

Topix and JPX400 indexes were down -2.12% and -2.52% respectively in July. The top CG rating score, CGTop20, was flat, but outperformed both indices for the 4th consecutive month.

The table below shows the period from April 2020, when the stock market is recovering from last year’s plunge due to the rapid spread of COVID infection, to March 2021, when the Bank of Japan announced a change in its ETF purchase program, and the period (b) after April 2021. CG Top20 underperformed against both indices in period (a), while it outperformed in period (b). It is unclear whether this is due to the effect of asset inflation caused by ultra monetary easing triggered by the COVID pandemic or the change in the Bank of Japan’s ETF purchase program, but I suspect it is because the stock market has started to reflect certain fundamentals more clearly. The outperformance of the CG Top 20 stocks suggests that the market has begun to value higher quality stocks.

Please see detail in the following link.

http://www.metrical.co.jp/

Please feel free to contact the below email address if any interest or query.

Aki Matsumoto, CFA

Executive Director

Metrical Inc.

akimatsumoto@metrical.co.jp

http://www.metrical.co.jp/jp-home/