Metrical has previously published “Retirement of treasury stock and performance, corporate governance” and “Dividend policy and performance, corporate governance,” and in the articles we have examined the relationship between share retirement and performance and corporate governance, and between dividend policy and performance and corporate governance, respectively (please contact us if you would like to know more). The current article on equity issuance is the third in a trilogy. Surprisingly, interesting analysis results were confirmed for each of these approaches.

To summarize the previous two articles, the stock retirement score is positively correlated with ROA (actual) and Tobin’s q, and companies that have retired their own shares three or more times have significantly better key performance indicators in ROE (actual), ROA (actual), and Tobin’s q. Similarly, in evaluating corporate governance practices (including actions), the Metrical Corporate Governance Score, the % of Independent Directors, the Equity Issuance Score, and the Dividend Policy Score, the 100 companies that have retired their own shares three or more times have significantly higher scores than the companies that have retired their shares less frequently. This confirms that these companies have a strong awareness of the need to improve their corporate governance, as these scores are significantly higher than those of the companies that have retired their own shares less frequently.

The Dividend Policy Score has a certain relationship with the Key Performance Indicators. Companies with a payout ratio target or forecast of less than 10% have the lowest ROE (actual) and ROA (actual) as key performance indicators compared to the group with the higher dividend policy score, while they have the highest Tobin’s q. In addition, companies with a payout ratio target or forecast of less than 10% have the lowest dividend policy score compared to the group with the higher dividend policy score in the Metrical Corporate Governance Score, Equity Retirement Score and Equity Issuance Score as an evaluation of corporate governance practices (including actions). These companies have the lowest Corporate Governance Score, Equity Cancellation Score and Equity Issuance Score compared to the group with the higher Dividend Policy Score. Therefore, it can be pointed out that these companies may have relatively low awareness of improving corporate governance.

Metrical evaluates the Equity Issuance Score according to the type of equity issuance (capital increase, CB, WB, preferred stock, etc.) and the frequency of such issuance. Specifically, if a company has never issued equity since 2000, the score is 0, and if it has subsequently implemented equity financing, the score is lowered according to the type of issuance. Specifically, the score is -2 for capital increases that directly issue new shares and -1 for equity financing that mitigates the dilution of shareholder interests, such as CB, WB, and preferred shares, and a negative score is added for each equity financing.

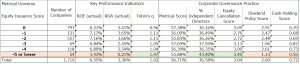

The number of companies with an Equity Issuance Score of 0 (no equity issuance since 2000) is 797, the number of companies with an Equity Issuance Score of -1 (has issued equity only once using CBs, WBs, preferred shares, etc. that are not directly dilutive) is 121, the number of companies with an Equity Issuance Score of -2 (has raised capital once or has issued equity twice using CBs, WBs, preferred shares, etc. that are not directly dilutive) is 557, and the number of companies with an Equity Issuance Score of -3 (has issued more equity than the above) is 69, the number of companies with an equity issuance score of -4 (has issued more equity than the above) is 118, and the number of companies with an equity issuance score of -5 or lower (has issued more equity than the above) is 54.

In the table below, in descending order of equity issuance score, ROE (actual), ROA (actual), and Tobin’s q are shown as key performance indicators. In the same way, Metrical Corporate Governance Score, % Independent Directors, Equity Cancellation Score, Dividend Policy Score, and Cash Holdings Score are shown to evaluate corporate governance practices (including actions).

This shows that there is a certain relationship between the Equity Issuance Score and the key performance indicators. The 54 companies with the lowest equity issuance score of -5 or lower (the most frequent equity issuers in the metrical universe) have the lowest ROE (actual) and ROA (actual) as key performance indicators compared to the group with the higher Equity Issuance score. On the other hand, Tobin’s q is the highest. The reason for this may be that frequent equity issuance dilutes shareholder interests in terms of ROE (actual) and reduces the efficient management of assets in terms of ROA (actual). On the other hand, high Tobin’s q may be due to the fact that equity financing increases the valuation of the stock price due to the expectation of future profits. Alternatively, it could be that the high stock price allows the company to execute equity financing. It is difficult to logically deduce such practices and actions at this point. I will continue to analyze and monitor the movements of these companies.

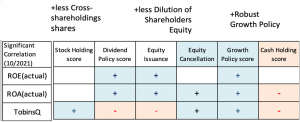

The table below shows a portion of the correlation matrix for October 2021. For the 1,716 companies in the Metrical Universe, the Equity Issuance score has a significant positive correlation with ROE (actual) and ROA (actual), while it has a significant negative correlation with Tobin’s q. Therefore, we can conclude that while equity issuance may dilute the shareholder value and have a negative effect on the efficient management of assets, the stock price tends to be highly valued due to the expectation of investment in future growth. The stock prices of such companies are probably relatively volatile, so from the perspective of investment strategy, if you can seize investment opportunities, you may be able to earn a relatively large return.

Aki Matsumoto, CFA

Please see detail research the following links.

http://www.metrical.co.jp/

Please feel free to contact the below email address if any interest or query.

Aki Matsumoto, CFA

Executive Director

Metrical Inc.

akimatsumoto@metrical.co.jp

http://www.metrical.co.jp/jp-home/