Nicholas Benes

Representative Director, The Board Director Training Institute of Japan (BDTI)

(The following is my personal opinion and not that of any organization. This is a translation of the original article.)

As sent to prospective candidates to be the next Prime Minister, in no particular order:

Chief Cabinet Secretary Yoshimasa Hayashi, Minister for Foreign Affairs Yoko Kamikawa, Minister of Economy, Trade and Industry Ken Saito, Minister for Digital Transformation Taro Kono, Minister in Charge of Economic Security Sanae Takaichi, Secretary-General of the Liberal Democratic Party Toshimitsu Motegi, House of Representatives Member Shigeru Ishiba, House of Representatives Member Shinjiro Koizumi, House of Representatives Member Takayuki Kobayashi, House of Representatives Member Seiko Noda, House of Representatives Member Katsunobu Kato.

CC: Prime Minister Fumio Kishida, Deputy Chairman of the Liberal Democratic Party’s Political Research Committee Masahiko Shibayama, Parliamentary Vice-Minister of Health, Labor and Welfare of the Liberal Democratic Party Akihisa Shiozaki, Deputy Secretary-General of the Liberal Democratic Party Seiji Kihara, House of Representatives Member Kenji Nakanishi.

Japan’s Corporate Governance Code (CGC) and the investor Stewardship Code need to function as “two wheels” of a cart. I had advocated this since 2013, and when I had the opportunity to formally propose the establishment of the CGC to the Liberal Democratic Party in 2014[1], I insisted that the most important thing was to “promote the disclosure of information that enables one to verify governance structure and substance” at firms.

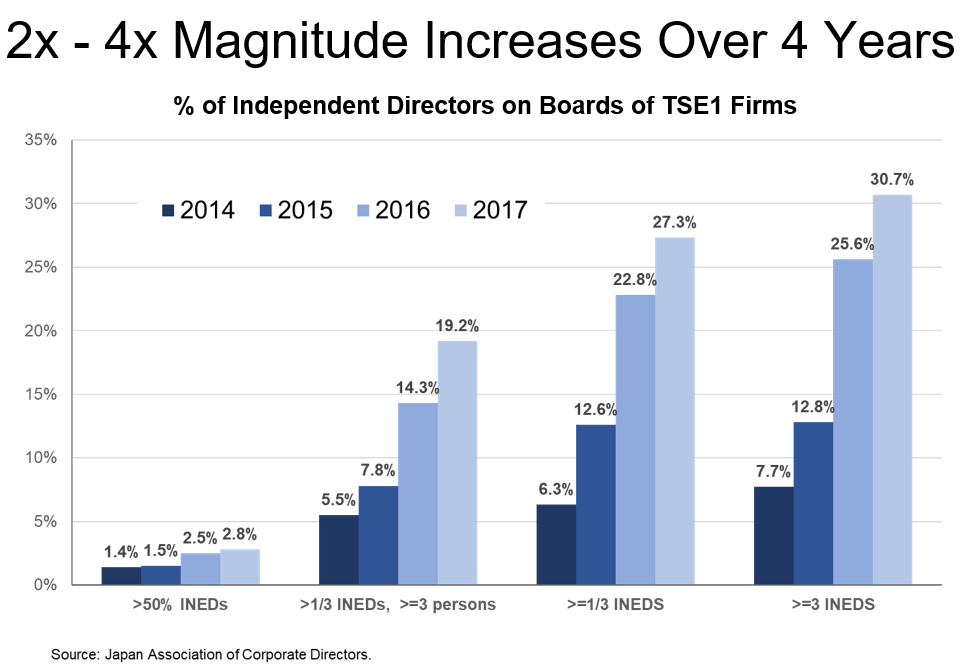

“Governance and oversight are more likely to function effectively on a board that has a majority of truly independent and qualified independent directors.” As of 2014, this dynamic had been recognized in many countries around the world. At the time, I thought that if companies disclosed their actual governance practices and stewardship by investors started functioning well, Japan, as a developed country, would naturally adopt a similar stance within the next five years or so.

Ten years later, however, there is still no serious discussion of these two issues in Japan. Now that global investors are paying more attention to the Japanese stock market, I believe it is time for us to confront these core issues and take the following steps to speed up Japan’s governance transformation.

Board portals have established themselves as a must-have in board communications. The current generation allows boards to go entirely paperless.

Board portals have established themselves as a must-have in board communications. The current generation allows boards to go entirely paperless.