Conclusion paragraph: “We believe that Toshiba Machine’s implementation of its New Buyout Defense Mechanism that does not take into account (but rather opposes) shareholder opinions hinders the development of corporate governance in Japan, which has been built on the efforts of various parties including governmental agencies and self-regulation organizations such as the Ministry of Economy, […]

Tag: corporate governance

Correlation and Causation: Good Governance Practices and Firm Performance in Japan

On December 11, 2019, I gave a lecture on BDTI’s analysis about corporate governance practices and and firm performance in Japan. Since then we have added indicators of statistical significance to our materials. To view the entire presentation as translated into English, click here: Presentation to Securities Analyst Association 2019.12.11. Those who read Japanese can read the full speech here, and can download the Japanese version of the presentation materials.

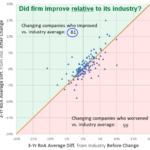

Our methodology is shown on page 23 . Our analysis suggests that the adoption of the following practices leads is followed by (appears to cause) improvements in ROA compared to the average for a firm’s industry over the next two years. Please see the charts on the left side of each page:

- Adding an nomination committee of some sort (p. 27)

- Appointing an outside director as the chair of that committee (p. 28)

- The combination of nomination committee with a board composition with >33% independent directors (p. 30)

- Adopting a performance-linked compensation plan for executives (p. 29)

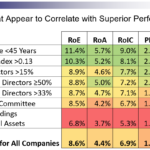

Various other factors that appear to correlate with superior performance, are shown on page 22, and page 34. We will explore the direction of causation with some of these later.

Governance Practices and Firm Performance in Japan – Preliminary Analysis of Causation

On December 11, 2019, Nicholas Benes gave a lecture on Corporate Governance Practices and Firm Performance in Japan at the Securities Analysts Association of Japan. It was generally well-received and covered the following topics:

- An Introduction to BDTI

- General Trends in Corporate Governance

- Correlation Analysis on Relationships Between Corporate Governance and Firm Performance, and the Direction of Causation

- Advice for Investors and Prospects for Future Research

- Appendix: Preview of our internal corporate governance relational database

Of note were the three main themes that were discussed: (1) There are visible relationships between certain corporate governance practices and financial performance (2) the direction of causation is most important to confirm, and so far, BDTI’s analysis suggests that a number of specific governance practices actually do seem to “cause” improvement rather than simply serve as evidence that management wants to “look good”; and (3) this information is vitally useful for analysts and investors alike, in order to improve the effectiveness of investor engagement that enhances profitability, growth and stock performance in a win-win cycle.

The Cause of Japan’s Low Productivity

In the Nikkei Business series on how to “wake up Japan”, Senior Chairman and former CEO of Japanese leasing and financial services company Orix Yoshihiko Miyauchi sees three mistakes that have led to Japan’s “lost three decades”:

- Allowing an asset bubble to develop in Japan the first place

- Not stabilising the economy after the asset price crash

- Not restructuring the Japanese banking system quicker – real restructuring did not happen until the 2000s, 10 years after the crash.

As a result, Japanese companies were “like tiny boats on a big ocean,

using all their energy to avoid large waves. Rather than innovate or

grow, they focused on cost cutting”, says Miyauchi.

Glass Lewis:” Proxy Guidelines for 2020″

“….As announced in our policy guidelines last year, beginning in 2019, for companies listed on the first and second sections of the TSE, we will begin making recommendations against members of a board that does not have any incumbent or proposed female members. In such instances, we will generally recommend voting against the chair of the company (or the most senior executive in the absence of a company chair) under the two-tier board or one-tier with one committee structures, or against the nominating committee chair under a one-tier with three committees structure. In the case of a two-tier board structure, we will examine the board of directors and board of statutory auditors as a whole, and in the cases of one-tier with three- committee structures, we will consider whether the company has any female executive officers as well as female directors.

Euromoney : “Governance brings an M&A bounty to Japan”

“Although the field of foreign investment banks active in Japan has dramatically thinned over the years, those that have stayed the course are in an unusually bright frame of mind today. The reason is a boost in M&A opportunity; the story of how we got here goes back several generations.”

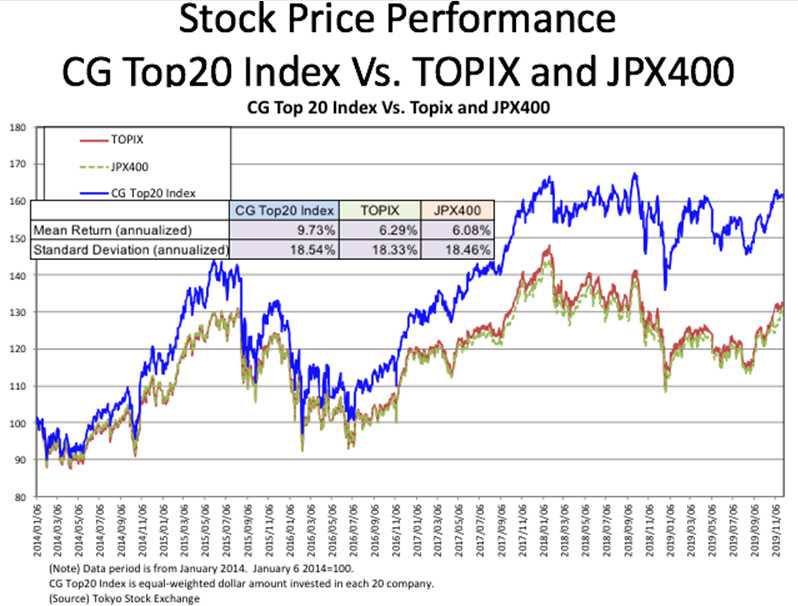

Metrical:”November Market Indices and CG Top 20 stocks kept higher.”

Stock prices closed higher amid risk-on mood from the previous month. TOPIX and JPX400 market indices gained 0.10% and 0.08% respectively for the month. CG Top 20 stocks rose modestly by 0.04% for the same period.

“Japan’s Unfinished Corporate Governance Reforms”, by Nicholas Benes

My article on Japan’s unfinished reforms is online now. Lest the Abe administration and regulators “declare victory” when they are only half done, I describe seven specific measures that Japan needs to adopt in order to bring its market up to a global standard for a developed nation:

- Detailed rules for an independent committee

- A clear requirement for a majority of independent directors on the board

- Codifying the role and responsibilities of executive officers

- Consolidation of overlapping disclosure reports

- Protection of minority shareholder rights

- Enhancing transparency to reduce entrenchment and enhance inclusiveness

- Strengthening stewardship throughout the investment chain

I stress the reality that in all of these, strong political leadership from the Prime Minister and other senior parliamentarians will be needed. “Thus, is it essential that the Tokyo Stock Exchange (JPX/TSE) and the various regulatory agencies keep up reform momentum. However, one senses a desire from these groups to ‘declare victory’, and they have a tendency to not fully coordinate with each other. If Prime Minister Abe’s cabinet did more to make the key players coordinate their efforts in key areas, meaningful governance change (and protection of investors) would accelerate….

Some Simple Questions for Softbank

For companies with Softbank Group’s corporate governance structure (a company with Board of Statutory Auditors), Article 362 of Japan’s Company Law stipulates the following:

…..(4) [the] Board of directors may not delegate the decision on the execution of important operations such as the following matters to directors: [which means: “may not delegate these matters to directors or anyone else with executive responsibilities. In other words, the board must approve the following: ]

(i) The disposal of and acceptance of transfer of important assets;

(ii) Borrowing in a significant amount;

(iii) The appointment and dismissal of an important employee including managers;

etc. “”

Because of this language in the law, companies draft up “criteria for board decisions” (“fugi kijun”) , and have them approved by the board. These criteria define numerically (and in other ways if necessary) what will be considered “important” under each of the categories set forth above and therefore will require board approval, e.g. purchases of real estate larger than 1.0 Billion Yen (about $10 million), investments or acquisitions larger than 2 Billion Yen ($20 million), etc. – a “limit amount” referred to below as “X” .

BDTI/METRICAL Joint Research Update: “CG Practice and Value Creation Linkage”

BDTI and METRICAL are continuing to collaborate on finding “linkages between CG practice and value creation.” METRICAL has recently updated the results of our analysis at the end of October 2019 for about 1,800 listed companies representing a market capitalization of more than 10 billion yen. In this update, we see that the number of […]