On December 11, 2019, Nicholas Benes gave a lecture on Corporate Governance Practices and Firm Performance in Japan at the Securities Analysts Association of Japan. It was generally well-received and covered the following topics:

- An Introduction to BDTI

- General Trends in Corporate Governance

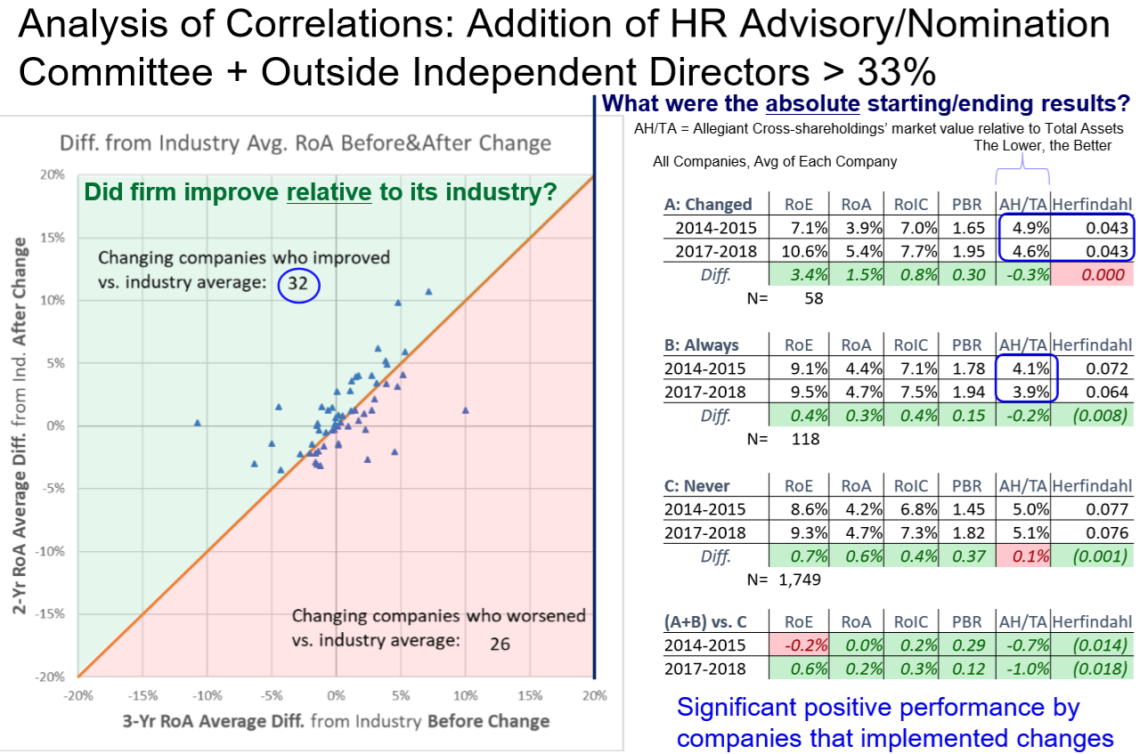

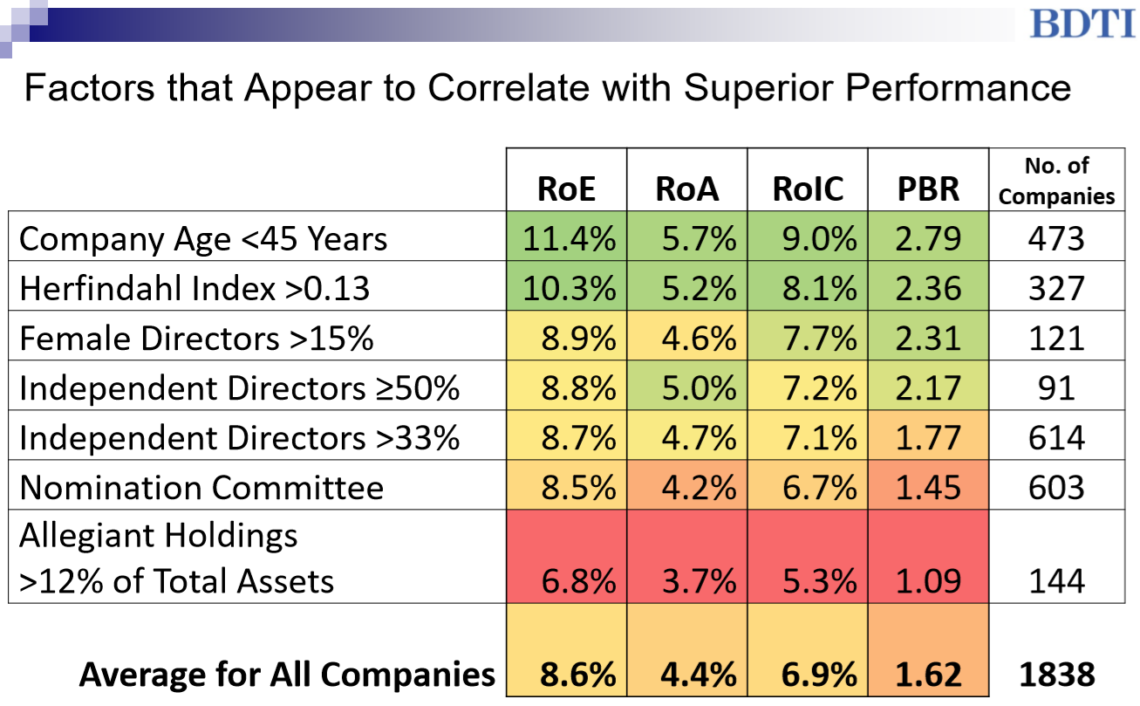

- Correlation Analysis on Relationships Between Corporate Governance and Firm Performance, and the Direction of Causation

- Advice for Investors and Prospects for Future Research

- Appendix: Preview of our internal corporate governance relational database

Of note were the three main themes that were discussed: (1) There are visible relationships between certain corporate governance practices and financial performance (2) the direction of causation is most important to confirm, and so far, BDTI’s analysis suggests that a number of specific governance practices actually do seem to “cause” improvement rather than simply serve as evidence that management wants to “look good”; and (3) this information is vitally useful for analysts and investors alike, in order to improve the effectiveness of investor engagement that enhances profitability, growth and stock performance in a win-win cycle.

To view the entire presentation, click here: Presentation to Securities Analyst Association 2019.12.11

For those looking to scan the material quickly, page 36 provides a summary of our results detailing the relationship between corporate governance and corporate performance; while methodology and full details can be found on pages 23-33.

Example slides appear below.

Example of causation analysis: