Conclusion paragraph: “We believe that Toshiba Machine’s implementation of its New Buyout Defense Mechanism that does not take into account (but rather opposes) shareholder opinions hinders the development of corporate governance in Japan, which has been built on the efforts of various parties including governmental agencies and self-regulation organizations such as the Ministry of Economy, […]

Author: Admin

Correlation and Causation: Good Governance Practices and Firm Performance in Japan

On December 11, 2019, I gave a lecture on BDTI’s analysis about corporate governance practices and and firm performance in Japan. Since then we have added indicators of statistical significance to our materials. To view the entire presentation as translated into English, click here: Presentation to Securities Analyst Association 2019.12.11. Those who read Japanese can read the full speech here, and can download the Japanese version of the presentation materials.

Our methodology is shown on page 23 . Our analysis suggests that the adoption of the following practices leads is followed by (appears to cause) improvements in ROA compared to the average for a firm’s industry over the next two years. Please see the charts on the left side of each page:

- Adding an nomination committee of some sort (p. 27)

- Appointing an outside director as the chair of that committee (p. 28)

- The combination of nomination committee with a board composition with >33% independent directors (p. 30)

- Adopting a performance-linked compensation plan for executives (p. 29)

Various other factors that appear to correlate with superior performance, are shown on page 22, and page 34. We will explore the direction of causation with some of these later.

Great Analysis of the Larry Fink/BlackRock Letter

“Today, after more than a year of increasing pressure from climate activists, investors, legislators, and thought leaders, BlackRock CEO Larry Fink, in his highly-anticipated annual letter to CEOs and to clients, announced a sweeping new set of policies which aim to put climate change and sustainability at the center of BlackRock’s business model. BlackRock is the world’s largest asset manager with almost $7 trillion in assets under management as of Q3 2019. …..The announcement is a major shift for BlackRock, which previously had failed to take meaningful action on climate, and is a very important step in the right direction as the world faces increasing risk from climate change. Massive capital shifts away from fossil fuels and deforestation-risk commodities are necessary to mitigate the worst of the climate crisis and set the world on a path toward sustainability.

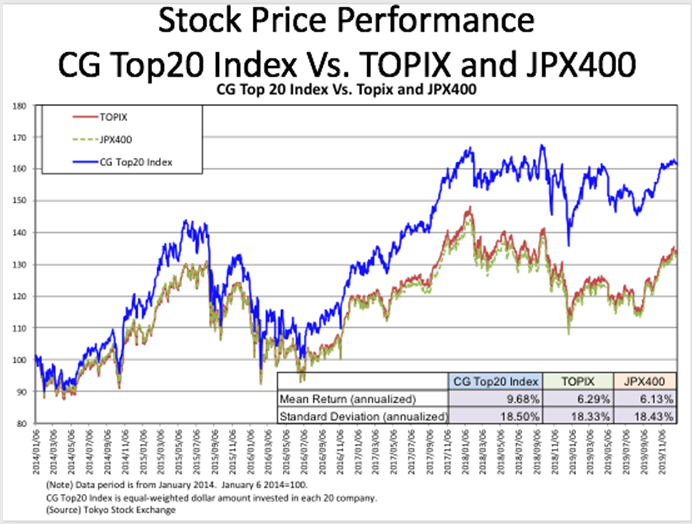

METRICAL:December Market Indices and CG Top 20 Stocks Remained Solid

Stock prices edged slightly higher amid low trading volume from the previous month. TOPIX and JPX400 market indices gained 0.06% and 0.06% respectively for the month. CG Top 20 stocks kept solid up by 0.02% for the same period.

METRICAL: Does the Legal Structure of BoD Affect Japan’s Corporate Governance and Performance?

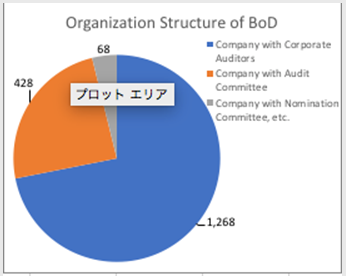

Public companies in Japan employ three types of legal governance structures for their boards. The three types of organizational structure are the Company with Corporate Auditors, the Company with an Audit Committee and the Company with Nomination Committee, etc. However, as shown in the pie chart below, very few companies use the Nomination Committee format. The number of companies shown below is based on Metrical’s research universe of 1,754 companies but the number of Companies with Nomination Committee, etc. would not be much different even if more smaller companies were included.

Governance Practices and Firm Performance in Japan – Preliminary Analysis of Causation

On December 11, 2019, Nicholas Benes gave a lecture on Corporate Governance Practices and Firm Performance in Japan at the Securities Analysts Association of Japan. It was generally well-received and covered the following topics:

- An Introduction to BDTI

- General Trends in Corporate Governance

- Correlation Analysis on Relationships Between Corporate Governance and Firm Performance, and the Direction of Causation

- Advice for Investors and Prospects for Future Research

- Appendix: Preview of our internal corporate governance relational database

Of note were the three main themes that were discussed: (1) There are visible relationships between certain corporate governance practices and financial performance (2) the direction of causation is most important to confirm, and so far, BDTI’s analysis suggests that a number of specific governance practices actually do seem to “cause” improvement rather than simply serve as evidence that management wants to “look good”; and (3) this information is vitally useful for analysts and investors alike, in order to improve the effectiveness of investor engagement that enhances profitability, growth and stock performance in a win-win cycle.

Nicholas Benes: Public Comment on Revision of the Stewardship Code

1) Pension Funds

2) Other Types of Investors

3) “ESG Factors”

4) Debt Instruments

1) Pension Funds

The proposed revisions to the Stewardship Code do not make it clear enough exactly how corporate pension funds, or smaller pension funds of any type, can sign the Code and comply with it without bearing excessive cost, work, or confusion. Because this is not sufficiently clear at present, to date only an extremely small number of the defined-benefit pension funds at listed non-financial companies in Japan have signed the Code (only about 10, out of a total of 700 or more such funds). As a result, a rather odd situation exists in that most Japanese companies claim to care for their employees deeply, but judging from their actions, do not seem to care much about employees’ investments or post-retirement quality of life – or even, to care about preserving shareholder value by reducing the cash infusions needed to keep their pension plan fully funded. This makes a mockery of the language in the Corporate Governance Code about stewardship (Principle 2.6 企業年金のアセットオーナーとしての機能発揮), and of the Stewardship Code itself.

Results of CFA Society Japan and CFA Institute survey regarding amendments to the Foreign Exchange and Foreign Trade Act

Almost 70% of respondents do not agree with the amendment and 86% showed their concern that the amendment might give a negative impact on the investment into the Japanese equity market.

Specialist or Generalist Education and Careers?

It’s well known in Japan that entry to good universities is fiercely competitive, and then students mess around for four years, sleeping in lectures, putting more effort into club activities than study. As a consequence, the large employers who recruit hundreds of graduates every year mainly assess applicants on character and potential, and treat new hires as “trainees” to be developed, rather than contributors.

The Need to be “Applied” in Japanese Universities

Shigenobu Nagamori, the founder of Nidec is interviewed in the Nikkei Business series on how to “wake up Japan” about his latest acquisition – not a company this time, but a university – Kyoto Gakuen. He feels that Japan has become too brand name obsessed about higher education and that 18 year olds should not have their future decided simply on the basis of their standardised score for the university entry exams.