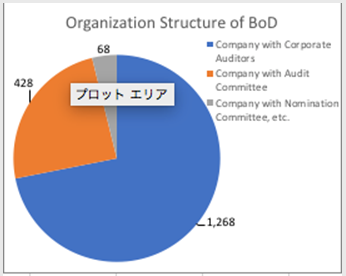

Public companies in Japan employ three types of legal governance structures for their boards. The three types of organizational structure are the Company with Corporate Auditors, the Company with an Audit Committee and the Company with Nomination Committee, etc. However, as shown in the pie chart below, very few companies use the Nomination Committee format. The number of companies shown below is based on Metrical’s research universe of 1,754 companies but the number of Companies with Nomination Committee, etc. would not be much different even if more smaller companies were included.

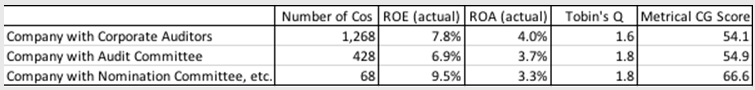

Metrical doesn’t reflect differences in the type of legal structure of the BoD in arriving at its CG scores. However, the CG scores are highest for Companies with Nomination Committees, etc. , followed by Companies with Audit Committee and Companies with Corporate Auditors. The Company with Nomination Committees etc. also shows superior performance in terms of ROE (actual) and Tobin’s Q, two of the three key performance measures we use (i.e., except ROA (actual)) . We believe that companies that achieve superior performance would tend to enhance their CG practices and therefore move to convert to the “Nomination Committees, etc.” structure over time, and vice versa.

On the other hand, Companies with Audit Committee tend to rank in the middle of of the three types organization structure. This new type of organization structure has been employed by a number of companies for three years, since the company law amendments enabling it became effective in May 2015. As mentioned earlier, Metrical doesn’t vary its scoring to reflect the type of legal organization structure, but the average score for this governance format is far lower than that of the Company with Nomination Committee, etc. and only slightly higher than the Company with Corporate Auditors.

Metrical pointed a couple of issues for a company that was moving to the new type of organization structure from the structure of a Company with Corporate Auditors, and was skeptical that CG practices would change much. The issues included: (a) concerns about weaker effectiveness of auditing for the new structure compared to the traditional structure with corporate auditors, which has an “investigation right” that each statutory auditor can exercise individually; (b) concern about neutralizing the function of the BoD, as the organization structure could allow executive (inside) directors to make decisions about important matters without authorization of the BoD if the BoD is composed by the majority of outside directors or the article of incorporation have been changed to allow such delegation.

Unexpectedly, the result as shown the table below indicates that a number of companies that moved to this organizational structure “look good” in terms of BoD composition, because the superficial number of outside directors of BoD often increases simply by shifting corporate auditors to director positions at a Company with Corporate Auditors. However, if these persons focus mainly on their audit committee duties, in fact the company might not significantly enhance its CG practices. We don’t think all companies are reluctant to enhance CG practices, but it takes much time to move to what we consider to be the “final form”, the “Company with Nomination Committee, etc.”

For instance, an office manager who is in charge of governance might be keen to enhance CG practices, but realistically it takes much time to convince board directors and get consensus, particularly at a traditional company. Consequently, the office manager would plan to make progress step by step, changing the structure first and moving to the final form as the next step. This same tendency is also reflected in the slower pace of change than expected for Japanese companies’ management decisions in general. This would be one of the reasons that CG practices are now improving at slower pace since the Corporate Governance Code was introduced in 2015. We should keep an eye on how, or if, the companies which employ the structure “Company with Audit Committee” move to the final form. If they stay there for long time, perhaps they are not considering CG seriously.

Download the full report: Linkage Between CG and Value Creation-12-2019

Please see detail research the following links.

http://www.metrical.co.jp/

Please feel free to contact the below email address if any interest or query.

Aki Matsumoto, CFA

Executive Director

Metrical Inc.

akimatsumoto@metrical.co.jp

http://www.metrical.co.jp/jp-home/