We would greatly appreciate it if you could possibly donate to BDTI, and even if not, forward this link to any and all. Thank you for your support !

s

Crafting the ‘G’ in ESG: Accountability in the Boardroom

As investment in environment, social and governance (ESG) gains momentum, investors and stakeholders increasingly expect swift and concrete sustainability initiatives from companies across the globe. But boards have lagged behind the ESG fervor. While 40% of directors were found to be ESG conscious with some level of knowledge in the space, only 8% of board directors were found to be competent and capable of effective, embodied action, according to a 2021 study of the top 100 public corporations internationally.

We recently considered the evolving perspectives in ESG, as well as tools and strategies for boards to meet the ESG expectations of their stakeholders.

CG Top 20 Stock Performance (October 2022)

The stock market closed higher in October, driven by rising U.S. equity prices, which rose on expectations of a slowdown in U.S. policy rate hikes.

The performance of the TOPIX and JPX400 indexes in October was up 5.11% and 5.22%, respectively. Over the long term since 2014, the CG Top 20 continues to outperform both indices by about 2% per year. Note that the CG Top20 has been reassessing its component stocks since July 1. The new individual stocks are listed in the table below.

-1024x767.png)

METRICAL: What Initiatives are Companies with High Valuations Taking?

In my previous article, “Transitional companies in the prime market: to increase valuations,” I examined companies that increased their market capitalization over the December 2020-February 2022 period and found that the increase was due to higher valuations. I then examined the initiatives of the companies whose Tobin’s q increased during the period in question. I found that changes in Tobin’s q were closely related to increases in foreign ownership, and that firms with large increases in Tobin’s q showed declines in cash equivalents and total assets, suggesting that firms moved to use their assets more effectively. Related to the effective use of assets, these companies have clearly articulated the balance between investment in growth and shareholder returns in their capital allocation policies and have made efforts to communicate with shareholders and investors. With regard to board practices, the companies that significantly increased their Tobin’s q made notable improvements in ensuring the independence of their independent director ratios and compensation committees, as required by prime market listing standards. It was also inferred that the inclusion of companies that eliminated takeover defenses also contributed to boosting Tobin’s q. In light of these results, I’m now interested in what tends to happen to companies with high valuations in the first place, and would like to examine what efforts have been made to address this issue.

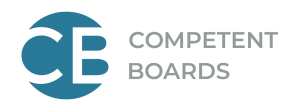

The table below shows the correlation analysis between the change in Metrical Tobin’s q and the change in Profile and Key Performance Indicators. Over the period, changes in Tobin’s q are significantly positively correlated with changes in market capitalization and foreign ownership. This confirms that changes in Tobin’s q (valuation) are closely related to changes in market capitalization and foreign ownership. The change in Tobin’s q also shows a significant negative correlation with the change in cash equivalents and the change in total assets. I find that firms that increased Tobin’s q tended to decrease cash equivalents and total assets during the period in question.