Detail/Nominate: https://jwliccja.org/apply-3/

Deadline (extended): Sunday, May 19 – Japan Time

Make a new forum entry

Detail/Nominate: https://jwliccja.org/apply-3/

Deadline (extended): Sunday, May 19 – Japan Time

I would like to examine which companies have experienced an increase in stock valuations over the past year, and have analyzed the characteristics of the 1,755 companies in the comparable Metrical universe whose Tobin’s Q increased between the end of December 2022 and the end of December 2023. The table below shows the median value of the change in Tobin’s Q for each of the six groups.

Weakness in the U.S. stock market due to concerns about the risk of prolonged inflation and selling of semiconductor sector stocks caused Japanese stock prices to fall from mid-month, but the yen continued to weaken due to the Bank of Japan’s ongoing monetary easing, leading to a buying bounce toward the end of the month.

The TOPIX and JPX400 indexes gained -0.77% and -0.30%, respectively, in April, while the CG Top 20 index underperformed both indices by 1.30%.

The composites of CG Top 20 stocks has been replaced as of July 1.

Wacom (6727), K’s Holdings (8282), Eisai (4523), NSD (9757), and Trend Micro (4704) were new additions, while Ebara Corporation (6361), Orix (8591), United Arrows (7606), Tokyo Gas (9531) and Hoosiers Holdings (3284) were removed. Details of the component stocks are shown in the table below.

The February stock market continued to be strong from the beginning of the month.

In February, the CG Top 20 underperformed both the TOPIX and JPX400 stock indices.

Supported by high overseas stock market prices in the U.S. and other countries, the Japanese stock market was also solid throughout the month, with the Nikkei 225 hitting its all-time high in 1989 on February 22. The stocks continued to be firm toward the end of the month.

The TOPIX and JPX400 indexes gained 4.83% and 4.75%, respectively, in February, while the CG Top20 stocks underperformed against both indexes, dipping -0.97%.

The composites of CG Top 20 stocks has been replaced as of July 1.

Wacom (6727), K’s Holdings (8282), Eisai (4523), NSD (9757), and Trend Micro (4704) were new additions, while Ebara Corporation (6361), Orix (8591), United Arrows (7606), Tokyo Gas (9531) and Hoosiers Holdings (3284) were removed. Details of the component stocks are shown in the table below.

Metrical provides monthly corporate governance assessments of approximately 1,800 companies, primarily prime market listed companies. This year, continuing on from last year, we would like to see how much progress has been made in corporate governance initiatives by listed companies over the past year.

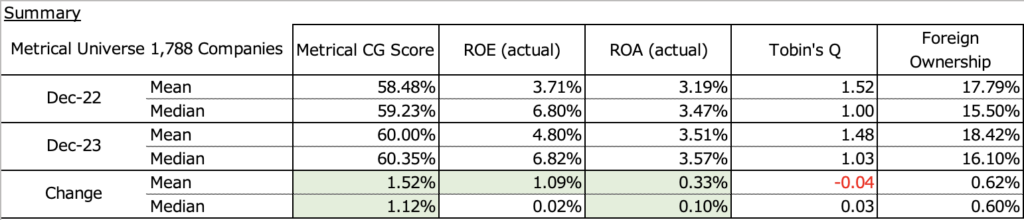

We analyzed how much the 1,788 companies in the comparable Metrical universe improved in each evaluation category between December 31, 2022 and December 31, 2023. The table below shows the Metrical CG score, which is the overall corporate governance score, the average ROE and ROE over the past three years, the change in Tobin’s Q and foreign shareholding ratio in December 2022, December 2023, and change from 2022 to 2023, and the mean and median values.

On October 26, 2023, the TSE released the “Publication of the List of Disclosed Companies Regarding “Measures to Achieve Management Conscious of Cost of Capital and Stock Prices.” I would like to provide an overview of this document below and consider the issues it discusses.

1. Future initiatives regarding “measures to realize management conscious of cost of capital and stock price”

Publication of the list of disclosing companies, and re-communication of the purpose and points to be noted.

Publication of a list of companies disclosing information in accordance with the request, with a view to informing investors of the status of companies that are taking steps to comply and to encourage their efforts. The list will be published on January 15, 2024, and will be updated monthly.

Based on interest from participants overseas, BDTI held its English Director Boot Camp via teleconference on January 19th. The day-long intensive course was attended by highly-experienced and highly interactive participants all the way from Hong Kong, Papua New Guinia to Europe. The participants heard lectures about corporate governance by Nicholas Benes and there were lots of interactive discussion and Q&A about real-life situations on Japanese boards, and how to handle them. You get even more in the additional materials we provide in your thick binder.

Following the previous analysis of the ratio of independent directors, here is an analysis of the ratio of female board members. As you know, the Japanese government has set a target of increasing the ratio of female board members ( board directors, statutory executive officers, and statutory auditors) to 30% by 2030 for companies listed on the prime market. Using data from the Metrical Universe at the end of September, I will examine the characteristics of each group in terms of the ratio of female board members.

Of the 1,781 companies in the Metrical Universe at the end of September, 74 (4.2%) have achieved a ratio of 30% or more female directors. The government and TSE have also set an intermediate goal of appointing at least one female board member by 2025. 1,567 (88%) of the 1,781 companies in the Metrical Universe at the end of September have at least one female board member. The 1,781 companies in the Metrical universe also include companies listed outside the prime market. It also includes companies like Canon that are expected to appoint female board members at future AGMs, so it is likely that the majority of prime market listed companies will have appointed female board members by 2025.

This being New Year’s Day, I will recommend one book to read in 2024 to learn about not only about the challenges that Japan faces, but how the country is evolving to cope with them (and even thrive) in the global economy. Richard hits the nail on the head in many ways, but to summarize a major theme; if Japan is to fare better during next 15years than its past 25 years would seem to indicate, it will not be because the business models and management thinking of its large firms are simply updated.

The tax year will soon end! If you are interested to help improve corporate governance in Japan by supporting its up-and-coming “Institute of Directors”, please consider making a tax-deductible donation to our government-certified non-profit using this link: https://bdti.or.jp/en/about/make-a-donation/ . a Here is “why director training is so essential in Japan: あ Donations to BDTI can be […]