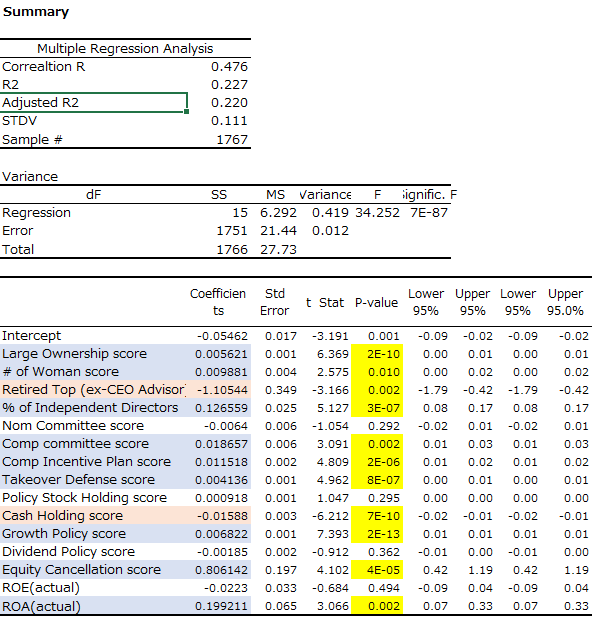

BDTI and METRICAL are continuing to collaborate on finding “linkages between CG practice and value creation.” METRICAL has recently updated the results of our analysis at the end of October 2019 for about 1,800 listed companies representing a market capitalization of more than 10 billion yen. In this update, we see that the number of […]

Discussion Forum

Make a new forum entry

BDTI News

| Next Director Boot Camp is January 31st! |