Keidanren published a “Cyber Risk Handbook(Japanese)” in October 31st.

Download a handbook from here : Cyber Risk Handbook(Japanese)

Keidanren HP: http://www.keidanren.or.jp/policy/cybersecurity/CyberRiskHandbook.html

Keidanren published a “Cyber Risk Handbook(Japanese)” in October 31st.

Download a handbook from here : Cyber Risk Handbook(Japanese)

Keidanren HP: http://www.keidanren.or.jp/policy/cybersecurity/CyberRiskHandbook.html

My article on Japan’s unfinished reforms is online now. Lest the Abe administration and regulators “declare victory” when they are only half done, I describe seven specific measures that Japan needs to adopt in order to bring its market up to a global standard for a developed nation:

I stress the reality that in all of these, strong political leadership from the Prime Minister and other senior parliamentarians will be needed. “Thus, is it essential that the Tokyo Stock Exchange (JPX/TSE) and the various regulatory agencies keep up reform momentum. However, one senses a desire from these groups to ‘declare victory’, and they have a tendency to not fully coordinate with each other. If Prime Minister Abe’s cabinet did more to make the key players coordinate their efforts in key areas, meaningful governance change (and protection of investors) would accelerate….

On November 13th, BDTI held its English Director Boot Camp , attended by a number of highly experienced participants. Participants from various companies heard lectures about corporate governance by Nicholas Benes and Andrew Silberman of AMT, and exchanged experiences and opinions at a spacious, comfortable room kindly donated for our use by Cosmo Public Relations, a leading communications and PR firm in Tokyo.

We are planning to hold the next course on Wednesday, February 19th,2020. Sign up early!

“Despite Japan’s aging population and mounting public debt, the country offers a host of investment opportunities, according to Katie Koch, co-head of Goldman Sachs Asset Management’s (GSAM) Fundamental Equity business. Koch recently returned from GSAM’s annual Investor Tour, held this year in Tokyo and Kyoto, where the team hosted 20 CEOs, CIOs and heads of equity from large global institutions along with Japanese policy makers, government officials and C-suite executives….”

“Waseda Institute for Advanced Study (WIAS) will conduct a 3-day international seminar with Said Business School, University of Oxford, Ecole des hautes etudes en sciences sociales (EHESS) and University of British Columbia (UBC) by Core-to-Core Program of JSPS. A 3-session symposium for invitees will be held on the first day, while the second and third day will be roundtable discussion on the evolving diversity of corporate governance in Europe and emerging countries in Asia. The purposes of this seminar are to wrap up the past research activities and to explore new issues to be challenged….”

ACGA submitted a letter to the Ministry of Finance (MOF) in Japan to express their deep concerns about the direction and substance of recently proposed amendments to the Foreign Exchange and Foreign Trade Act (FEFTA). They said “If passed, this would cut the threshold for mandatory pre-reporting of foreign investments in restricted sectors from 10% […]

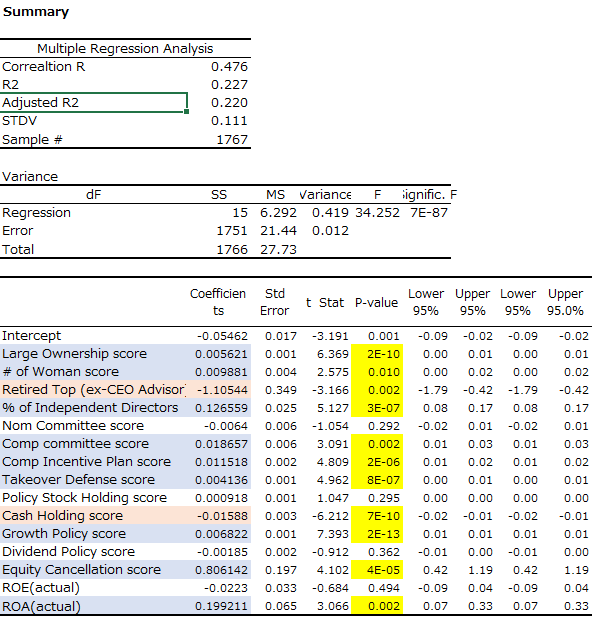

While overseas investors’ ownership decreased a year ago, activist investors are now likely to focus on Japanese companies. Corporate governance in Japan has improved since the Corporate Governance Code was introduced in June of 2015, but progress is much slower than foreign investors hoped. At this time, we analyze the relationship between % ownership held by overseas investors and key governance criteria. The following table shows the result of our regression analysis of the 13 governance factors that METRICAL uses as criteria and two performance measures, ROE and ROA. Of the 15 factors, 14 factors are significantly correlated with level of ownership by overseas investors.

When you squint closely at the facts, not as much as you might think. Mostly, it is the difference between individual self-dealing and collective self-dealing.

As corporate policy, many Japanese companies re-hire their executive directors as “advisors (“sodanyaku” or “komon“) immediately after they retire from the board. The re-hiring occurs automatically, and the work expected from such “advisors” in their contracts (if any) is usually vague to the point of being non-existent.

Does anyone have any theories as to why institutional investors that support director training in Japan are overwhelmingly foreign, and not Japanese?

The Board Director Training Institute of Japan (BDTI) was established as a “public interest” nonprofit in order to enable Japanese institutional investors to support something badly needed by their home market, director and governance training, on a tax-deductible basis…. so that such training could be offered at high quality yet low price, thereby spreading customs of governance/director training throughout Japan. However, after running BDTI for eight years since obtaining certification, we have noticed a disturbing but continuing reality: over time, more than 95% of BDTI’s donations from institutional investors have come from foreign institutions or fund managers, and less than 5% of donations to BDTI have come from Japanese institutions. Moreover, none of the Japanese institutional donors are “major” (top 30) investing institutions in Japan.

On July 12, 2019, I gave a presentation about Work Style Reform in Japan at a seminar organized by the Japan America Society of Washington DC in the beautiful meeting room of the Groom Law Group. The talking points in my presentation were the background of the reform (political background and male dominated office), the major points of amendment to laws, the problems and keys to improving productivity, the young generation’s view of employment activity and work-life balance, protection for non-regular employees, and some implications to businesses in Japan. The questions and opinions raised by the participants were as follows.