BDTI and METRICAL are continuing to collaborate on finding “linkages between CG practice and value creation.” METRICAL has recently updated the results of our analysis at the end of October 2019 for about 1,800 listed companies representing a market capitalization of more than 10 billion yen. In this update, we see that the number of […]

Category: Governance

ASIA TIMES:”Japan Inc’s dividends go on a bull run – at last”

“Now, the moment which Japanese stock aficionados have long dreamed has arrived. Pressure on CEOs to champion shareholder value and raise returns on equity are paying off with a bull market in dividends. Even better, it may be just beginning. Those are the signals emanating from Nomura, one of Japan Inc’s most fabled investment houses. Its analyst reckons that dividends doled out by blue-chip companies grouped in Tokyo Stock Exchange’s first section hit the US$133 billion mark in August. That’s more than twice what companies were shelling out in 2012. And this windfall is coming even as the global trade war crimps growth and economists warn of a rocky 2020. This raises two pivotal questions. First, can the dividend surge continue? Second, what’s the catch?”

Full article :”Japan Inc’s dividends go on a bull run – at last”

FTADVISER:”Japan’s corporate reforms ‘here to stay'”

“Japan’s corporate governance reforms are “here to stay” and will likely be good for investors, according to the manager of the AVI Japan Opportunity trust.

Speaking to FTAdviser, Joe Bauernfreund said he thought the reforms brought forward by Prime Minister Shinzo Abe were more than a political move and would result in higher returns for investors….”

METRICAL:”CG Stock Performance (Japan): September 2019″

Stock prices closed higher amid low trading volume. TOPIX and JPX400 market indices rose 0.26% and 0.27% respectively from the end of the previous month. CG Top 20 stocks slightly underperformed against the both indices, closed up by 0.16% in September.

Vision with Core Values and Ideologies enhances a company’s life cycle

We have been observing that life cycles of the companies are shortening every 5 years. The visionary companies are time tested and standing tall and withstanding the headwinds and adversaries in the journey of the Company Life Cycle of even 100 years! Who are such visionary companies? What they do and How they do? What is that core substance which get them glued from “Top to Bottom” with the same mission? How a company can be distinguished as a “VISIONARY COMPANY” from other peer following company?

September 12th “Director Boot Camp” – Another Successful Program! Next Course: November 13th, 2019!

On September 13th, BDTI held its English Director Boot Camp , attended by a number of highly experienced participants. Participants from various companies heard lectures about corporate governance by Nicholas Benes and Andrew Silberman of AMT, and exchanged experiences and opinions at a spacious, comfortable room kindly donated for our use by Cosmo Public Relations, a leading communications and PR firm in Tokyo.

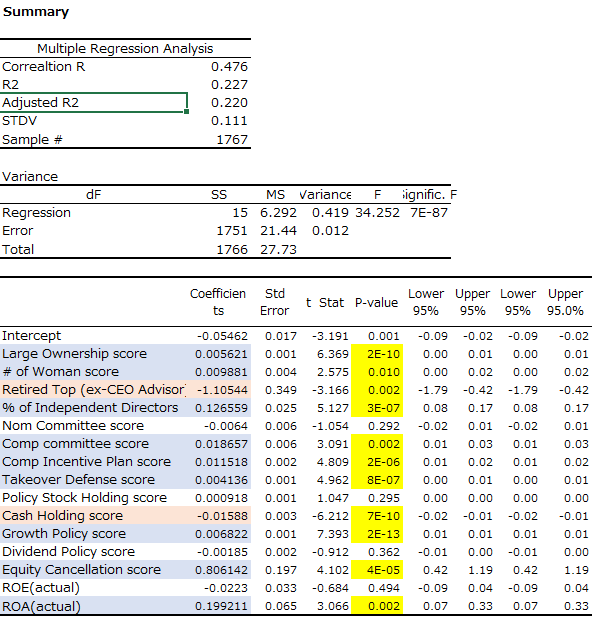

Correlations Between Governance Factors and Foreign Ownership

While overseas investors’ ownership decreased a year ago, activist investors are now likely to focus on Japanese companies. Corporate governance in Japan has improved since the Corporate Governance Code was introduced in June of 2015, but progress is much slower than foreign investors hoped. At this time, we analyze the relationship between % ownership held by overseas investors and key governance criteria. The following table shows the result of our regression analysis of the 13 governance factors that METRICAL uses as criteria and two performance measures, ROE and ROA. Of the 15 factors, 14 factors are significantly correlated with level of ownership by overseas investors.

TIIP:”Sustainable Investing in Japan: An Agenda for Action”

Executive Summary

More than a quarter of assets under management (AUM) worldwide are invested in “sustainable” strategies, strategies that consider environmental, social, and governance (ESG) factors in pursuit of financial sustainability and/or environmental or social sustainability. Investors – both individual and institutional and at all wealth levels – are increasingly interested in integrating these strategies into their financial plans and investment portfolios, and asset managers and global financial institutions are embracing the approach and expanding related services and product offerings.

Interest in sustainable investing and sustainably invested AUM are growing rapidly in Japan. But despite this enthusiasm and growth, few mainstream investors, financial advisors, and investment consultants in Japan are embracing the practice.

Taking a Horse to Water – Prospects for the Japanese Corporate Governance Code

This paper was originally published by Zeitschrift für Japanisches Recht (Journal of Japanese Law) in its 2019 Spring edition (Vol.24). It is reproduced here by kind permission of the Executive Editors.

SUMMARY

“In 2014–2015 Japan implemented a series of reforms to its corporate governance regime. The principal measures adopted were the country’s first Corporate Governance Code, revisions to its Companies Law, and a Stewardship Code, together with a report (the Itō Review) on corporate competitiveness and incentives for growth. In this paper we analyse the objectives of these reforms and make an assessment of their likely success.

METRICAL/BDTI:Ratings of 1,800 companies (July 2019 Update)

In our July ratings, a more nuanced pictured emerged for Japanese companies. The significantly positive correlation of financial performance with the percentage of INEDs and the number of Female Directors disappeared this month, suggesting that an increasing number of non-superior performers are “copying” other companies in this respect, and/or have only only done so recently so no positive impact (should there be any) is discernible.