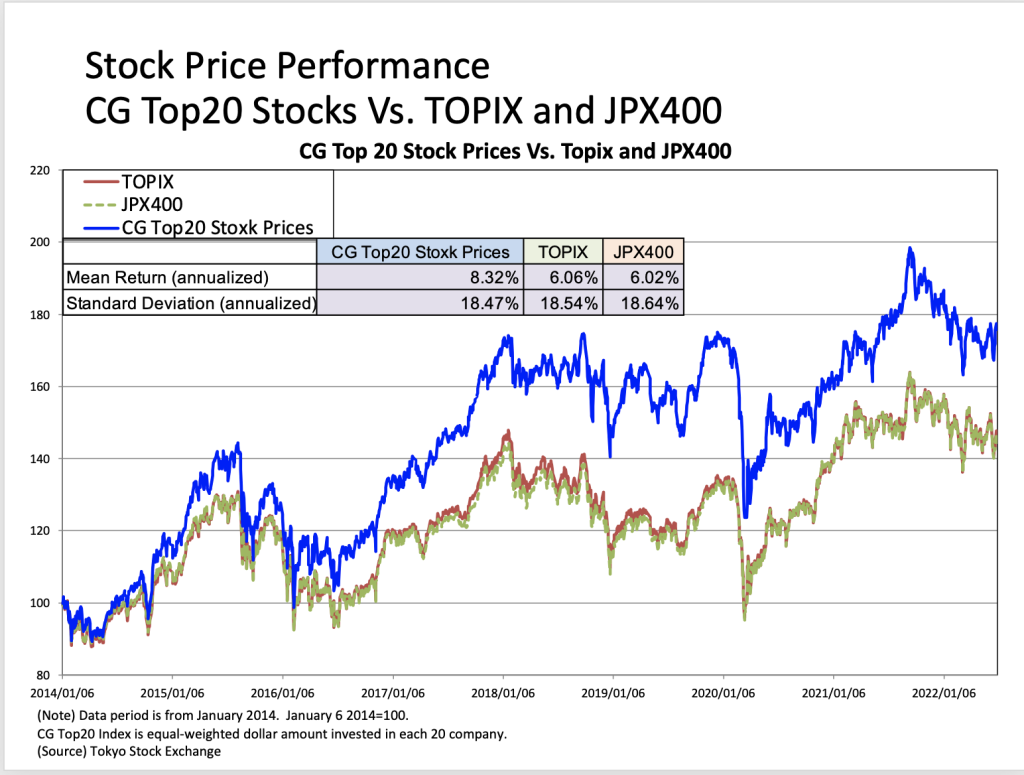

August stock prices rose sharply until the first half of the month as the U.S. stock market rallied on expectations of an early end to monetary tightening in the U.S. Toward the end of the month, the market turned highly volatile as the U.S. stock market fell on the concern about longer-than-expected U.S. monetary tightening. The CG Top 20 outperformed both TOPIX and JPX400 during the month.

Until mid-August, the stock market rallied in favor of the U.S. stock market, which rose on expectations of an early end to the U.S. monetary tightening due to the U.S. economic recession speculation. In the latter half of the month, market volatility increased due to concerns about the U.S. FED’s long-term monetary tightening. The TOPIX and JPX400 indexes gained 1.53% and 1.33%, respectively, during the month of August, while the CG Top20 index outperformed both indices, rising 1.66%. The table below shows the components of the CG Top 20 as reviewed on July 1.

The next Boot Camp will be on

The next Boot Camp will be on