Photograph of the Prime Minister delivering an address

”Prime Minister Shinzo Abe attended the Executive Women Symposium Reception held in Tokyo.

Photograph of the Prime Minister delivering an address

”Prime Minister Shinzo Abe attended the Executive Women Symposium Reception held in Tokyo.

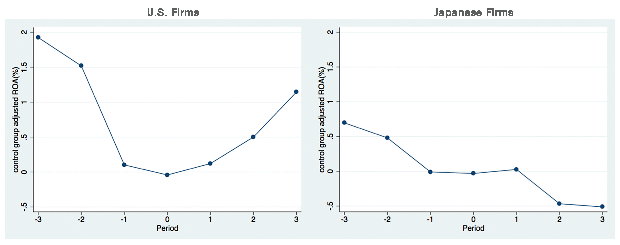

Figure 2: Return on Assets Before and After Corporate Leadership Change

Hyeog Ug Kwon, Faculty Fellow, RIETI: ”Japanese firms invest in research and development (R&D) on a level comparable to that of their U.S. counterparts. They possess a high-quality workforce and receive decent management practice scores for organizational and human resource (HR) management. Yet, they fall significantly behind U.S. firms when it comes to earning power.

”This is what happens when economies rely on easy money but don’t follow through with the hard work of reform.

If ever there was a country that illustrates the bizarre economic conditions the world finds itself in, it’s Japan.

Usually, when a country’s central bank cuts interest rates, its currency weakens on the global stage, making it easier to sell goods and services abroad as well as providing incentives for banks to lend. Both are supposed to increase economic growth. Except nothing is working like it’s supposed to these days in the global economy, and Japan is the number one case in point.

”Listed Japanese companies are on track for a third-straight year of record dividend payouts, with the figure set to hit 10.8 trillion yen ($93.38 billion), topping the 10 trillion yen mark for the first time.

「50 corporate governance experts representing 16 countries and five continents gathered at Schloss Leopoldskron on October 1-3, 2015 for the session on Corporate Governance in the Global Economy: The Changing Role of Directors, which marked the inaugural meeting of the Salzburg Global Forum on Corporate Governance.

”To manage a massive amount of funds safely and efficiently, it is vital to build an effective organization and system suited to carrying out the task.

A council of the Health, Labor and Welfare Ministry has proposed that the current ban on direct stock investment by the Government Pension Investment Fund (GPIF) remain in place, at least for the time being.

”The Council of Experts Concerning the Follow-up of Japan’s Stewardship Code and Japan’s Corporate Governance Code has published “Publication of “Corporate Boards Seeking Sustainable Corporate Growth and Increased Corporate Value over the Mid- to Long-Term……..”

Governor of the Bank of Japan (BoJ) Haruhiko Kuroda explains his negative interest rate plan

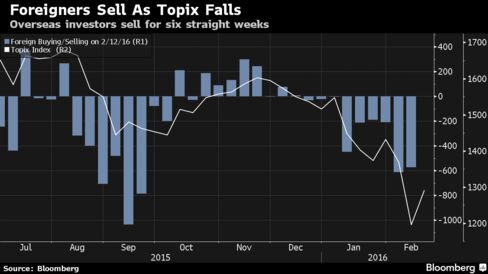

”The skiing season would have been a great time to have been on the slopes in Japan—and out of the market.

A ski-lift ride up to the level of the Nikkei 225 average intraday high of 19,967 yen on December 3 would have been followed by a thrilling (or agonizing) almost uninterrupted slide to its 52 week low of 14,952 yen set on February 12.

This it to those who were not able to attend the lecture that was recently held last Thursday 18th February 2016 by Martin Hemmert and Hitoshi Yamanishi

”Japan and South Korea are home to numerous multinational firms, particularly in highly globalized manufacturing industries such as automobiles and electronics. Both countries also have distinct business cultures and management systems which arguably lend strong competitiveness to their leading multinationals. However, the business activities of Japanese and Korean firms are increasingly being transferred to overseas locations, resulting in the need to attract, nurture and retain talent from all over the world. How can firms with strong national roots manage their global human resources competently without giving up their home-grown competitive strengths? How can they effectively integrate managers who neither know the business cultures nor the languages of their firms’ home countries? …….”

”As foreign investors flee Tokyo stocks, the world’s largest asset manager says the move by the Bank of Japan that spooked the market will be one of the main things that pushes it back up.