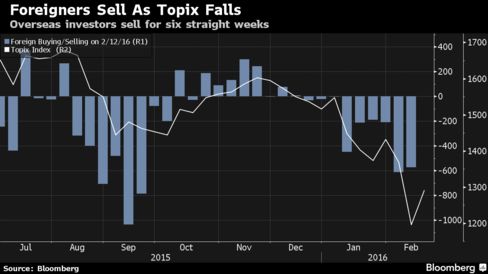

”As foreign investors flee Tokyo stocks, the world’s largest asset manager says the move by the Bank of Japan that spooked the market will be one of the main things that pushes it back up.

BlackRock Inc. is bullish on Japanese shares even after this year’s equity rout sent the Topix index into a bear market. The central bank’s decision at the end of January to adopt negative interest rates punished banking shares, sending the market to a 15 month low on Feb. 12. But that and other stimulus measures will hold down the yen and help boost corporate earnings, said Russ Koesterich, global chief investment strategist at the $4.6 trillion money manager.

“We are overweight Japanese equities,” Koesterich said in an e-mailed response to questions. “The BOJ’s negative interest rate surprise, in addition to the existing quantitative easing program, should keep a lid on the yen in the near term and buoy exporter earnings, which are expected to be ahead of other developed markets……….”