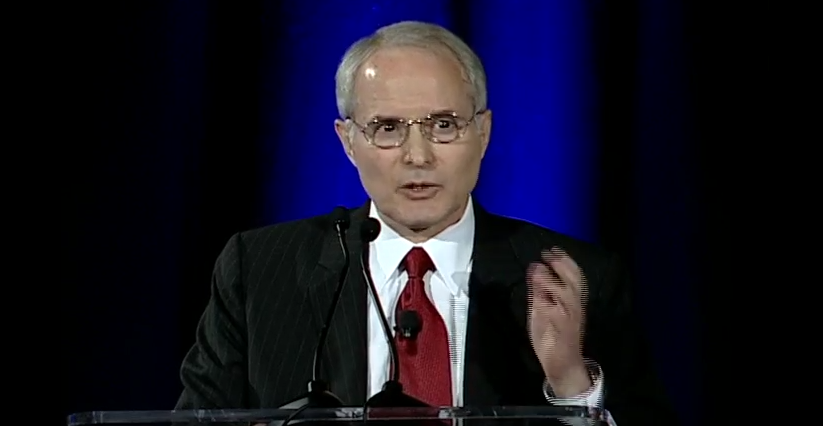

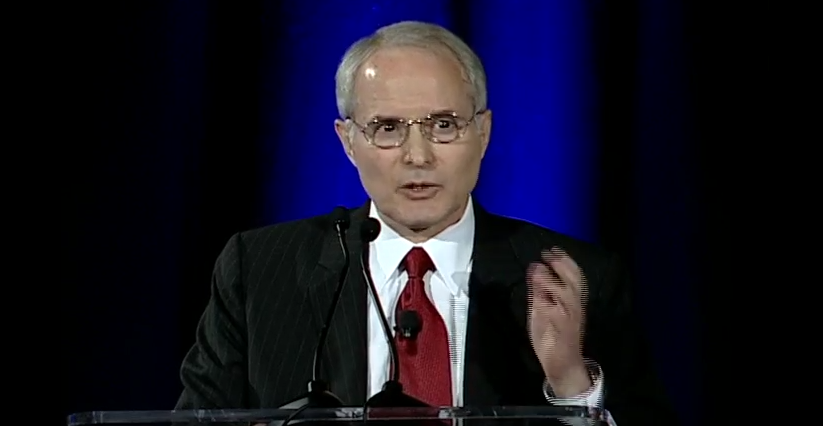

Here is the short speech that I gave to the Fall 2016 Conference of the Council of Institutional Investors (CII), on September 30, 2016. On this video, my speech starts at the 36:00 minute point. Below, I have reproduced the CII’s summary of my comments, and further below, the full text of my speech.

” Nick Benes, representative director for the Board Director Training Institute of Japan, said a sea change is underway in Japan in terms of companies beginning to comply with the Corporate Governance code, but there is still room for improvement. He reported that almost 80 percent of Japanese companies now have two or more independent directors and 40 percent of large companies have their own corporate governance guidelines, but beyond that, the reforms that companies say they have in place are lacking in substance. He estimated that 90 percent of firms say they comply, but have little evidence this is the case and few have actually changed their practices. Despite these setbacks, Benes said he remains optimistic that Japanese companies will move in the right direction because there is now broad awareness that “governance is good”. Additionally, disclosure has vastly improved and the number of votes opposing the re-election of directors is climbing. A video of this session is available here.

Text of Speech (and Slides)

“In 2013, I was lucky enough to propose to key congressmen in Japan, that Japan should have a Corporate Governance Code. I then advised them, and then the Financial Services Agency, about the content of the Code.

So I am very pleased to have this opportunity to summarize the progress that Japanese companies have made so far in implementing the principles of the Code, based on my activities as consultant, independent director, “directorship” trainer, and policy advocate.

My main message to Committee members is this:

1) A sea change is underway in companies, the media, the government, and the public. Because Japan is a “shame-based” society, the vastly enhanced disclosure required by the Code has created a strong virtuous circle.

2) These changes represent a very big opportunity for foreign investors, but only IF they study the Code and the disclosures in detail, and then leverage the Code’s principles so as to make specific requests for better governance practices to Japanese companies they invest in, while also brandishing the possibility of consequences – such as not re-electing senior executives, – if progress is not made.

Here are some highlights “from the trenches” about what is occurring in Japan: