I recently gave a presentation in which I tried to answer this question. Here are the top-line conclusions:

- Investors are finding their voting voices

- Now they need to find to find their asking voices

- There is a way to tear down the “allegiant shareholder ” wall

- Factors that correlate with superior performance include: >= independent directors, low “allegiant” holdings, >15% female directors, and age of firm <45 years

- Activism is becoming more effective

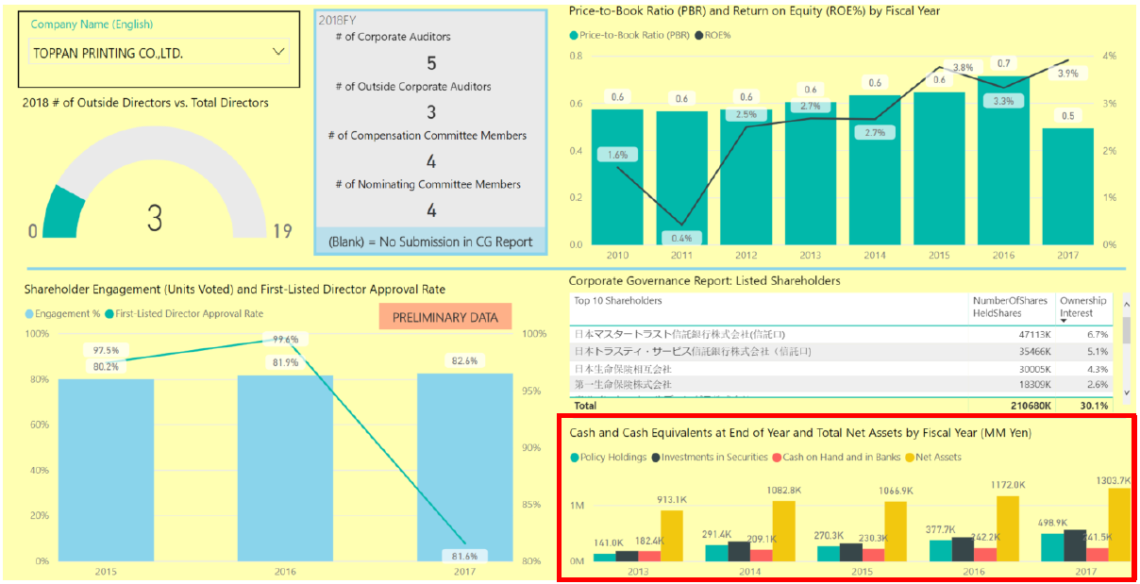

These conclusions are based on a huge amount of time-series data we have collected. We are now building a comprehensive time-series database that includes not only financial data, but all text and numerical data from financial reports and CG Reports, as well as tabulated AGM voting results for each resolution. The data will be organized so that one can zero in on exactly the data one needs. Here is a simple example showing board practices parameters, historical AGM participation and CEO approval rates, and the trend of ownership of “allegiant shareholdings”: