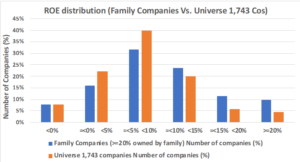

So far, we have been conducting analysis focusing on the relationship between improvement of corporate governance and stock price and key performance measures (ROE, ROA). This is the reason that we are keeping close eyes on the enhancement of corporate governance in the perspective of long-term investors. In addition, we decided to analyze the key performance measures based on the past 3 years average ROE and ROA from this month, as maximizing the shareholder value for the long-term or sustainability is a common goal of public companies and shareholders.

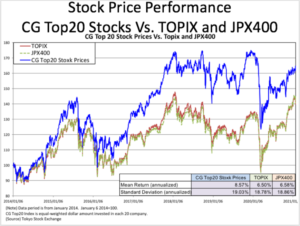

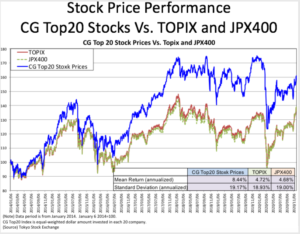

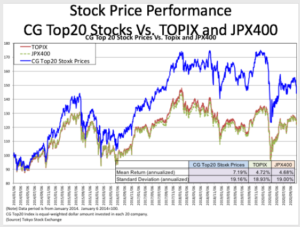

It goes without saying that the stock price is one of the important indicators of a public company. In the previous monthly letter as well, I mentioned that the disclosure information of IRs and shareholder meetings is highly correlated with stock prices (Tobin’s Q), key performance measures (ROE, ROA), and comprehensive corporate governance scores. Information disclosure is a very important starting point for management transparency. In fact, the stock price also shows the results of efforts to disclose the above information. Metrical reshuffles the composites of the top 20 companies based on the total corporate governance score as of July every year and provides the performance comparison between CG Top20 stock prices and the stock market indices (TOPIX, JPX400) monthly. It was this month in July that we reviewed the 20 composite companies (the corporate governance score itself changes each month). Lately, the members of the composite companies of CG Top 20 changed from the limited large companies for several years ago, as we expanded the universe from slightly more than 500 companies to 1,800 companies and other companies are willing to improve the corporate governance. This year, 6 companies have been replaced since last year. The 4 completely new companies are Shionogi Pharmaceuticals, Meitec, Kenedix, Net One Systems and NSD. Kakaku.com and Omron returned to the top 20 club again, raising the scores.