In the previous article, based on the study classified the 3 groups of the universe companies by the ownership of major shareholders: (a) Companies with major shareholders that hold >=50% of shares, (b) Companies with major shareholders that hold >=20% and <50% of shares and (c) Companies without major shareholders that hold >=20% of shares. A subsidiary and an affiliate company owned by a parent company or founder’s family company show superior performance in the key performance measures such as ROA and ROE and Tobin’s Q. In this point, it would be an effective way for a listed parent company to raise the return measures such as ROA and ROE of the parent company by consolidating the subsidiary or the affiliate company with relatively higher return. Such a case is increasingly occurred. We introduced investment strategies to buy listed subsidiaries (and affiliated companies) in anticipation of the acquisition of listed subsidiaries with high profit margins of the parent company.

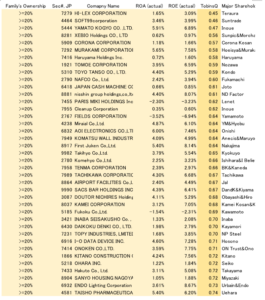

At this time, on the contrary, we focused on family companies whose stock prices have remained lower. There are several purposes for going public, but if one of the purposes is the diversification of funding measures, the purpose wouldn’t’ be achieved in this situation where the stock price is low. There would be an option to reconsider listing on the stock market. From the management side, going private would be an alternative through MBO etc. The table below shows the family companies in our universe with Tobin’s Q less than 0.8, divided into 2 groups of family’s ownerships more than 50% or more than 20% and less than 50%. For a company that suffered low ROA and ROE, the low performance would be a reason for the low share price. However, some companies that have high ROA and ROE are traded at low. For a company in which there is no problem with return performance, but the share price remains low, it may be an option to consider “going private.” Aside from whether or not an investor actually acts such an effort in the engagement, this is an investment strategy to focus on such a viewpoint.

Please see detail in the following link.

http://www.metrical.co.jp/

Please feel free to contact the below email address if any interest or query.

Aki Matsumoto, CFA

Executive Director

Metrical Inc.

akimatsumoto@metrical.co.jp

http://www.metrical.co.jp/jp-home/