We have been observing that life cycles of the companies are shortening every 5 years. The visionary companies are time tested and standing tall and withstanding the headwinds and adversaries in the journey of the Company Life Cycle of even 100 years! Who are such visionary companies? What they do and How they do? What is that core substance which get them glued from “Top to Bottom” with the same mission? How a company can be distinguished as a “VISIONARY COMPANY” from other peer following company?

Month: September 2019

September 12th “Director Boot Camp” – Another Successful Program! Next Course: November 13th, 2019!

On September 13th, BDTI held its English Director Boot Camp , attended by a number of highly experienced participants. Participants from various companies heard lectures about corporate governance by Nicholas Benes and Andrew Silberman of AMT, and exchanged experiences and opinions at a spacious, comfortable room kindly donated for our use by Cosmo Public Relations, a leading communications and PR firm in Tokyo.

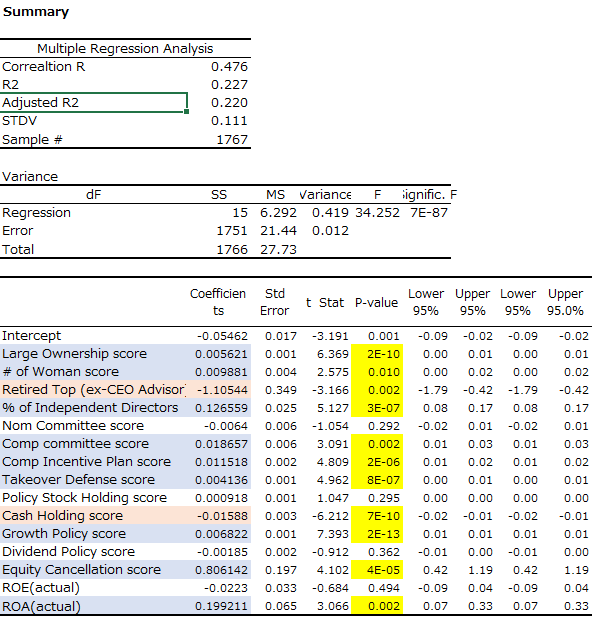

Correlations Between Governance Factors and Foreign Ownership

While overseas investors’ ownership decreased a year ago, activist investors are now likely to focus on Japanese companies. Corporate governance in Japan has improved since the Corporate Governance Code was introduced in June of 2015, but progress is much slower than foreign investors hoped. At this time, we analyze the relationship between % ownership held by overseas investors and key governance criteria. The following table shows the result of our regression analysis of the 13 governance factors that METRICAL uses as criteria and two performance measures, ROE and ROA. Of the 15 factors, 14 factors are significantly correlated with level of ownership by overseas investors.

TIIP:”Sustainable Investing in Japan: An Agenda for Action”

Executive Summary

More than a quarter of assets under management (AUM) worldwide are invested in “sustainable” strategies, strategies that consider environmental, social, and governance (ESG) factors in pursuit of financial sustainability and/or environmental or social sustainability. Investors – both individual and institutional and at all wealth levels – are increasingly interested in integrating these strategies into their financial plans and investment portfolios, and asset managers and global financial institutions are embracing the approach and expanding related services and product offerings.

Interest in sustainable investing and sustainably invested AUM are growing rapidly in Japan. But despite this enthusiasm and growth, few mainstream investors, financial advisors, and investment consultants in Japan are embracing the practice.