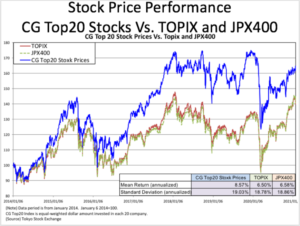

Over the past six years Japan has put in place a long list of corporate governance reforms, amounting to a virtual revolution in thinking at corporations, domestic institutional investment firms, and even society. However, because Japan is still only halfway through the “tunnel” of reform and thinking, much of the resulting value creation for investors and other stakeholders is yet to come. Key takeaways from this whitepaper’s data-driven review of Japan’s governance “revolution” include:

Tangible corporate governance reform has come to Japan, in the form of a robust Corporate Governance Code and Stewardship Code.

In tandem with government policy, advocacy by investor groups and pro-governance corporate leaders will continue these positive reforms in the years to come.

Japanese firms have “got the message” that a sea change has occurred: a majority of firms are hiring outside directors, establishing nominations and compensation committees, and reducing takeover defenses such as poison pills.

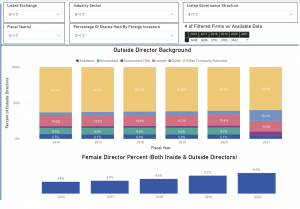

Japanese boards are starting to embrace global trends for incentive-based compensation, higher levels of diversity, and focus on returns and capital efficiency.

Cross-shareholdings and other “allegiant holdings” are being unwound as foreign and domestic institutions alike have become more proactive in their proxy voting strategies, making the market more attractive in general.

Merger and Acquisitions (M&As) and activism are on the rise, raising capital efficiency or managerial awareness of the need for it.

As a result of many of the above changes, Return on Assets (ROA) values in Japan are trending higher across the board.