A UK perspective on corporate governance issues.

John McFarlane talks to Governance and Compliance about the misplaced value in bonus culture and why the board must be sceptical

A UK perspective on corporate governance issues.

John McFarlane talks to Governance and Compliance about the misplaced value in bonus culture and why the board must be sceptical

Photograph of the Prime Minister delivering an address

”Prime Minister Shinzo Abe attended the Executive Women Symposium Reception held in Tokyo.

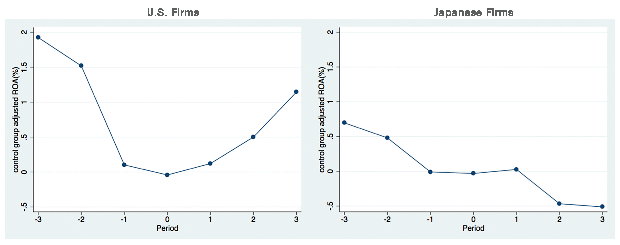

Figure 2: Return on Assets Before and After Corporate Leadership Change

Hyeog Ug Kwon, Faculty Fellow, RIETI: ”Japanese firms invest in research and development (R&D) on a level comparable to that of their U.S. counterparts. They possess a high-quality workforce and receive decent management practice scores for organizational and human resource (HR) management. Yet, they fall significantly behind U.S. firms when it comes to earning power.

This it to those who were not able to attend the lecture that was recently held last Thursday 18th February 2016 by Martin Hemmert and Hitoshi Yamanishi

”Japan and South Korea are home to numerous multinational firms, particularly in highly globalized manufacturing industries such as automobiles and electronics. Both countries also have distinct business cultures and management systems which arguably lend strong competitiveness to their leading multinationals. However, the business activities of Japanese and Korean firms are increasingly being transferred to overseas locations, resulting in the need to attract, nurture and retain talent from all over the world. How can firms with strong national roots manage their global human resources competently without giving up their home-grown competitive strengths? How can they effectively integrate managers who neither know the business cultures nor the languages of their firms’ home countries? …….”

Ian Wright, founder of NonExecutiveDirectors.com, urges women to have the confidence to go for board-level positions, because diversity improves how effective a business is.

Interestingly, the letter refers to Mr. Loeb's proposal as one that may merit consideration, and cites a number of provisions of the Corporate Governance Code at the end.

June 1st, 2015

I recently spoke to directors and officers about oversight of risk management by boards of directors. I prepared a list of 25 reasons that risk management failure happens, based on my experience assisting boards, including boards that have failed and boards that cannot afford to fail. Almost all of what follows below is based on real examples. I have never encountered a risk management failure where the board was not at fault, based on what the board said or did, or failed to say or do.

Here are 25 reasons for risk management failure:

BDTI’s Representative Director Nicholas Benes is quoted in his article about Sharp in the Financial Times this morning. Excerpts:

Sharp, a century old stalwart of corporate Japan, has unveiled an annual loss of $1.9bn and warned of “material uncertainty” about its ability to stay in business, less than three years after facing a similar crisis of survival.

Japan did not reap the benefits of the information, computer and technology revolution as did the US at the dawn of the new millennium. Why that is so is the focus of ongoing research by Professor Kyoji Fukao, Director of the Institute of Economic Research at Hitotsubashi University. According to Prof. Fukao, productivity growth in […]