”Listed Japanese companies are on track for a third-straight year of record dividend payouts, with the figure set to hit 10.8 trillion yen ($93.38 billion), topping the 10 trillion yen mark for the first time.

Council : ”Prioritize reinforcing governance of public pension fund management”

”To manage a massive amount of funds safely and efficiently, it is vital to build an effective organization and system suited to carrying out the task.

A council of the Health, Labor and Welfare Ministry has proposed that the current ban on direct stock investment by the Government Pension Investment Fund (GPIF) remain in place, at least for the time being.

Forbes: ”Will BoJ Write-Off Japan’s Debt? The Nikkei, JGBs, And The Failure Of Abenomics”

Governor of the Bank of Japan (BoJ) Haruhiko Kuroda explains his negative interest rate plan

”The skiing season would have been a great time to have been on the slopes in Japan—and out of the market.

A ski-lift ride up to the level of the Nikkei 225 average intraday high of 19,967 yen on December 3 would have been followed by a thrilling (or agonizing) almost uninterrupted slide to its 52 week low of 14,952 yen set on February 12.

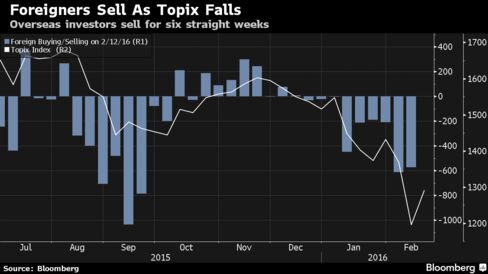

Bloomberg: ”BlackRock Is Betting on Japan Stocks as Other Foreigners Flee”

”As foreign investors flee Tokyo stocks, the world’s largest asset manager says the move by the Bank of Japan that spooked the market will be one of the main things that pushes it back up.

Reuters: Japan fund makes late move to thwart Hon Hai in Sharp battle: sources

Q&A – One Investor’s Picks for Japan During Market Turmoil

A Fanuc robot is seen in this 2013 file photo.Rodrigo Reyes Marin/AFLO/Zuma Press

“For a long-term investor, market turmoil can offer a chance to snap up the shares of solid businesses at a discount. Matthew Brett, a co-portfolio manager of Edinburgh-based Baillie Gifford & Co.’s £7 billion ($10 billion) Japanese equity fund, says his team has been buying shares of robot maker Fanuc Corp. and optical-product maker Topcon Corp. over the last couple of weeks.

NORTON ROSE FULBRIGHT – “Top Ten Things To Remember When Considering Virtual Shareholder Meetings”

Overview — In recent years, a small but growing number of companies have held annual shareholder meetings exclusively online or provided for online participation. Some of the early-adopting companies that decided to switch to an annual shareholder meeting held exclusively in cyberspace (without a physical meeting of shareholders happening simultaneously) received objections from investors and negative publicity, and this topic continues to be debated in corporate governance circles.

BARRON’s: ” Japan’s Corporate Governance Woes”

…BUT THIS VOTING SEASON has turned into a big disappointment. Despite ISS’ shareholder-rights campaign, the presidents of Japan’s top 200 companies received median voting support of 96.6%—a 0.5 percentage point rise from 2014. Even the president of Toshiba (6502.Japan), which lost a third of its market value from an accounting scandal and write-downs, got a 94% approval rating. Some 76% and 91% of investors voted against dividend hikes and share buybacks, respectively.

New Stewardship Code Signatories (Highlighted on this list)

There are now 191 signatories to the Stewardship Code. The most recent signatories are highlighted on this list:

http://www.fsa.go.jp/en/refer/councils/stewardship/20150611/02.pdf

“Stewardship Code: 9/2/2014 Message from the FSA – To institutional investors that have yet to accept the Code”, and others

September 2, 2014

[To institutional investors that have yet to accept the Code]

160 institutional investors have already announced their acceptance of Japan’sStewardship Code (hereinafter referred to as the “Code”) by the end of August2014.

The Financial Services Agency (FSA) would welcome the decision to accept the

Code by those who have yet to do so. The Code allows its signatories to take intoaccount their specific conditions and situations, as far as it is in line with the “aimand spirit” of the Code.

The acceptance of the Code by asset owners is particularly important becausethey are expected to work as a “driver” for the implementation of the Code.