This excellent working paper by Naoshi Ikeda, Kotaro Inoue and Sho Watanabe describes their research that leads to the conclusion (similar to BDTI’s own research) that cross-shareholdings in Japan negatively impact risk-taking, investment for growth, and the frequency of restructuring activities. Conversely, when managers are monitored more heavily by investors and independent directors, they are positively affected.

Category: Governance

August 30th “Director Boot Camp” …Next Course: October 26th!

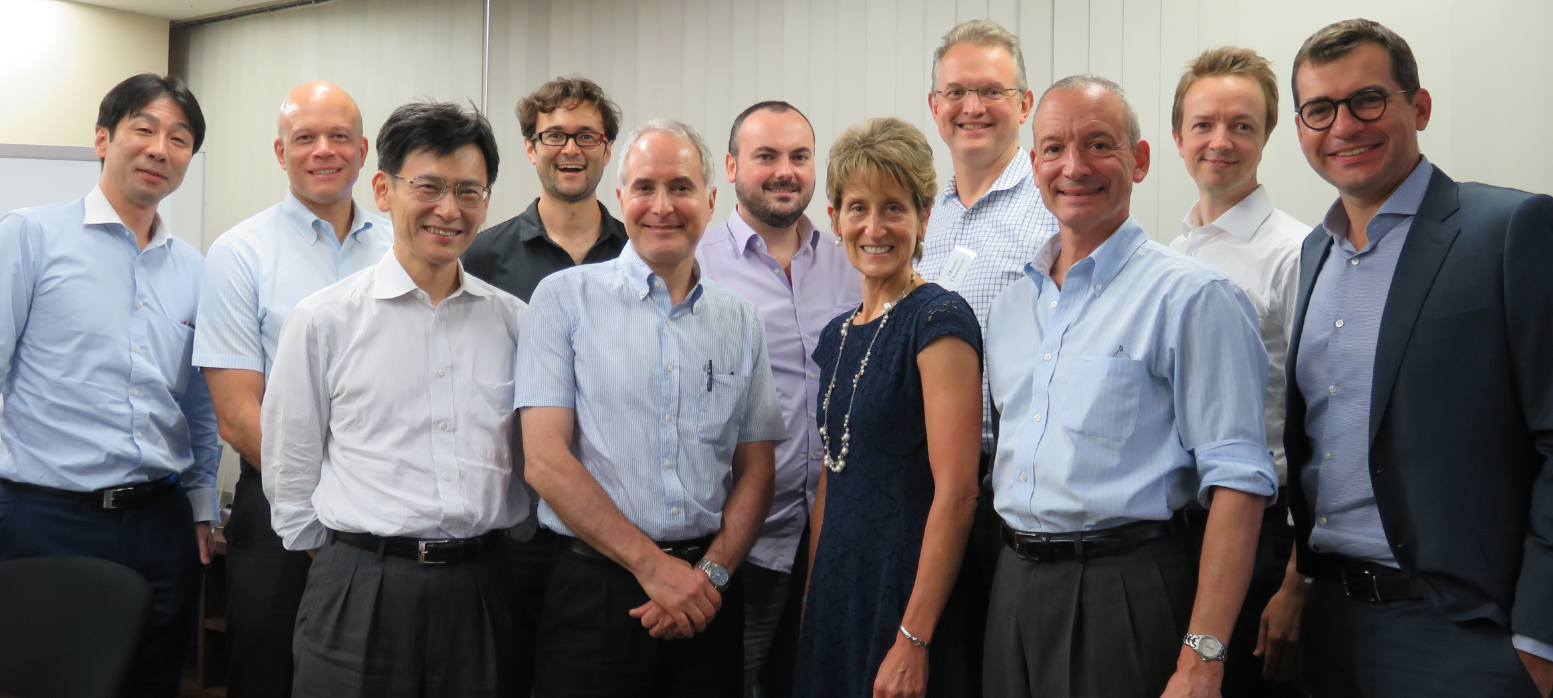

BDTI’s August 30th English Director Boot Camp was a great success, with active participation by a diverse group of Japanese, American、and European persons! Participants from various companies heard lectures about corporate governance and related topics by Nicholas Benes and Andrew Silberman of AMT, and exchanged experiences and opinions at a spacious, comfortable room kindly donated for our use by Cosmo Public Relations, a leading communications and PR firm in Tokyo.

Thank you all for coming!

The next course will be held on Thursday, October 26th. Sign up now to secure your spot!

Company Law Reform in Japan: Losing its Mojo?

by Nicholas Benes

This year, Japan’s governance reform drive will either keep going, or run out of steam. Judging from the amendment of the Company Law that is now underway by an advisory council of the Ministry of Justice (MOJ), the latter is likely.

Strikingly absent is a clear over-arching vision of the most important themes that amendment of the Company Law should address now that the country has a corporate governance code. In other words, what is missing, that can only be addressed via the Company Law?

If the government were truly intent on bringing about behavioral change on the part of all Japanese boards and executives, it would focus on harmonizing key aspects of the confusing array of three different corporate governance models which listed companies can adopt, and moving towards a more consistent version of the “monitoring model” for governance that has become internationally accepted and is now embodied in its own corporate governance code.

To do this, it would change the law to enable boards to flexibly appoint capable (and legally accountable) senior executives from a much wider range of candidates than is currently possible. It would also establish rules that require boards to fulfill the independent supervisory and oversight roles envisioned for them under the corporate governance code, unaffected by managerial self-interest, if they wish to delegate wider authority to executives and pay them incentive compensation determined solely by the board.

Event on ‘The Third Arrow’: Reforming Corporate Governance in Japan (Chicago Booth Insights)

Chicago Booth Insights, a series of global events where leaders address the complex issues facing businesses today, will be organizing one of such events here in Tokyo. It will be hosting the event on Tuesday, July 4th 2017 to discuss the effectiveness of recent efforts to improve corporate governance in Japan.

If you are interested in being a part of this event, please see details and guidelines on how to register here.

Progress: GPIF Refers to “Corporate Governance Codes” for the First Time

The GPIF should be highly commended for including reference to “the corporate governance codes of each country” to its recent statements regarding its stewardship policy and its proxy voting policy. This is a major step forward, considering the politics that it faces and the long-standing and unfounded claim by leaders in the industrial community who claim that if the GPIF had its own “principles and guidance for governance and proxy voting”, that would be “intervening in managerial decision making. Even though the reference in the recently-released principles bends over backwards to encourage “giving a full hearing to explanations of non-compliance”, if you know the full background, this is significant progress. (For the first time, the GPIF has uttered the words “corporate governance code” in writing!)

What Correlates with Superior Corporate Performance? (Summary of Research)

BDTI and METRICAL conducted joint research regarding the governance structure/practices and related corporate actions that correlate with superior firm performance in Japan, and reported on the preliminary results at seminars hosted by BDTI on March 16th and by Goldman Sachs on April 4th. Our research is still underway, but the preliminary results are intriguing and provide useful guidance for the next stage of analysis.

BDTI and METRICAL believe that corporate governance is not functioning effectively unless it leads to superior strategy, fine-tuning of capital allocation and capital structure, and other value-creating corporate actions. Therefore, in our research we have sought to identify the apparent linkages and correlations between board practice, key corporate actions, and value creation.

In Phase 1 of our analysis, we studied the TOPIX100 Index composite (large 100 companies) to see whether scores we assessed for each company’s nomination policy, training policy, compensation policy, board evaluation policy, and the % of independent directors significantly correlate with ROA and ROE.

2017 OECD Corporate Governance Factbook

(Orrick) – “Corporate Governance Features for Silicon Valley and San Francisco Bay Area Public Companies”

(17-page report Ed Batts, Global Chair of Orrick’s M&A and Private Equity group.) – ”Corporate governance features have Executive Summary become increasingly prominent for public companies. This has accelerated as economic-oriented activist investors team with institutional investors to serve as catalysts for change. We are often asked by clients in the course of our practice:

What do other companies do?

We thought it would be useful to compare the three primary governance documents – certificate/ articles of incorporation, bylaws and corporate governance guidelines – of Silicon Valley and San Francisco Bay Area publicly traded companies.

We focused on three general areas:

• Board of Directors

• Shareholder Actions

• General Provisions

Varieties of “Independent” Director in Asia

As this working paper reveals, however, the meteoric rise of the ‘independent director’ in Asia is considerably more complex than it initially appears. Although the label ‘independent director’ has been transplanted precipitously from the US (in some cases via the UK) throughout Asia, who is labelled an ‘independent director’ (i.e., the ‘form’ that independent directors […]

CMi2i Global Governance Report: “ Asset Managers Expect to Meet with Directors”

CMi2i, one of Europe’s leading investor relations and corporate governance consultancies, canvassed the opinions of institutions managing over US$5 trillion of assets. This survey found that the majority of asset managers now expect to meet with executive management more frequently on issues such as remuneration, board structures, succession planning and cyber security.