In October, the stock market was in step with the U.S. stock market, which rose and fell in response to changes in U.S. long-term interest rates, and after a decline at the beginning of the month and a rebound in the middle of the month, the stock market was in a selling trend toward the end of the month.

The CG Top 20 index outperformed the TOPIX and JPX400 indexes for the second consecutive month in October.

At the beginning of October, the weak U.S. stock market trend continued due to persistent caution about the persistence of high U.S. interest rates. Later, the release of U.S. price indexes reduced concerns about a prolonged tightening of monetary policy, and when U.S. long-term interest rates lowered, the mood of risk taking strengthened. When U.S. long-term interest rates subsequently began to rise again, the stock market weakened toward the end of the month, as U.S. stocks weakened.

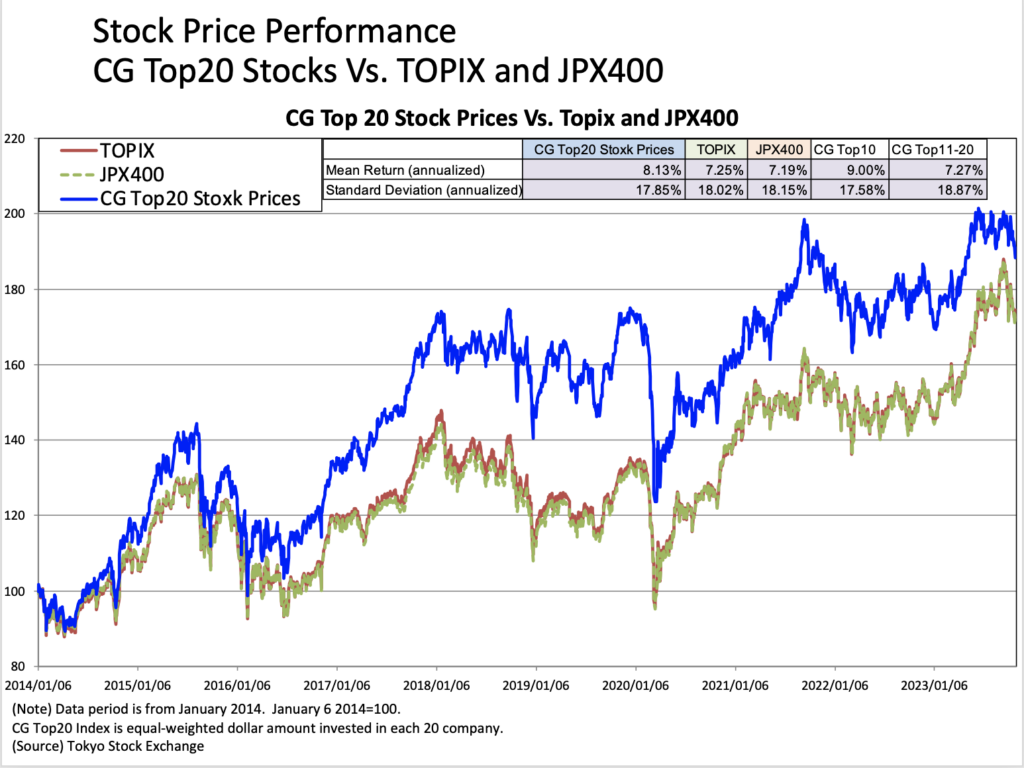

The TOPIX and JPX400 indexes fell in October -2.88% and -3.37%, respectively. The CG Top20 stocks outperformed both indices, dipping -2.83%.

Over the long term since 2014, the CG Top20 stock price has continued to outperform both indexes by about 1% per year and lower volatility than the market indexes. The CG Top 20 has been reassessed as of July 1.

Wacom (6727), K’s Holdings (8282), Eisai (4523), NSD (9757), and Trend Micro (4704) were new additions, while Ebara Corporation (6361), Orix (8591), United Arrows (7606), Tokyo Gas (9531) and Hoosiers Holdings (3284) were removed. Details of the component stocks are shown in the table below.

Please see detail in the following link.

http://www.metrical.co.jp/

Please feel free to contact the below email address if any interest or query.

Aki Matsumoto, CFA

Executive Director

Metrical Inc.

akimatsumoto@metrical.co.jp

http://www.metrical.co.jp/jp-home/