The ratio of independent directors is on the rise, with the number of companies with a majority of independent directors (more than 50%) increasing to 280 out of the 1,781 companies in the Metrical Universe at the end of September 2023. I would like to examine the characteristics of companies with a majority of independent directors.

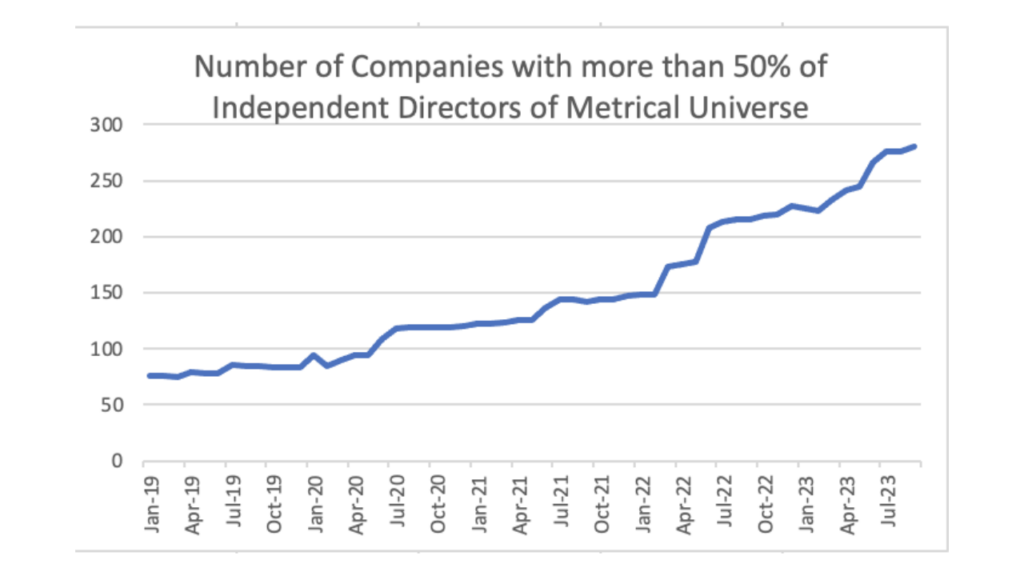

The chart below shows the number of companies in the Metrical universe with a majority of independent directors (more than 50% independent directors). Since there are less than 1,800 companies in the Metrical universe, the percentage of companies in the universe with a majority of independent directors (more than 50%) has just risen to 15.7% as of the end of September 2023, so it will take some time before a majority of companies have a majority of independent directors on their boards. It is likely to take some time before the majority of companies have a majority of independent directors on their boards. However, the number of such companies is gradually increasing.

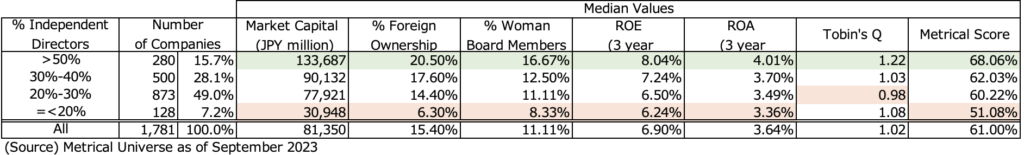

The table below shows the characteristics of the Metrical Universe (as of September 30, 2023) by independent director ratio. The group of companies with more than 50% of independent directors is extremely unique in terms of market capitalization, ratio of foreign shareholders, ratio of female directors, ROE, ROA, Tobin’s Q, and Metrical Score (comprehensive evaluation of corporate governance). At the opposite end of the spectrum is the group of companies with less than 20% of independent directors. The group of companies with more than 50% of independent directors has superior market capitalization, foreign shareholder ratio, ratio of female board members, ROE, ROA, Tobin’s Q, and Metrical Score. We find that this group has higher ROE, ROA, and Tobin’s Q. We can hypothesize that it is the ratio of foreign shareholders that is the driver of raising the ratio of independent directors in these companies. This is because these companies, and the large market capitalization in which overseas investors invest, proves this. In addition, these companies show higher profitability and higher stock valuations than the other groups, as indicated by ROE, ROA and Tobin’s Q. The high ratio of female board members and the high Metrical Score indicate that the company has gradually made efforts to improve its corporate governance practices in response to requests from overseas investors for improvement, backed by its high foreign shareholding ratio.

Divided into four groups based on the ratio of independent directors, the groups with higher ratios of independent directors generally show superior numbers in the categories of market capitalization, foreign shareholder ratio, and ratio of female directors. Even if overseas investors’ demands for improvement are behind this, it is good to see companies demonstrate a commitment to improvement in profitability and corporate governance practices, such as having a majority of independent directors. In Tobin’s Q, only the group with more than 50% independent directors is clearly higher than the other groups. Although it can be inferred that the high ratio of foreign ownership in this group leads to a high share price valuation, it may indicate a way forward for companies suffering from a low share price valuation of less than 1x P/B.

There are still only 15.7% of companies in the Metrical universe with an independent director ratio of over 50%. It is not expected that a higher ratio of independent directors will have at least a negative impact on profitability, stock valuation, or corporate governance practices. Therefore, it is expected that an even larger number of companies with an independent director ratio of over 50% would have a positive impact on profitability, stock price valuation, and corporate governance practices.

To summarize the above, I have considered the ratios of independent directors of the 1,781 companies in the Metrical Universe at the end of September 2023 as an axis.

The number of companies with a majority of independent directors (more than 50% independent directors) is gradually increasing. As of the end of September 2023, the ratio has just finally risen to 15.7% in the Metrical universe, so it will still take a considerable amount of time before the majority of companies still have a majority of independent directors on their boards.

When examining the characteristics of market capitalization, ratio of foreign shareholders, ratio of female board members, ROE, ROA, Tobin’s Q, and Metrical Score (overall evaluation of corporate governance) by the ratio of independent directors, the group of companies with more than 50% independent director ratio showed extremely high values in all the categories. The driver for these companies to increase their independent director ratios can be seen in the ratio of foreign ownership. These companies have been gradually making improvements in response to requests from overseas investors to improve their corporate governance practices. In Tobin’s Q, only the group with an independent director ratio of more than 50% is clearly higher than the other groups, which may indicate a way to go for those companies suffering from low share price valuations of less than 1x P/B.

Given the still high presence of overseas investors, it is expected that profitability, stock valuation and corporate governance practices, including the ratio of independent directors, will continue to improve in the future.

Aki Matsumoto, CFA

Please see detail research the following links.

http://www.metrical.co.jp/

Please feel free to contact the below email address if any interest or query.

Aki Matsumoto, CFA

Executive Director

Metrical Inc.

akimatsumoto@metrical.co.jp

http://www.metrical.co.jp/jp-home/

What are the factors driving the number of companies to increase gradually?