9/13 “Director Boot Camp” Held by Zoom! Next Courses: 12/1 !

September 2, 2022

Nicholas Edward Benes

(Writing as an individual. Please see below.)

Setagaya-ku, Tokyo

benesjp22@gmail.com

(Please feel free to email me to receive a PDF copy of this letter.)

Prime Minister Fumio Kishida

Prime Minister’s Residence

2-chōme-3-1 Nagatachō

Chiyoda-ku, Tokyo 100-0014

cc:

Deputy Chief Cabinet Secretary Seiji Kihara

Mr. Masahiko Shibayama, Deputy Chairperson, Election Strategy Committee of the LDP

Hon. Prime Minister,

I am writing this letter with the respect that is due you as the foremost leader of this country, who has set forth a concept for “a new form of capitalism.” If I may, I would like to share my concrete thoughts on how further improving corporate governance in Japan can be a positive game-changer for Japan’s economy, society, and financial markets.

When I saw your moving speech to the NPT Review Conference, I was impressed how fluently you read English. Therefore, I am taking the liberty to write this letter in English, attaching a Japanese translation. As the person who suggested to the US government that President Obama visit Hiroshima, I was pleased with your passionate comments.

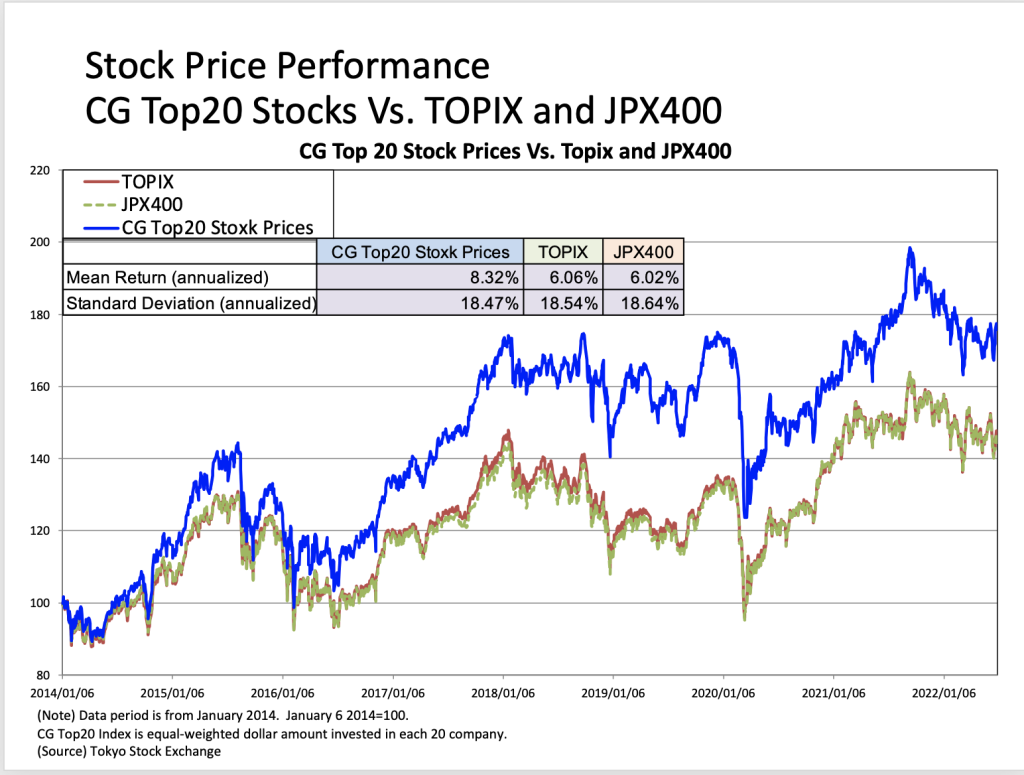

Until mid-August, the stock market rallied in favor of the U.S. stock market, which rose on expectations of an early end to the U.S. monetary tightening due to the U.S. economic recession speculation. In the latter half of the month, market volatility increased due to concerns about the U.S. FED’s long-term monetary tightening. The TOPIX and JPX400 indexes gained 1.53% and 1.33%, respectively, during the month of August, while the CG Top20 index outperformed both indices, rising 1.66%. The table below shows the components of the CG Top 20 as reviewed on July 1.

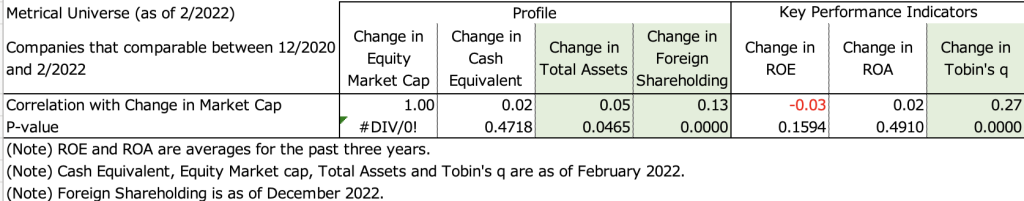

The common goal of both company management and shareholders is the sustainable growth of the company’s corporate value. Finding such a company is also an important objective for investors. To explore this, I would like to use the 1,487 comparable companies in the Metrical Universe for the period from the end of December 2020 to the end of February 2022 to explore changes in market capitalization and effective factors during this period.

The table below shows the correlation analysis between changes in market capitalization and changes in the Profile and Key Performance Indicators for the period from the end of December 2020 to the end of February 2022. For the period in question, the change in market capitalization shows a significant positive correlation with the change in total assets, the change in foreign ownership, and the change in Tobin’s q. This indicates that companies with higher market capitalization tend to have higher total assets, higher foreign ownership ratios, and higher Tobin’s q. Behind the increase in market capitalization, it makes sense that Tobin’s q, which represents valuations, would increase. It is also natural that there is a correlation between changes in the foreign shareholding ratio and changes in market capitalization in the Tokyo stock market, where foreign investor trading has a strong presence. As for the correlation between changes in total assets and changes in market capitalization, one factor may be the increase in assets supporting earnings growth, but this remains to be examined. On the other hand, change in market capitalization did not show a significant positive correlation with change in cash equivalents, change in ROE, or change in ROA. It can be seen that in the period in question, the change in profitability on an actual basis over the past 3 years did not have much impact on the change in market capitalization.