This article (letter to the Tokyo Stock Exchange (cc: portfolio companies) is posted by BDTI on behalf of Yuya Shimizu, Hibiki Path Advisors Pte. Ltd.

****************************************************************************

[English translation of a letter sent by Hibiki Path Advisors to Tokyo Stock Exchange]

To:

Yamaji Hiromi, President & CEO

2-1 Nihombashi Kabutocho, Chuo-ku Tokyo 103-8220 Japan

Tokyo Stock Exchange, Inc.

My name is Yuya Shimizu, Representative Director and CIO of Hibiki Path Advisors, an institutional investor based in Singapore. I have had the opportunity to greet you in the past. As a person who has been investing in Japanese companies and observing the stock market for many years, I am sending you this letter to convey my concern about Japanese companies and the Japanese stock market. I know this may sound like preaching to the choir, but I would appreciate it if you could read this letter.

I have always wondered if the capital markets have radically changed since 2020 when the coronavirus spread. In terms of phenomena, until the latter half of 2021, in an environment of low-interest rates, the stock prices of a few very large and well-known companies rose dramatically worldwide, and trading was concentrated in these stocks, while others, such as those of our portfolio companies, were left behind. The question is: Why? My “personal” conclusion at this point is that the stock market is undergoing structural changes in its “character” due to the recent significant changes in the our living environment. We are still swimming amid the changing tides and feeling various phenomena daily, but it is difficult to see the big picture when you are a part of these changes. Having said that true intention of this letter is an attempt to somehow grasp it and link it to effective action by involving your company.

Concentration in the Stock Market

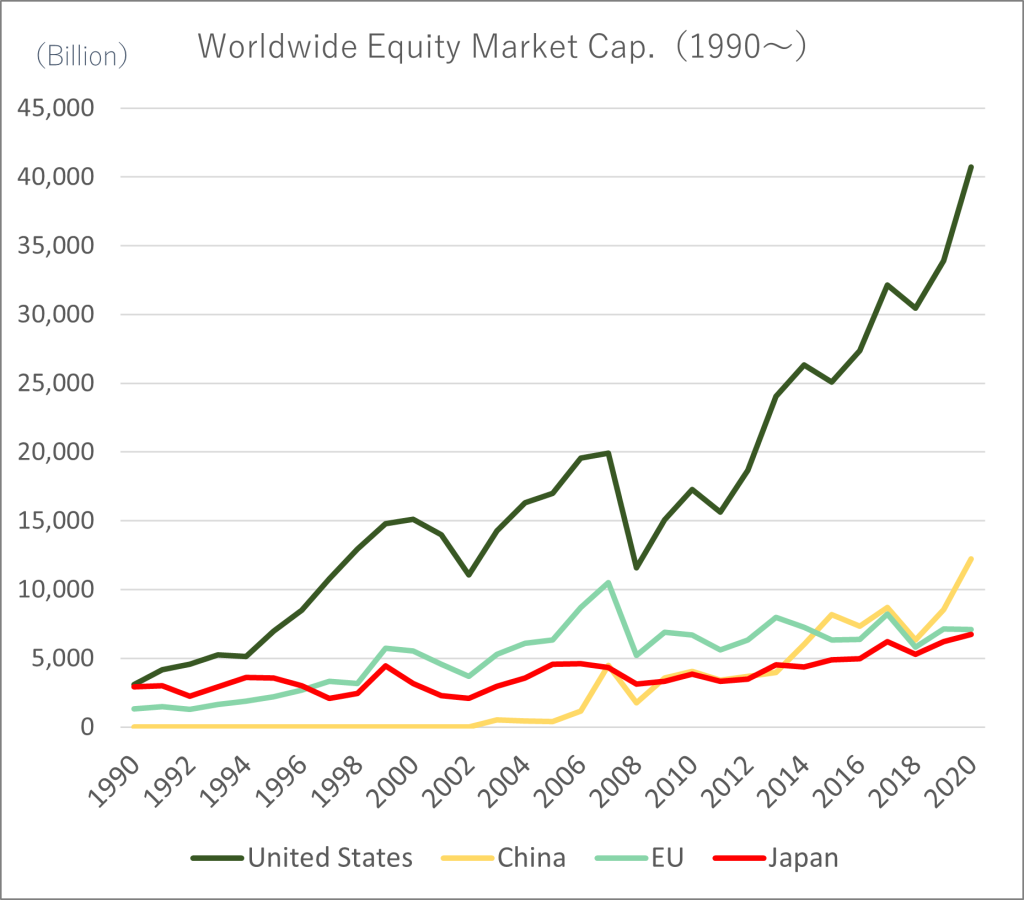

First, let us look at the phenomenon of regional concentration in the stock market (Figure 1). The left side shows the market capitalization of the equity market, and the right side shows the composition of it. As expected the increase in market capitalization in the U.S. has been significant, increasing approximately 13 times between 1990 and 2020. While the capitalization of the rest of the world has also increased, the U.S. remains 40% of the total, indicating that the U.S. still maintains a central position in the world’s capitalist economy. Japan accounted for more than 20% of the world in the 1990s, but its relative position has now declined significantly to the 7% level.

(Figure 1:market capitalization and composition of the global equity market)

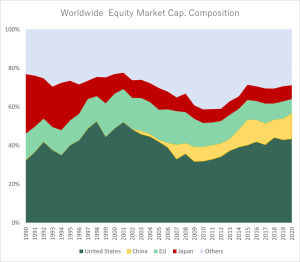

(Figure 2: Stock Liquidity in the Japanese Market)

2) The top 10 companies are Toyota, Sony, Daikin, Fanuc, Tokyo Electron, Fast Retailing, Softbank, Mitsubishi UFJ, Keyence, and KDDI (in no particular order).

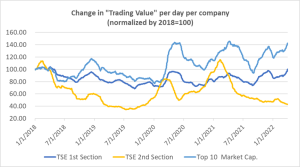

We are value investors who take a bottom-up approach to discovering and investing in quality companies that have missed the spotlight of the market and are overlooked by most of the market and are committed to holding these companies for the long term. We believe that a diverse group of active investors with strategies like ours ensures the dynamism of the stock market and its price discovery function. However, as you know, the shift to passive markets is growing in momentum and shows no signs of slowing down (Figure 3).

(Figure 3) Passive fund composition in Japan, the U.S., and Europe (including ETFs)

(Source: Morningstar)

Most recently, I have heard a number of well-known active investors have stopped/are stopping their Japanese equity-focused strategies, and also seen some of my allies closing their Japanese equity funds in distress due to redemption from long-term overseas clients and other factors. Some asset owners have even assured me that since the weighting of Japan in the MSCI index has dropped significantly, they no longer consider Japan as a particular category of Japan and APAC ex-Japan, but as a part of Greater Asia. As an investor who has dedicated my life to developing Japanese companies and markets, this is the saddest thing I have ever heard.

We have been watching the reorganization of the TSE market with great anticipation since it began with a bang. However, I am afraid to say that most of the results are a lateral move from the old market classification, and the status quo is maintained. As for the transitional measures, the deadline was not strictly defined, and the result was just like Parturiunt montes, nascetur ridiculus mus.

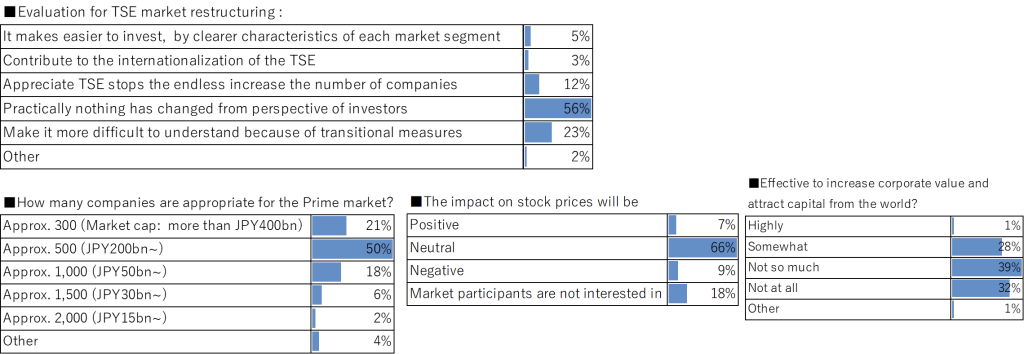

The result of the survey was that there should be about 300-500 companies in Japan that “have a market capitalization (liquidity) large enough to be the target of investment by many institutional investors, have higher standards of governance, and are committed to sustainable growth and medium- to long-term improvement of corporate value with a focus on constructive dialogues with (global) investors”. We understand that this was not satisfactory for many investors who thought that “300-500 companies in Japan” was a reasonable number. According to a QUICK survey, more than 70% of the investors thought that 300-500 companies were appropriate and that the current restructuring was “ineffective” in increasing corporate value and attracting investment money from all over the world. This is another indication of the reality that investors are exposed to too much information, which narrows their vision, and they can only see what is well-known.

(Source: QUICK)

Recently, we have received the following comments from many of our portfolio companies.

- When we announced a modest forecast in our earnings report, the stock price dropped significantly because investors simply believed the guidance

- The ROE is over 8%, but the P/B ratio does not reach 1x, even if we try our best in IR

- It seems that the market only looks at profit increases or decrease

- No matter how many IR activities we do, such as 1 on 1, it seems ineffective

In fact, we have seen similar phenomena occurring simultaneously throughout the market. Except for a very few companies that are covered by a large number of sell-side analysts, the situation is such that the tremendous efforts of management are being ignored. I think the price discovery function that should exist in the market has become nearly dysfunctional. This is what I mentioned at the beginning of this letter, the “character” of the stock market is undergoing a structural change. It makes no sense to do the same thing as before when the market has essentially changed.

A Multi-Polarized Market

As you know, the stock market is an innovative value creation system created by humankind. As I have mentioned in a previous letter to CEOs, the “government bond and currency” market developed initially to finance trade and wars between nations. As the social system stabilized, the first national corporations, such as the East India Company, responsible for colonial development, and later private corporations could also raise funds. Now that we have experienced a once-in-a-century pandemic, our economy and society have significantly transformed. Various, or somewhat “strange,” phenomena have become commonplace. For example, (1) YouTubers and TikTokers have already established an ecosystem in the world where they earn money on an individual basis and invest that money to attract more people, (2) Bitcoin and other cryptocurrencies (cryptocurrency) have been wildly popular and have emerged, and (3) Recently, a large amount of money flowing into digital tokens known as Non-Fungible Tokens (NFTs), which have enthused a lot of people. Below are some curious recent examples.

(Source:Bored Ape Yacht Club Website)

The digital ownership episode of the Bored Ape Yacht Club (hereafter “Bored Ape”) was launched in April 2021 by Yuga Labs LLC. The episodes of digital ownership of various patterns of Bored Ape pictures make us realize that human society, including capitalism, is undergoing a significant structural change. This started as a holiday project launched by four friends in a “playful” way, involving artists and programmers they were acquainted with. It is founded on the ecosystem of the cryptocurrency Ethereum, but to put it in simple, this is the ownership of “the painting of a monkey, the only one in the world that exists only in digital space. In other words, there are about 10,000 unique monkeys with various patterns, and they were initially sold for about 20,000 yen per picture (IPO) and sold instantly in 12 hours, but now they are priced at tens of millions of yen (!) per picture. Celebrities such as Madonna and Justin Bieber have used it on Instagram and other social media, and it has exploded in popularity among people.

The group that operates the Bored Ape project offered the “land” of cyberspace called Otherside in April 2022 as the project obtained popularity, and it became a topic of conversation when it raised about 40 billion yen as investors and wealthy individuals around the world continued to purchase the parcel. ApeCoin, a currency developed for trading NFTs and other products in the Bored Ape space, has become the most popular cryptocurrency in the market since the beginning of this year. And its market capitalization started at USD 2bn (JPY 250bn) when it was first issued in March this year, rose to USD 7bn (JPY 875bn) at one point, and is now slightly below USD 2bn. In other words, it is true that hundreds of billions of dollars from other capital markets have flowed into this “monkey picture” and metaverse cyberspace using blockchain technology. The giant players known as GAFAM are naturally well aware of the metaverse.

In this way, an individual or a loosely bonded group, whether it is a hobby, a pastime, or a bad joke (!), in a sense, it is an easy way to “raise funds”. Incidentally, the total market capitalization of all cryptocurrencies based on blockchain technology temporarily exceeded USD2.4 trillion (≈ JPY270 trillion) in 2021. Although it has recently crashed, even government bonds and stocks have surged and plunged many times over the past several hundred years to reach their current positions, and their presence in the market cannot be ignored. The total market capitalization of the U.S. stock market in 2020, as shown in the chart on the first page, exceeds USD40 trillion, so cryptocurrencies are still in their early days, but it is probably only a matter of time before they overtake the total market capitalization of Japan (USD6.7 trillion in 2020).

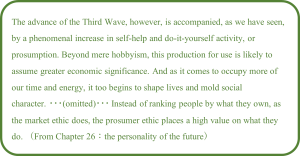

I will refrain from commenting on the “good” and “bad” aspects of such a phenomenon, as this goes into the matter of values, but this is at least the “reality” of the situation. On the positive side, it is suggested that the decentralized and highly reliable system of blockchain may activate commerce and communication between individuals in cyberspace without being controlled by anyone, and may greatly expand the value of art, IP, and hobbies, especially those that have been overlooked until now. In addition, it will become possible to “earn money while playing casually” in communities that like this kind of “special” content, and just as P. Drucker and Alvin Toffler predicted, production-consumers (prosumers) will spread from the real world to the cyber-space.

On the negative side, unfortunately, there is still a lot going on. Fraud and hacking are rampant, and as with Bored Ape, the reality is that a few people on the management side end up managing the finances of the community ecosystem, and it is doubtful that the blockchain ideal of a “decentralized and democratic world” has truly been realized. Nevertheless, it is an evolutionary process, as nations and stock markets have gone through similar processes to reach their current state.

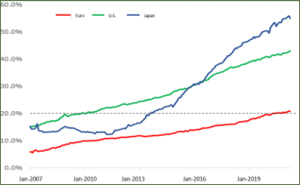

In summary, and this is just my interpretation, I feel that the “stock market” mechanism, which has been the pinnacle of capitalism for the past several decades, is already in a period of decline and that Covid-19 has accelerated this process. I do not regard this as pessimism but as a change (whether it is an evolution or not will become apparent in the coming history). Even in a situation where the stock market has developed significantly in the 80 years since the end of World War II, the foreign exchange market and the government bond market still have a dominant presence in capitalism, even if their relative positions have declined and the future is a situation where the position of the means of capital will undergo another major structural transformation over the next few decades.

In fact, as I mentioned earlier, many thinkers “predicted” this phenomenon. For example, Alvin Toffler, considered a futurist, stated the following in his seminal book, The Third Wave (1980).

Going off on a tangent, the U.S. company Tesla Inc. has become a “group” with many messages, not just a car manufacturer, due in part to the open and sometimes controversial statements of its founder, Elon Musk. Driving a Tesla car is cool because it is status, it is empathy, and it is a statement of will about the world’s environmental problems. In Debord’s words, it may be a true spectacle. As if in a mad rush in that direction, Mr. Musk is putting his personal assets into the Twitter acquisition. While maintaining its stubborn manufacturing spirit, Toyota Motor Corporation, the group’s largest employer in Japan, also (perhaps) intuitively decided that this was not enough and developed Woven City, a town at the foot of Fuji that allows for a variety of lifestyles. The strategy has even employed actors and announcers (to be scheduled) to actively communicate this attitude to people around the world who have diverse values.

I feel that I have overblown the subject, but in this decentralized, diversified, and highly information-oriented society, where a great deal of “visible” data is being analyzed and verified daily by AI and other means, the “invisible” has become as if it did not exist at all. Even Toyota, which has always had the attitude of “telling a good thing with your back,” is now trying to change with a sense of crisis that much noise will drown it out unless it desperately “communicates” its raison d’etre to the outside world. This may be the evolution that has come from confronting the monster, Tesla.

In the stock market as well, there is so much information and instantaneous fluctuations that investors and people are unable to digest it all, and they take shortcuts and concentrate on what is ” visible” and “easy to understand,” which is reflected in the concentration of transactions in the top few companies in terms of market capitalization. As consumers, individuals are becoming more decentralized, raising funds bypassing the stock market, as is the case with YouTube and Bored Ape. I personally analyze this as a structural change in the stock market and its relative positioning. I suspect this trend has accelerated under Covid-19 and has already reached a point of no return.

Bored Ape, regardless of whether or not what it offers is essential, presents a new standard of value, and in expectation of its value spreading (i.e., increasing), many participants have come together to form an exciting community. This is the latest in a series of mechanisms that allow people to pay to join a fan club and enjoy themselves as consumers while actually increasing the value of their possessions (i.e., participation tickets) and making money. It is actually similar in a broad sense to buying golf club memberships or stocks. It may seem like a strange thing, but at its ground, it is a combination of people’s desires for participation, ownership, recognition, happiness, and increased wealth. This kind of world is often referred to under jargons such as “Web3” and “metaverse,” but the technology and mechanisms that support it are revolutionary, and its essential content is not much different from a mechanism that satisfies various human desires.

Shareholders are “participants” in a stock company, just like the management, employees, and related business partners of a listed company, and they participate with various desires, but in essence, they are a fan club (and the management is the chairman of the management committee of that fan club). Unfortunately, the fan clubs of today’s society seem to have a boundless appetite for diverse ” something new,” and the relative pie of the stock market (especially the Japanese market) is on the decline. Without investors from around the world, including foreigners, buying stocks, the pond will dry up, so measures to increase the number of fans, including foreigners, are crucial.

What an Exchange can do

We have discussed the market’s changing nature from an investor’s point of view. So what could we do? We would like to share with you some ideas that have emerged from our discussions with issuers, investors, and IR support agencies. It would be our pleasure if this assists you in developing an action plan for your company.

Measure 1: Stop disclosing accumulated financial results and add page 0 as a dashboard in kessan tanshin決算短信.

Financial Results (kessan tanshin 決算短信) are essential for investors of all approaches to provide up-to-date financial information. However, they are not designed to show a complete picture of business performance at a glance. Also, the current financial statements are focused on YoY differences, in other words, very short-term change. Although we understand that different investment horizon requires different information, it would be meaningful to show information for the past 5-10 years of: 1) Sales, operating income, and operating margin by segment 2) ROE and ROIC 3) FCF 4) Dividends and share buybacks. Accumulated financials are unsuitable for analysis considering seasonality, and disclosing only quarterly figures is more user-friendly for analysts. In practice, corporate analysts need to subtract quarterly results from the accumulated ones and this is unproductive.

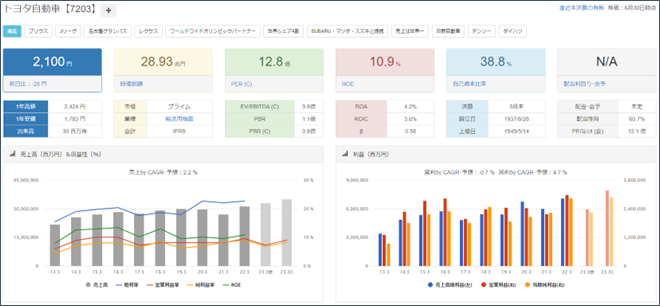

From the perspective of an investor who must process a large amount of information, the first page of financial results should be a dashboard of the necessary information. Even if it is not realistic to chart everything, the key is to make it easy to understand at a glance. For example, the web tool called “Buffett Code” which is popular among many individual investors, offers free (!) access to its basic functions and is an incredibly convenient dashboard.

(Source:Buffett code https://www.buffett-code.com/company/7203/)

Measure 2: Make Presentation Material and Web Presentations mandatory in both English and Japanese

“Easy-to-understand financial presentation material” is only a request by your company and is not an obligation. Therefore, large companies with ample resources to devote to IR provide full disclosure, while small- and medium-sized companies may only hold a presentation for the full fiscal year, or in some cases, there may be no presentation at all. In addition, there are still companies that do not disclose any presentation materials at all. As we have witnessed in our ESG scoring of portfolio companies, “lack of disclosure” alone is a discount factor.

Unfortunately, remaining its “request” leads to such a difference in action due to the difference in a corporate capacity. It may be said that small and under-resourced companies are losing their positive attitude toward IR and are heading toward a diminishing equilibrium. We believe that 1) preparation of presentation materials, 2) holding Web briefings, and 3) English-language versions of these materials are the minimum level of disclosure that should be mandatory. According to Japan Investor Relations Association’s survey, 49.1% of companies have a full-time IR staff (survey conducted in 2022). In addition, according to the English Disclosure Implementation Status Survey by your group, JPX/TSE (FY2021), the English disclosure rate is 54.6% for all markets, including those that plan to do. Is this adequate for an appealing market that attracts investors from around the world? We believe that your bold move to make English-language disclosure mandatory will catalyze a complete change in the situation.

Measure 3: TSE takes on disclosure support services and outsources them to IR agencies

It is not difficult to imagine that some companies will face difficulty responding if the abovementioned requests are made mandatory. If this is the case, it could be a new business opportunity for you, who knows the market very well. While we do not recommend that your company bring IR support services in-house, outsourcing such services to IR agencies could play a key role in promoting the growth of the stock market and the IR ecosystem as a whole. There are already many players now rapidly developing. This can contribute to “promoting investment in Japan from around the world” as stated in your company’s management plan.

Measure 4: Promote industry consolidation

It is often pointed out that there are too many listed companies in comparison to the U.S. market. From the perspective of us, investors with bottom-up approach, we recognize many listed companies that accumulate cash on their balance sheets without raising capital in the market, making large capital and human resource investments, or providing returns to shareholders. We know many meaninglessly listed companies on the stock exchange. Amid shrinking domestic market in the medium to long term, there is no doubt that the key to growth lies in capturing overseas demand. We cannot afford to be absorbed by excessive competition among domestic players. Instead, we need to promote mergers and acquisitions and create companies that can compete globally.

Although recently dissolution of parent-subsidiary listings and the going-private are accelerated as the standards required for corporate governance have become more sophisticated, there are still many companies that are small and lack corporate strength. As a result, there are many companies that lack the tools to take dynamic corporate actions using the power of capital, such as M&A through stock swaps. Can we simply leave industry restructuring to investment banks and M&A brokers? In some cases, so-called “activists” become catalysts for companies with low valuations that are eager to stay status quo. Even if you cannot take direct action at your position, we believe that you should be able to encourage action by improving the environment.

Measure 5: Ongoing monitoring and support of post-IPO companies

Even with the current plunge in the growth market, the presence of startups in Japan is still increasing. However, is the IPO market really a place for investment that cultivates healthy and strong companies? As the phrase “IPO goal” accounts for, there are countless cases in which going public is the highlight of a company’s life, and after that, the company’s stock price slumps as it falls out of the spotlight. While it is fine for the founder to make a certain amount of profit, a company is a going concern, and once it becomes a publicly listed company, it is healthy for the stock price to rise continuously along with the expansion of business performance. We believe it is effective for you not only to play the role of the gatekeeper at the time of IPO, but also to strengthen continuous follow-up (and selection) after listing to reinforce the level of the market as a whole.

Let me conclude this letter by stating that we are in the business of taking custody of funds, mainly from domestic and foreign pension funds and corporate funds, and investing them in Japanese companies to generate returns and play a part in the ecosystem that aims to expand the national asset base broadly. What I have written in this letter is my hope that all stakeholders, including exchanges, issuer companies, and investors, will develop together sustainably.

As I have described so far, there is no doubt that in this era of rapid change, the stock market is also changing at an unprecedented speed. While many measures to counter the decline in national strength due to demographic and industrial structural changes are left to politicians, there are many measures that you can take the initiative to increase the attractiveness of the stock market as a gateway for foreign money. Although our opinion is only that of a small market participant, we hope that you will take a positive approach and lead to effective actions. We hope to fight together to avoid the further sinking of the Japanese market.

Fortunately, crossing the border between Singapore and Japan has become very easy. We are increasing our travel to and from Japan as much as possible. We would be happy to have an opportunity to exchange views with you in person if our schedules allow.

Yuya Shimizu

Representative Director/Chief Investment Officer

July 4, 2022

39 Temple Street #02-01, Singapore 058584

Hibiki Path Advisors Pte. Ltd.

This document is prepared and issued by Hibiki Path Advisors Pte. Ltd. (HPA) and has not been reviewed by any regulatory authority. This document does not constitute an offer, recommendation, or solicitation to buy or sell any security or enter into any other transaction.